Disclosure: This is not investment advice. Consult your investment advisor to make decisions appropriate for your portfolio and life circumstances.

Current Status of Financial Markets

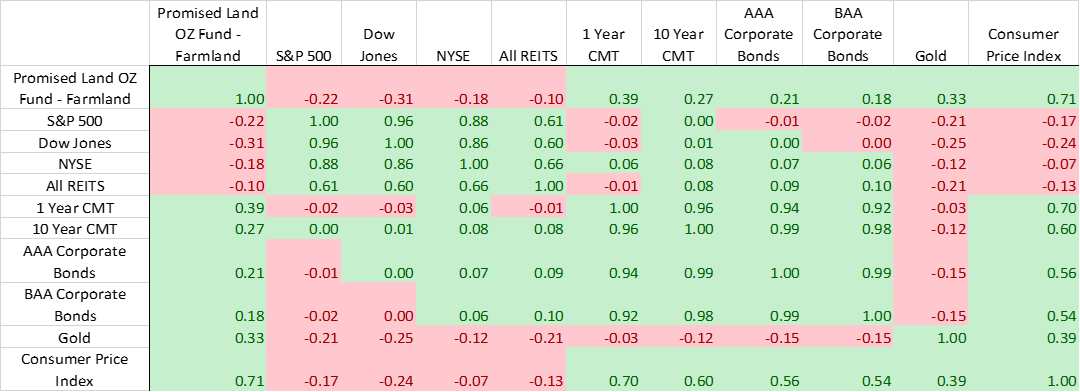

Financial markets have twisted and turned throughout much of 2022 as investors react to inflation, interest rate hikes, and looming concerns from the COVID-19 pandemic. The year-to-date graphs of market indices mimic a rollercoaster heading down a sharp drop before leveling off prior to its next unknown feature – steep ascension, another drop, or into a nauseating barrel roll. See Figure 1. Ironically, the oldest roller coasters are believed to have been the Russian Mountains, specially constructed ice hills located in St. Petersburg. As in any time in financial history, there are a variety of interlocking factors impacting markets and bringing about recessionary fears. Current circumstances may drive some investors to get off this rollercoaster market, but more seasoned investors will understand the importance of sticking to the long-term plan and riding out the volatility.

Figure 1: Market Indices Performance Year-to-Date

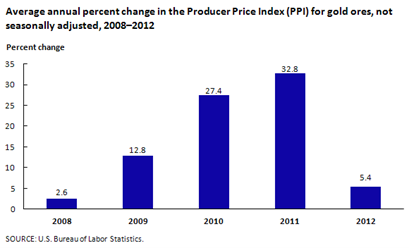

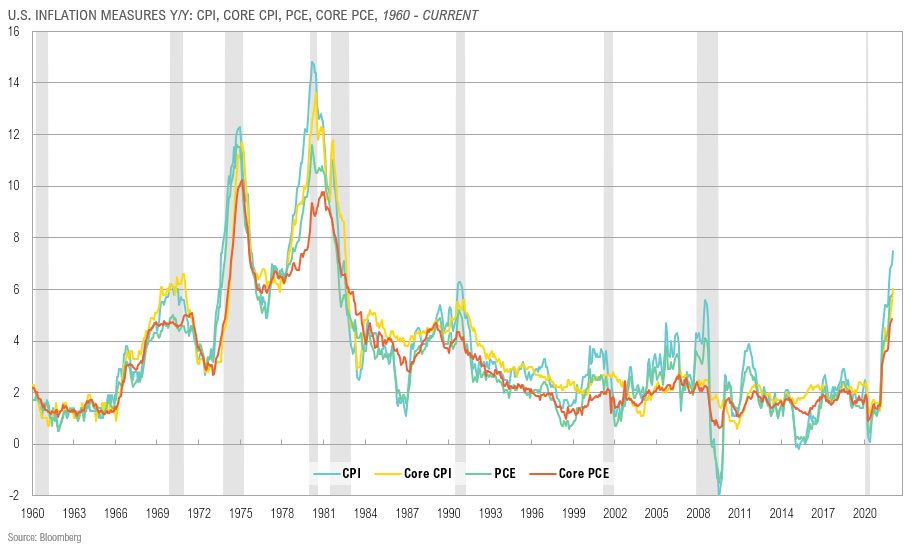

In February, we discussed the impact rising inflation was having on the global economy and since then inflation pressures have remained high. The U.S. annual inflation rate slowed slightly in April to 8.3% from 8.5% in March with the largest inflationary pressure stemming from the energy and food sectors. That comes as no surprise considering the U.S. average gas price is at $4.60/gallon, up from $3.04/gallon just one year ago. Escalating inflation prompted the Federal Reserve to adjust its monetary policy by raising interest rates 0.50% on May 4th, the biggest increase in two decades. Based on Fed Chairman Jerome Powell’s remarks after the decision, more 50-basis point rate hikes should be expected to curb inflation. The Federal Reserve’s policy actions prompted 30-year fixed-rate mortgages to rise to 5.27% on May 5th. Home sales are starting to slow as financing becomes more expensive and house ownership less affordable for consumers. Americans are beginning to wonder if there is an end in sight to rising costs and fluctuating financial markets.

Another factor causing inflationary pressure for consumers is ongoing supply chain issues. It has been more than two years since the start of the COVID-19 pandemic; however, the U.S. supply chain continues to struggle to meet demand. Recently, supply chain woes have especially impacted families with infants due to the baby formula shortage caused, in part, by bacterial contamination in Abbott Nutrition’s factory in Michigan. Abbott accounts for 40% of the market share for baby formula and the resulting plant closure has decimated the supply of baby formula. Supply chain shortages continue to be an issue in every industry from car manufacturing to food production. Not only is there a shortage of raw materials, but labor shortages have become a mounting problem. Shortages in truck drivers and warehouse workers are greatly impacting the manufacture and delivery of raw materials and finished goods.

On top of all this, geopolitical issues are straining global financial markets as the desire for socioeconomic justice persists. The Russian invasion of Ukraine has caused the U.S. and several other countries to place economic sanctions on Russia. The U.S. has focused its efforts on sanctioning Russian banks, bans on Russian oil and travel, and asset confiscations for Russian oligarchs, among other things. The European Union (EU) has responded similarly to the U.S. and is now proposing a complete ban on Russian oil which would likely put further pressure on global oil and gas prices. The EU, particularly manufacturing powerhouse Germany, is highly dependent on Russian natural gas and oil. Looming geopolitical pressures between China and Taiwan have also sparked more volatility in financial markets as President Biden said on May 23rd that the U.S. would defend Taiwan if China invaded. An invasion of Taiwan could bring about enormous economic disruption between the U.S. and China, causing more supply chain and inflation problems as China is the United States’ largest trading partner.

Bear Market Territory

The recent stock market drop from nose-bleed valuations was incited by unabated inflation and the Fed’s untimely interest rate hikes to “rail in” its excessively accommodative monetary policy. The Fed is playing catchup after continuously assuring markets that inflation was transitory. Unfortunately, markets have suffered from this adjustment, and bear market worries have ensued. Technically, a bear market occurs when an index or individual stock takes a roller coaster-like plunge of 20% or more from a recent high. The S&P 500 has been hovering near bear market territory as it is down -17.8% year-to-date. The Nasdaq is already in bear market territory down -28.0% year-to-date. The Dow Jones Industrial index has experienced a tamer ride, down -12.1% year-to-date. These metrics have investors on this monetary policy-induced joy ride wondering if they need to be concerned with a longer-term bear market and a potential recession or worse. Experts at Moody’s analytics and the Wall Street Journal say that the chance of a recession is around 30% and will increase if inflation is not subdued.

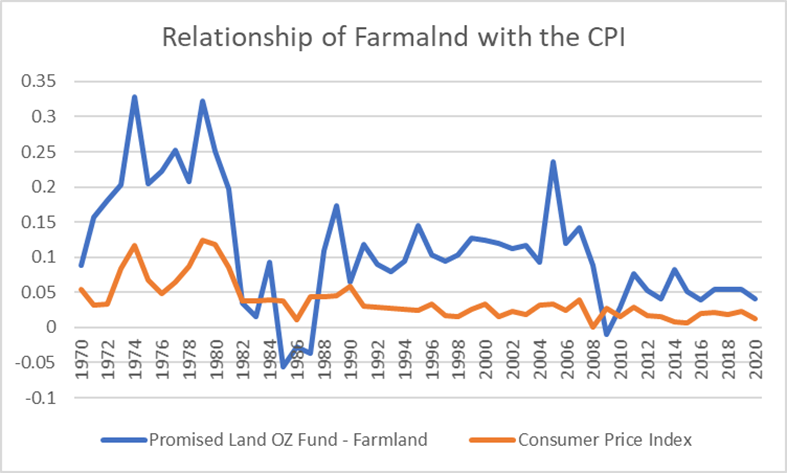

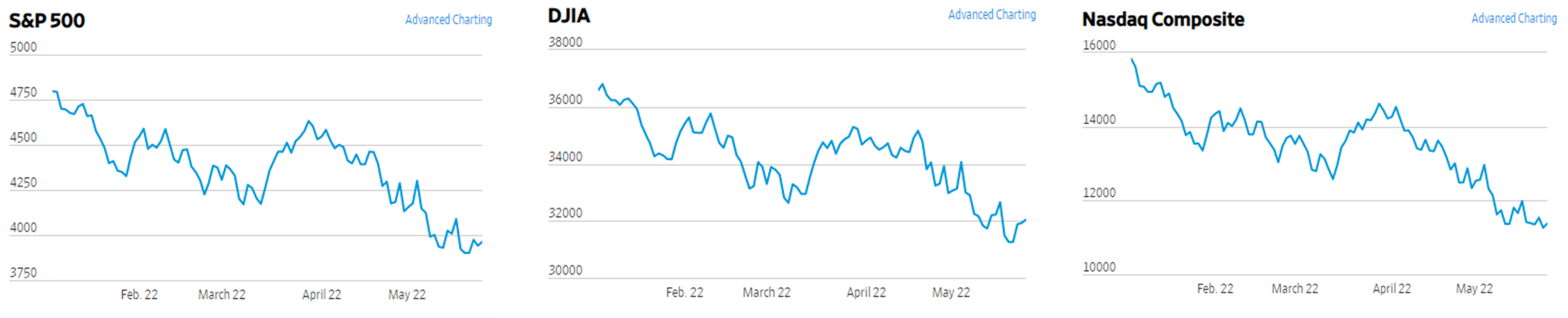

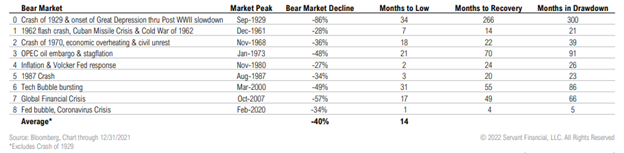

Seasoned investors know that bear markets are inevitable, and they don’t last forever. See Figure 2. The most recent bear market in the S&P 500 was prompted by the COVID-19 pandemic and economic fallout from government-mandated lockdowns which caused the index value to fall -34%. However, this steep drop was followed one month later by an epic ascension. See Figure 3. Other recent bear markets such as those associated with the Global Financial Crisis and the Tech Bubble burst lasted 17 and 31 months, respectively, before climbing back into a bull market. While this graph might shake younger, trade-oriented investors, seasoned investors understand that this is another cycle that the market must take.

Figure 2: Historical Bear Market Cycles

Figure 3: Historical Bear Market Events

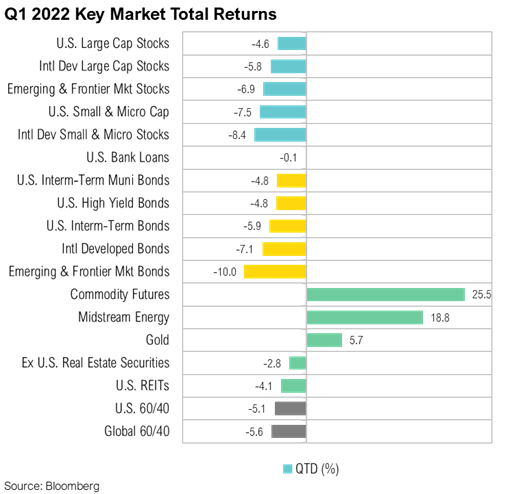

Market Performance of Non-stock Market Investments

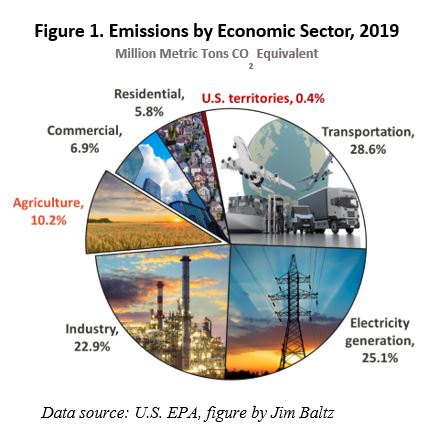

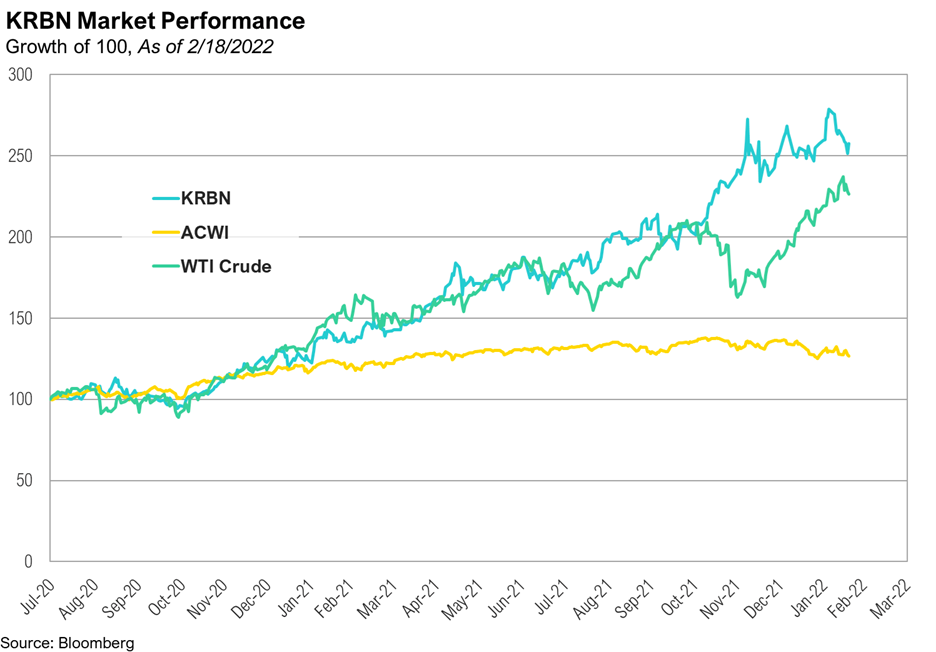

Although the broad stock market has been descending since January, other sectors have experienced positive returns. For example, the energy sector has been profiting from the runup in overall energy prices and Bloomberg reports the sector is up 1.9% this year. This is the second-best sector performance behind consumer discretionary spending which is up 3.0%. Not only is traditional energy investing trending right now but more investors, particularly, ESG (Environmental Social and Governance) investors are allocating more capital into the alternative energy space. Rising oil prices have both investors and consumers realizing the United States needs to evaluate its dependence on fossil fuels and how the transition to renewable energy sources could be managed more smoothly and strategically.

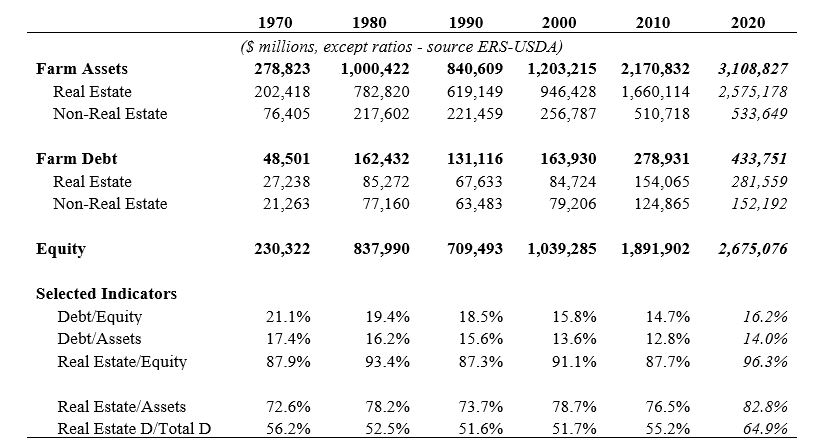

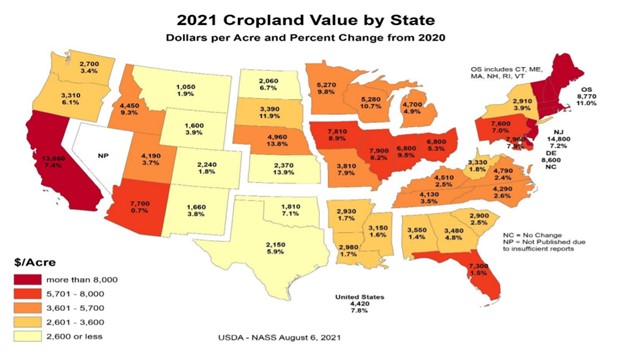

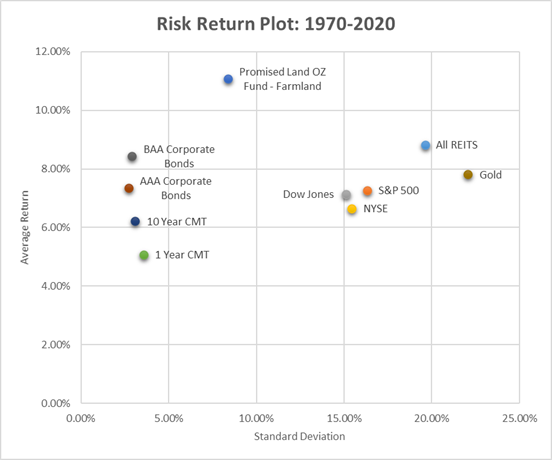

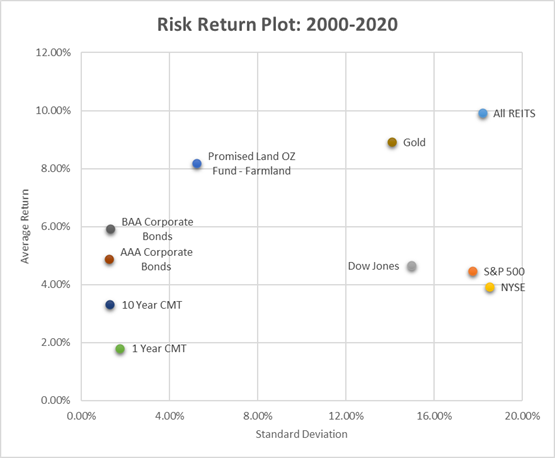

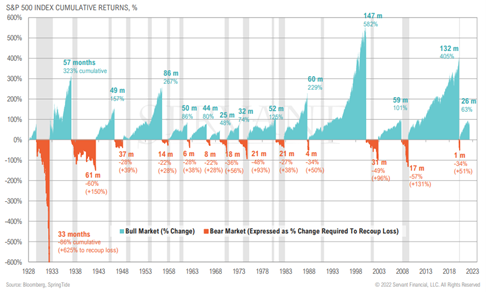

Another industry experiencing favorable returns year-to-date is the agricultural industry. The COVID-19 pandemic and rising inflation only highlighted the importance of a stable, secure food supply and that regardless of what is happening in the global economy, people still need to eat. Farmland, which historically has a positive relationship with inflation, has experienced strong returns throughout 2021 and 2022. Farmland values have soared 20-30% this year alone with the largest gains seen in the Corn Belt of the Midwest. Strong commodity prices are bolstering returns as corn, soybean, and wheat prices have been surging due to the geopolitical uncertainty in Russia and Ukraine, both large producers of bulk agricultural commodities. While the U.S. growing season is just getting started, strong grain prices are making for favorable market dynamics and improved farm profitability.

Riding the Volatility Spins

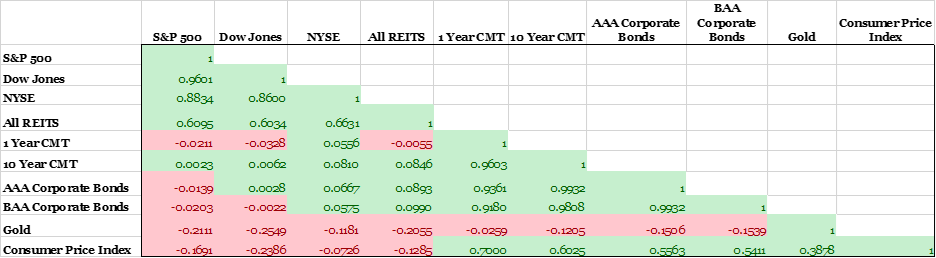

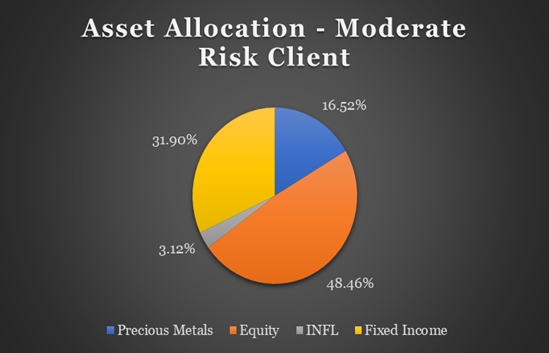

The volatility in the stock market may have some investors worried about their portfolio security. If market history has taught us anything, it’s those long-term investors that get in and stay in that realize the best investment performance. Trying to time the market’s natural gyrations is generally a fool’s errand. Staying the course with a sensible asset allocation and enjoying the ride has proven itself time and time again.

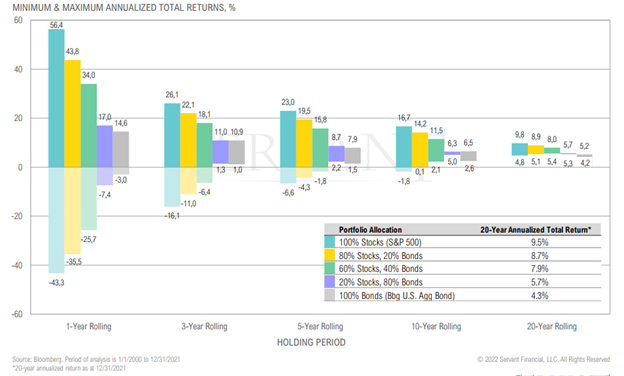

The S&P 500 has a 20-year total return of 9.5% and as investors allocate more to stocks and less to bonds, their return potential rises. See Figure 4. Allocating more to stocks also historically means more volatility. Figure 4 also shows that the longer the investment horizon, the lower the overall risk. Investing just 1 year in any asset can give any investor significant exposure to risk but as their investment horizon lengthens, they can smooth out much of that volatility associated with shorter time horizons. If we compare the recent year-to-date graphs of market indices (Figure 1) with the long-term performance of each of these indices we see that while there are periodic dips, in the long run, the market proceeds on a steady upward trend. This comparison leads to the conclusion that the best thing to remedy volatility, is time. The same goes for riding a rollercoaster. While on the rollercoaster, you may be tempted to want to stop the ride on that nauseating barrel roll. But if you roll with the changes and ride it out to the end, you may realize the thrill and enjoyment and find yourself back on the ride again.

Figure 4. Historical Returns Through Time