What is ESG Investing?

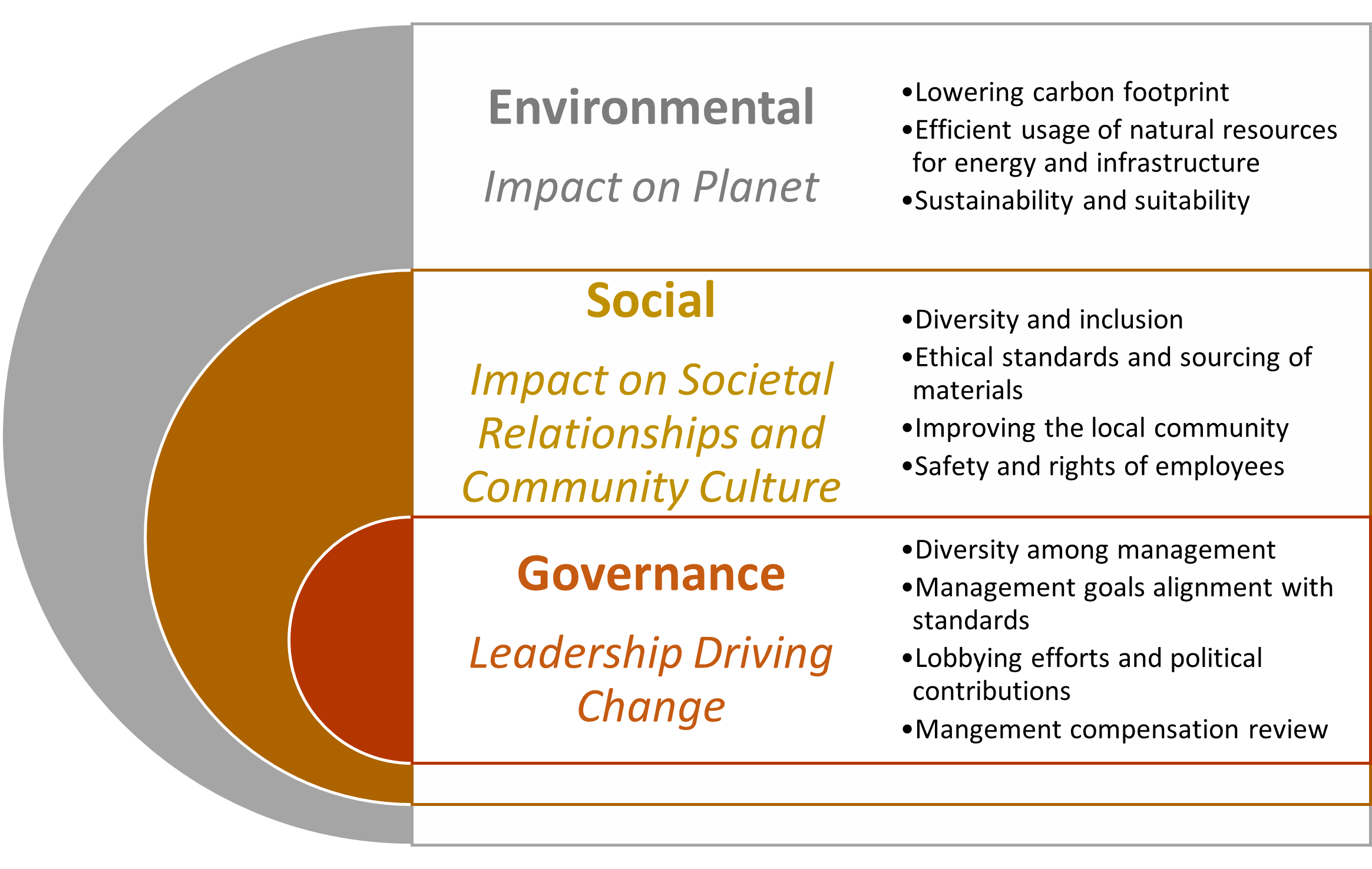

Earlier this year we introduced ESG investing to you as one of our 2022 investing themes to watch. Since then, it has continued to grow in interest not only for institutional investors but consumers as well. But what exactly is this phrase “ESG” and what does it mean as an investor? ESG stands for Environmental, Social, and Governance with the investment goal to put money to work to make the world a better place. An investment strategy geared towards ESG investing means investing in companies or funds that score well within the ESG standards set by independent research companies or groups. Investments are evaluated based on what kind of impact they have on the environment – positive or negative, how the company is improving society through its social impact, and in what ways the company’s leadership is paving the way for positive transformation organizationally through transparent and affirmative business practices. Overall, ESG investing aims to create an impact that is positive not only for the surrounding community and environment but for investor returns as well.

Rise and Growth of ESG Investing

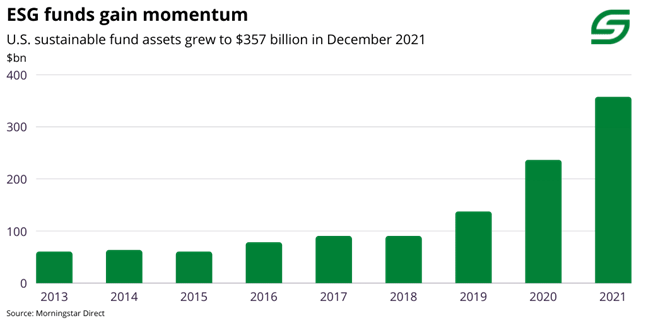

ESG investing has grown in popularity within the last 5-10 years as more investors and shareholders are demanding companies be held accountable for their business activities and impacts on the surrounding community. Society as a whole is becoming increasingly concerned with social change and environmental impact which has trickled down to the investing world. While investment in positive change has been occurring long before the term ESG was coined, the 2015 Paris Agreement that pledged to limit global temperature increases caused societal and investor interest in the investment strategy to grow in popularity and as a method of capital allocation. The concept of ESG investing is now a mainstream theme and Morgan Stanley found that 79% of individual investors are interested in sustainable investing with millennials and younger investors showing the most interest. Growth in the sector has exploded in the past 5 years. Currently, it is estimated that there is $2.74 trillion invested in the ESG thematic globally and $357 billion invested in the U.S. This burst in interest was driven by increasing environmental concerns, the COVID-19 pandemic, and other societal issues.

Source: SustainFi

Regulation and Reporting for ESG Investing

ESG investing relies on independent research firms to provide scoring models and rating standards to evaluate companies on their ESG initiatives. Each research firm has different reporting standards but the pillars of Environmental, Social, and Governance remain. Some of the most popular reporting agencies are Bloomberg, S&P Dow Jones Indices, and MSCI, and typically their scoring follows a 100-point scale with the higher the score meaning the higher the rating. Companies in the U.S. are not presently required to report their ESG metrics. However, pressure from shareholders and other stakeholders has prompted many companies to start reporting their sustainability data.

A variety of reporting frameworks exist such as the Sustainability Accounting Standards Board (SASB) and the Global Reporting Initiative (GRI) but there is no standardized reporting regulation globally. This discontinuity has caused speculation about reporting standards and an MIT study found that there is only a 60% correlation in ratings among different ESG reporting regimes. A conflict also exists on how much weight is placed on the individual factors within the diverse ESG standards. For example, Tesla and Exxon Mobil both received an “average” rating by MSCI even though some may argue that Tesla’s business model is much more sustainable while Exxon is an oil and gas company whose carbon based products are a major contributor to climate change. Exxon has much higher ratings for worker treatment and safety than Tesla does which raises its ESG ratings. As an individual investor, you have to decide which letter in the ESG acronym is the most important to you.

Investing in ESG

As in any investment strategy, you need to ask yourself what your investment goals and purposes are and consider your risk and return profile. The same goes for choosing an ESG investing strategy. Think about which issues within the ESG framework you are the most concerned with. For many investors, current economic concerns may drive their portfolio allocation decisions. Rising energy costs and fossil fuel concerns have many people looking to alternative energy sources to invest in. Solar, wind, and geothermal energy have all caught the attention of investors and consumers as oil and natural gas prices have been on the rise throughout much of 2022, making the switch to alternative energy more competitive across various applications. An alternative energy ETF that has been gaining investor attention is the iShares Global Clean Energy ETF (TICKER: ICLN). With $4.8 billion assets under management, it is one of the largest alternative energy ETFs with holdings in multiple solar, wind, and energy technology companies. It has a AAA rating in ESG standards from MSCI which is the highest rating given. Another ESG ETF we have been watching is ALPS Advisors’ Clean Energy ETF (TICKER: ACES) that has $658 of assets under management. ACES has a more diverse allocation of companies involved in solar, wind, energy management and storage, bioenergy, hydrogen/geothermal, electric vehicles, and fuel cell technology. Another fund with a diverse ESG themed allocation is Northern Trust Corporation’s ESG index fund (TICKER: ESG). It has diverse holdings in major large-cap stocks investing in technology, health care, energy, and industrials. Microsoft is its largest single company holding which has a AAA rating by MSCI for ESG standards.

Source: Getty Images

Future of ESG

Investors and markets of today are much more varied and dynamic than they were 50 years ago. Investors today are generally more passionate about making a positive impact on their communities and allocating capital with purpose to ensure its being put to work for the greater good of society, the planet, and future generations. Broadridge Financial Solutions predicts that investments in ESG will reach $30 trillion by 2030. Not only are investors demanding more sustainable investment options, but they also want better corporate transparency and the application of uniformed standards to hold companies accountable. It is expected that the U.S. Securities and Exchange Commission will issue more rigorous ESG reporting guidance and regulations for corporate disclosures on carbon emissions and environmental sustainability. While investors are interested in driving change, they also want to maintain strong portfolio returns. This doesn’t appear to have been an issue for ESG Themed Funds historically. Morningstar research found that ESG funds produce a good return on equity with lower volatility when compared to traditional funds. Environmental, Social, and Governance investing is here to stay and with the help of technology, data management, and uniform reporting, today’s investors will be more empowered to invest with purpose and include ESG holdings in their portfolios that are aligned with their investment preferences. For more information of ESG themed investments, please visit us at https://servantfinancial.com.

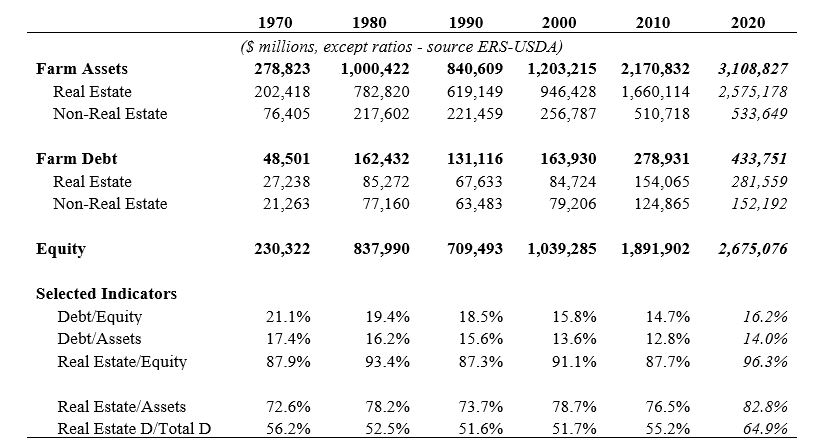

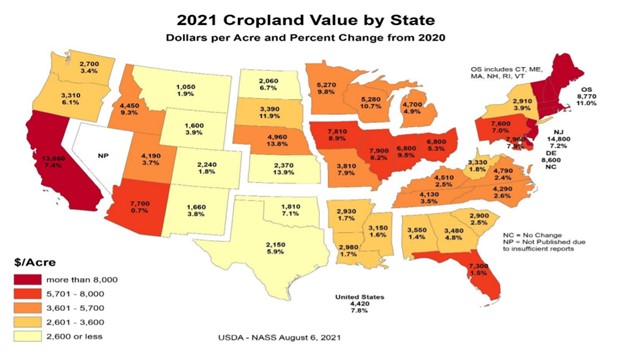

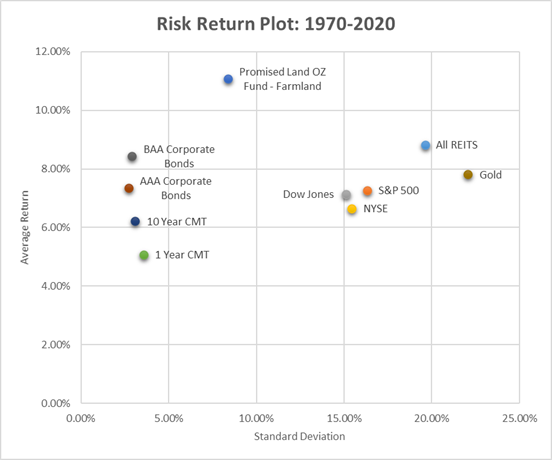

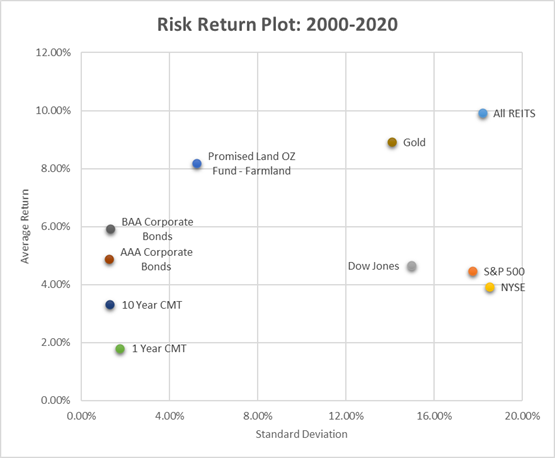

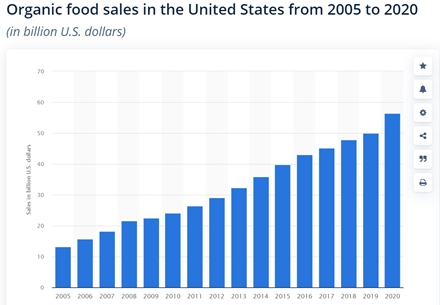

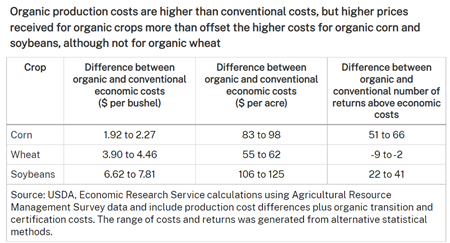

An investment in organic agriculture could be attractive for investors not only in investment performance but also may fit their preferences to actively support environmental, social, and governance (ESG) standards. Many

An investment in organic agriculture could be attractive for investors not only in investment performance but also may fit their preferences to actively support environmental, social, and governance (ESG) standards. Many