Contributions made by: John Heneghan & Michael Zhao

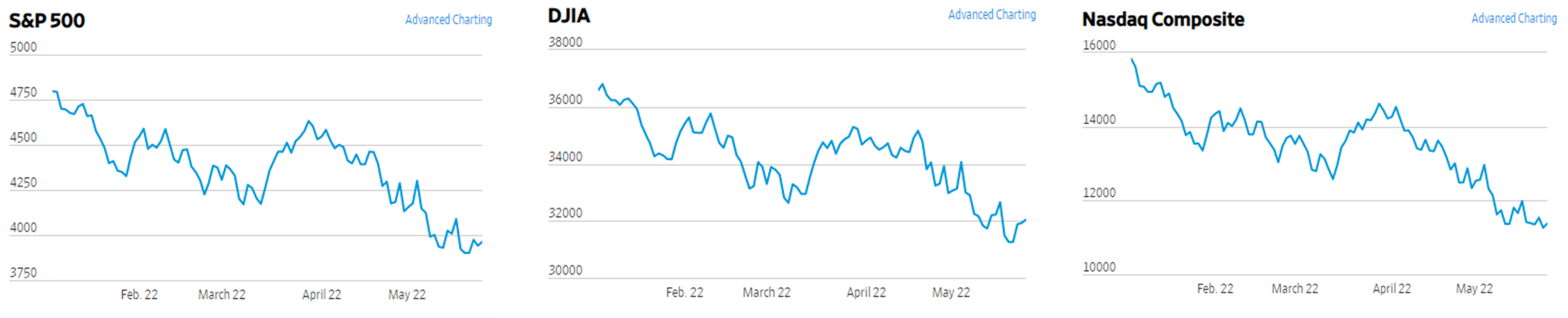

‘Twas the week before Christmas, when all through the financial house, not an investor was resting, not even a DC louse. 2022 brought investors increased market volatility and a wide array of risks and uncertainties remain, yet some opportunities may lie hidden under the Christmas tree. From inflation worries to geopolitical risks, we have been on a wild sleigh ride this past year. But whether you landed on the naughty or nice list this year depended on your ability to navigate the economic whiteouts caused by the likes of the Federal Reserve, Vladimir Putin, and Sam Bankman-Fried.

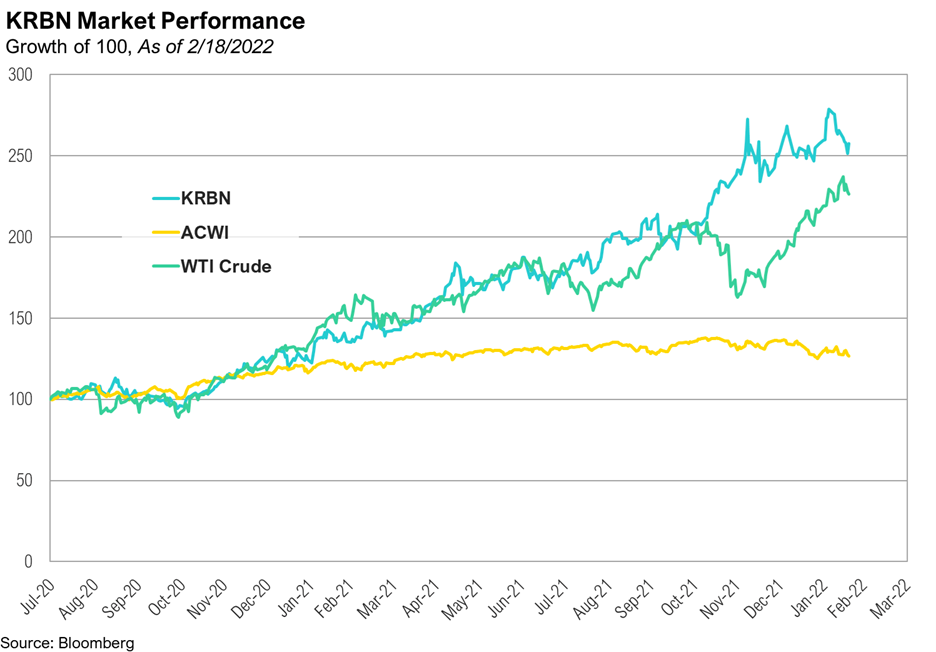

Tis’ the Season for Interest Rate Hikes

On the first day of Christmas, Federal Reserve Chairman stuffed my stocking with 7 rapid interest rate hikes. The Fed has been hiking the benchmark Federal Funds Rate at an unprecedented pace to combat high inflation which is causing concern among investors and consumers alike. As the cost of borrowing increases, whether it’s for a mortgage, car loan, or credit card, it impacts the affordability of goods and services for many households. People tend to hunker down on spending and are less likely to take on new debt, which impacts aggregate consumer spending and business investment. Recently, the Federal Reserve raised its benchmark interest rate from 4.25% to 4.5% in its final policy meeting of the year. This marks the seventh consecutive increase in just nine months to the highest benchmark interest rate in 15 years.

The Federal Reserve has signaled its desire to keep interest rates higher through 2023 with the potential of rate easing, not until 2024. As a result of the Fed interest rate hikes, mortgage rates have reached 20-year highs, interest rates for home equity lines of credit are at 14-year highs, and car loan rates are at 11-year highs. Savers, on the other hand, are seeing the best bank deposit and bond yields since 2008. The 10-year U.S. Treasury yield hit a 12-year high in September at 3.93% causing foreign investment to flock to U.S. treasuries and spurring strength in the U.S. Dollar. After several years of low-yielding bond investments, investors are busily re-balancing their investment portfolios so they can much more safely jingle their way to their investment objectives.

Source: Statista

Dashing through Inflation

Santa’s pocketbook may be feeling a bit squeezed this gift-giving season as inflation continues to rage at the North Pole, particularly for the basic foodstuffs like milk and cookies. The Bureau of Labor Statistics reported earlier this month that the U.S. Consumer Price Index (CPI) saw a 7.1% increase year over year during the month of November, down from annual CPI of 7.7% in October and lower than the 7.3% increase forecast by economists. Importantly, the November monthly increase slowed to 0.1% and was driven into positive territory primarily by rising food (0.5%) and housing costs (0.6%). The PCE Prices Index due this Friday is the last consequential data release for the year. Other data this week mostly focuses on the housing market where home sales have slowed down, but actual prices continue to rise. Still rising housing costs are a problem for the Federal Reserve as “shelter” expenses account for the largest share of CPI. Housing cost increases have been slowing down and many economists believe gauges for both home prices and rents will start to show declines in the coming months. The Fed’s owner’s equivalent rent measurement is a notorious lagging factor and when this statistic rolls over it may take a substantial bite out of headline inflation. Supply chain backlogs, rising costs, government spending, labor shortages, and increasing demand have all played a part in elevating inflation to its current levels. As a result, these inflation trends have been the principal driver of the Federal Reserve’s aggressive hiking policy which has economists, investors, and consumers appropriately worried that a Fed-induced recessionary winter storm might be brewing as the Fed overshoots on the hawkish side.

Baby, it’s Looking like a Recession

Current economic pressure really can’t stay, baby, it’s looking like a recession. Recession fears are rising as investors lose confidence in U.S. economic performance in the face of an unprecedentedly rapid and yet unfinished Fed hiking cycle. Despite relatively strong economic growth in the third quarter of 2022 and a still low unemployment rate of 3.7%, the Federal Reserve has lowered its forecast for next year’s U.S. economic growth in light of its rate hikes and expects the unemployment rate to rise by the end of 2023 as well. Some believe that the current widespread concerns about a recession may help us avoid one, as caution leads to less risk-taking and borrowing, potentially cooling the economy enough to reduce inflation and the need for further interest rate hikes. Lagging inflation statistics remain elevated and central banks globally are continuing to raise interest rates to destroy demand and slow economic growth in the coming year. More real-time inflation measures, like the Cleveland Fed’s “Inflation Nowcasting” measure, show inflation moderating. Inflation Nowcasting’s fourth quarter run-rate CPI is at 3.5% and Core CPI (excluding food and energy) is at 4.7% suggesting the Fed is “fighting the last war” rather than anticipating what will happen next.

The U.S. Dollar All the Way

Santa’s reindeer are taking a new launch angle this year along with the U.S. dollar by soaring to new heights in 2022. The US Dollar Index, a measure of the dollar against a basket of other major global currencies, had been on the rise throughout 2022 but started to taper off in late November and December. Other central banks have joined the competitive rate-hiking game and compressed interest rate differentials. The strong dollar is beneficial for American consumers who purchase foreign goods, as it makes them cheaper in U.S. dollar terms. However, it can be an earnings headwind for American businesses that export goods or have multinational business operations such as McDonald’s and Apple. McDonald’s reported that its global revenue fell 3% this past summer due to the strong dollar as the rising costs of Big Macs have foreign consumers turning to other options. The strong dollar is also a reflection of the relative strength of the U.S. economy compared to other advanced economies, such as those in Europe (Euro) and Japan (Yen). Foreign investors flocking to higher and arguably lower-risk U.S. treasury yields only bolsters the dollar further.

U.S. Dollar Index; Source: Google Finance

Eat, Drink, & Spend like Consumers

U.S. consumers found themselves on the nice list in this year of profligate government spending. The US government gave consumers several nice stimulus checks due to the COVID-19 pandemic. While some consumers used these relief funds to pay for day-to-day necessities, others have been able to enjoy new furniture, electronics, and vacations that have them saying “Mele Kalikimaka”. Economists predict this holiday season may be the last fling of spending toward luxury brands and exotic travel. The current level of consumer spending is projected to dwindle towards the end of next year as recessionary fears manifest and unemployment levels grow as the Fed’s aggressive hiking policy takes hold.

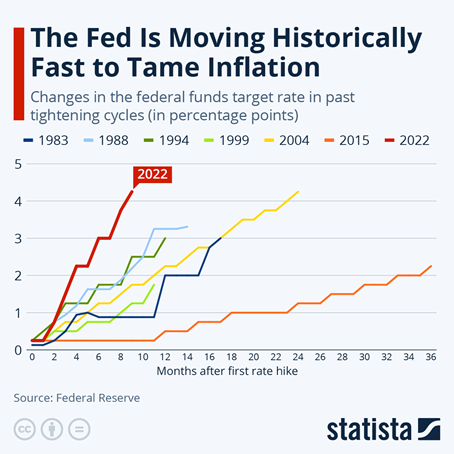

It’s Beginning to Look a lot like a Labor Shortage

Santa may be having a bit of trouble finding enough elves to manufacture toys in his workshop this year. The COVID-19 pandemic brought about many changes to people’s lifestyles, and many re-evaluated their lifestyles as they were challenged with their mortality. Across the nation businesses in every sector are feeling the pressure to find enough skilled labor to meet the growing consumer demand for goods and services. In 2021, 47 million workers quit their jobs in what is referred to as the “Great Resignation.” The industries hurting the most are food services, manufacturing, & hospitality. Workers have signaled a desire for better company culture, work-life balance, and compensation. Some believe the labor shortage will work itself out if a recession were to occur. However, others argue that this is just the beginning of secular labor shortages as declining birth rates in the U.S. and other developed nations have economists worried that we are not restocking the world’s workforce fast enough. Maybe Santa will be nice enough to supply us with some of his highly productive elves to bridge this gap until intelligent robotics develop further.

Source: US Chamber of Commerce

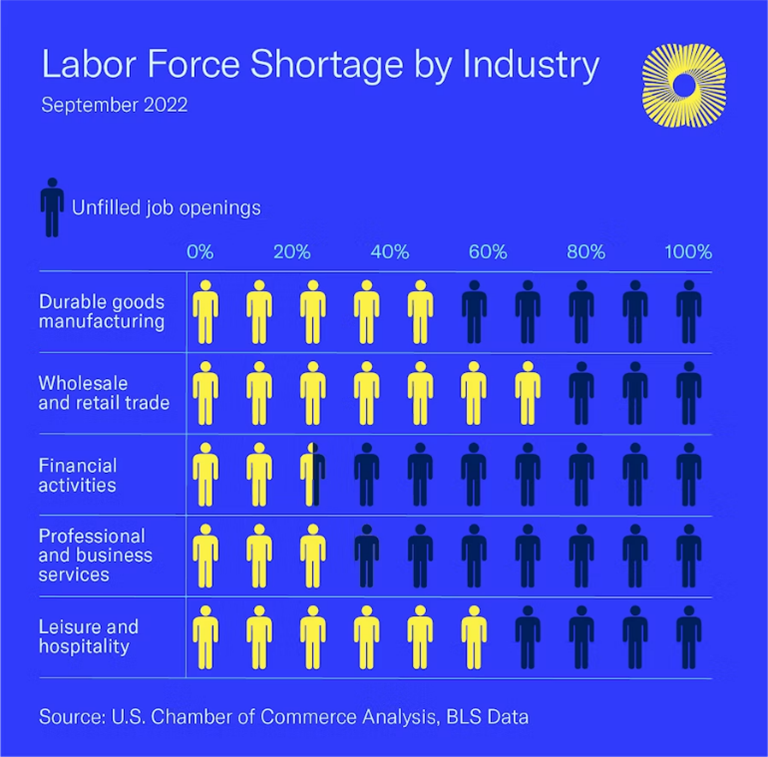

How Vladimir Putin Stole Ukraine

At the top of most of the world’s Christmas wish list is for the Russian-Ukrainian conflict to be resolved. Not only did the invasion of Ukraine in February bring about economic disruption but it has brought devastation to the Ukrainian and Russian people. It is estimated that close to 7,000 civilians in Ukraine have lost their lives in the conflict. The power-hungry, Russian Grinch Putin, is committed to overtaking Ukraine for strategic access to important trade routes and resources. Currently, Russia is occupying several major port areas along the Black Sea. The Ukrainian defense has been putting up a strong fight with the help of $32 billion and growing of financial support from U.S. taxpayers. Several trade restrictions and sanctions have been put into place to hurt Russia financially. However, since Russia is the global largest energy supplier of natural gas and oil, these sanctions are only putting more extreme pressure on energy prices worldwide. Ukraine is also a large exporter of agricultural products, and the conflict has caused several production and logistics issues for Ukrainian farmers. Commodity prices have climbed as a result, particularly for wheat. While the conflict today looks unresolvable, maybe Grinch Putin’s heart will grow three sizes and he’ll decide to shower Who-ville with presents instead of artillery. “Fahoo fores dahoo dores!”

Photo Source: Behance

Source: Wikipedia

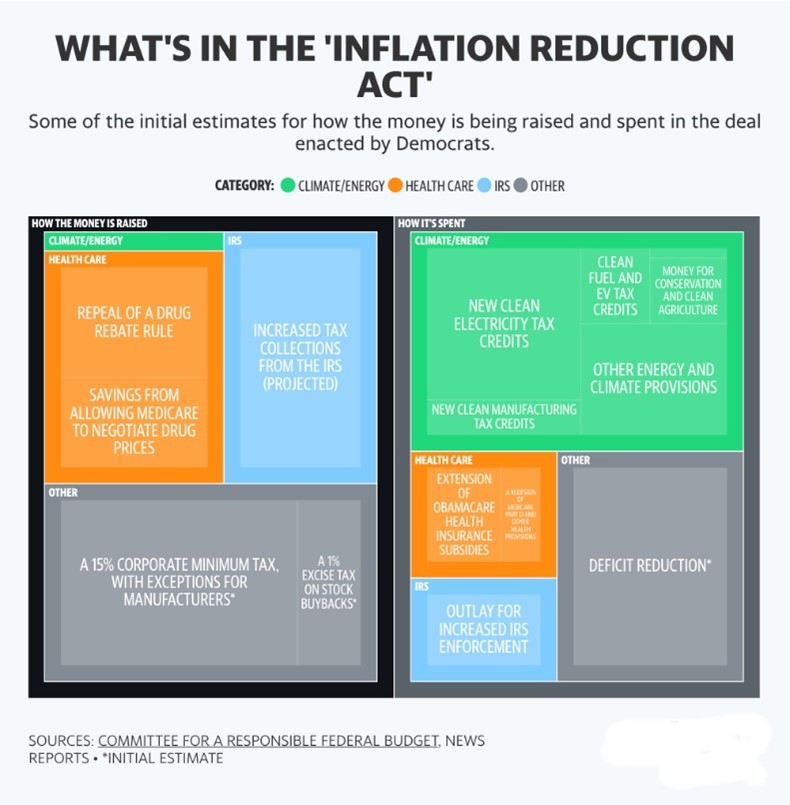

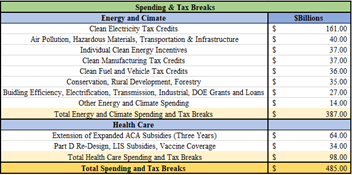

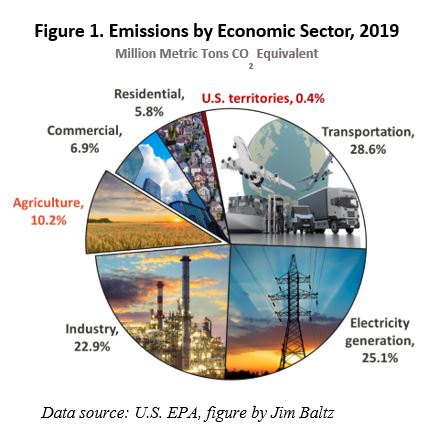

Making Energy Bills Bright

As the war between Russia and Ukraine rages on, energy bills for people around the world continue to climb. Oil and natural gas prices have soared in 2022 with Europe being hit hardest by the jump given its deep dependence on Russian natural gas. In August, gas futures hit a record high of 350 euros creating immense pressure for European nations to set price limits on natural gas. Household electricity prices from natural gas-fired plants have increased in Europe by 67% in just one year, stopping some Europeans from lighting their Christmas trees this year. The European energy ministers imposed an electricity price cap this week to help lessen the burden on consumers. The United States has also felt the brunt of high energy prices as power prices rose almost 16%, the highest increase in 41 years. Consumers also felt the pressure at the gas pump as the average price of a gallon of gas rose to $4.96. Maybe in 2023, we can be like Santa and his reindeer-powered business model by running more of our economy on renewable energy.

Cryptocurrencies Roasting on an Open Fire

Cryptocurrencies roasting on an open fire, Sam Bankman-Fried nipping at your confidence. One of the largest cryptocurrency exchanges and hedge funds, FTX, filed for bankruptcy this November after information was released about its risky holdings and clandestine relationship with its affiliated hedge fund Alameda Research spooked many of its exchange customers. Several exchange customers sought to withdraw their crypto holdings from the FTX exchange, prompting the bankruptcy filing of the company. It turns out FTX was another Ponzi scheme or con game with apparently none of FTX’s well-healed venture capital investors doing any due diligence or demanding a role in corporate governance. The price of Bitcoin has fallen 65% in the past year with investors losing confidence in an asset class imputatively regulated by the SEC and Commodities Futures Trading Commission (CFTC). The CFTC has defined bitcoin as a commodity, but a turf war has continued with SEC creating regulatory uncertainty and ample opportunities for miscreants. FTX was a Bermuda-based firm regulated by the Securities Commission of the Bahamas. The SEC could have required crypto exchange registration and reporting and U.S. domestic incorporation. Former FTX CEO, Sam Bankman-Fried, has agreed to extradition and will now be answering to the Justice Department and SEC for violations of wire fraud, money laundering, securities fraud, commodities fraud, and conspiracy to violate campaign finance laws. The once shiny wrapped package that was FTX Digital Markets now looks like a lump of coal. Expect the naming rights for FTX Arena, home of the Miami Heat, to become available soon and most of FTX’s liberal political contributions to be returned to the bankruptcy court. Bernie Madoff will look like a petty thief compared to SBF.

Dreaming of Student Loan Forgiveness

About 43 million Americans received a nice Christmas present from President Biden this year, with forgiveness for part of their $1.6 trillion student loan debt. President Biden announced the plan earlier this year sparking both joy for recipients and scrutiny from every other U.S. citizen. The plan would eliminate $10,000 in federal loans for individual borrowers making less than $125,000 per year or couples earning less than $250,000 annually. Pell Grant recipients, which account for 60% of current student debt holders, could receive upwards of $20,000 in forgiveness. However, this largesse begs the question of where the money for this forgiveness will come from as the US government already is $31 trillion in debt. Biden’s Executive Order faces many legal challenges in Congress and the Supreme Court to overcome and move this profligate effort forward.

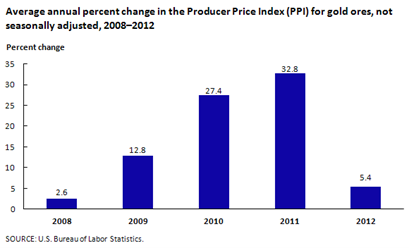

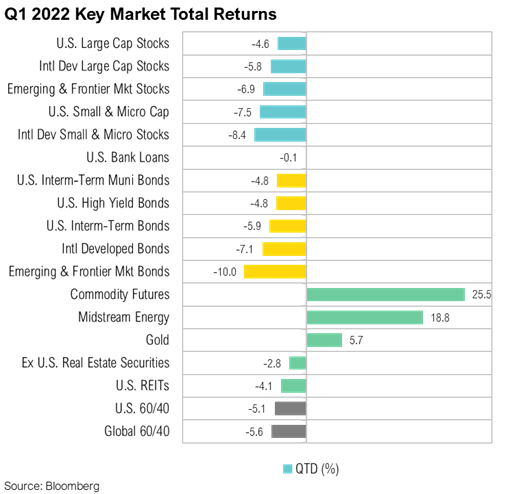

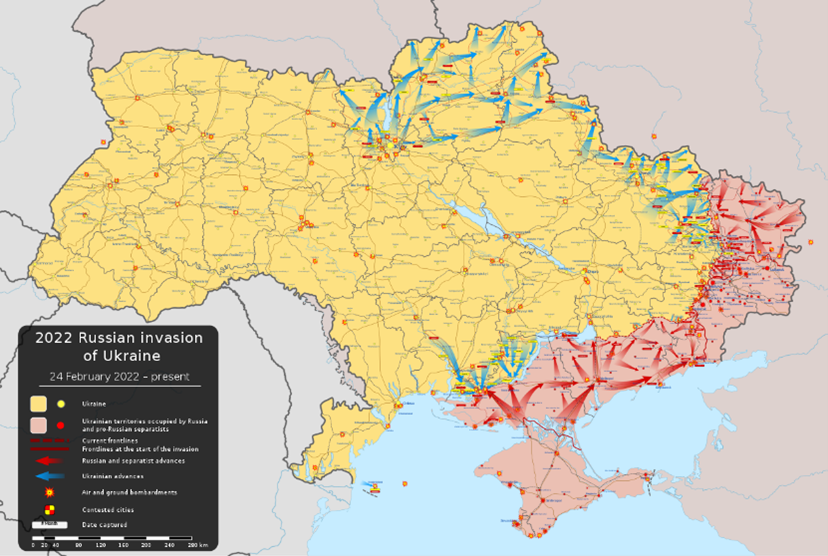

All I Want for Christmas is Farmland

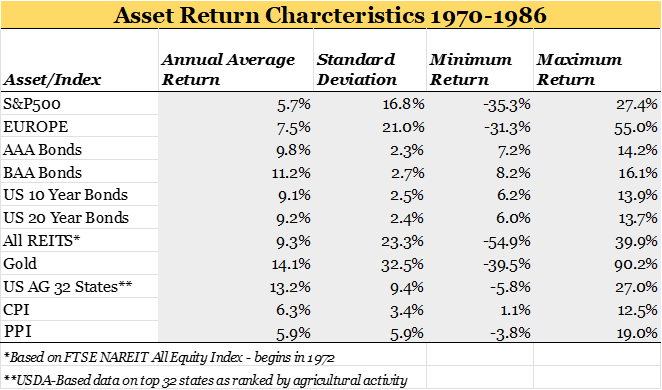

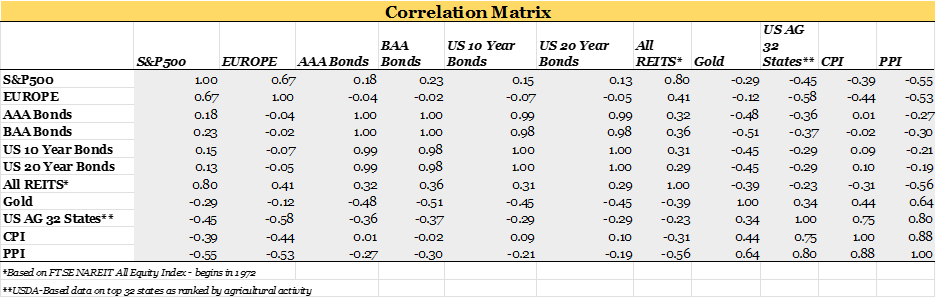

The bright star on top of the investment tree this year is an asset class that has been at the top of many institutional investors’ Christmas wish lists all year, U.S. farmland. Farmland hasn’t always been seen as an accessible investment option. However, farmland funds such as Promised Land Opportunity Zone Fund and others have been formed to allow investors access to in this durable, inflation-beneficiary asset class. Iowa State University recently reported farmland values in Iowa were up 17% in 2022 which comes on top of a 29% increase in 2021. Similar stories have been reported throughout the Midwest as strong commodity prices fuel farm incomes and transacted land values. The COVID-19 pandemic had people re-evaluating what is important to our world with basic human needs, like food, at the top of the list. While consumer preferences and social trends may change, people will still need to eat, making farmland one of the most durable asset classes through time. This has many investors saying “All I Want for Christmas is Farmland.”

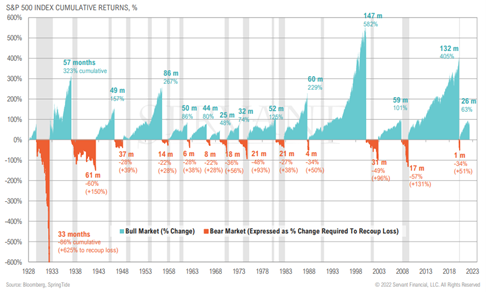

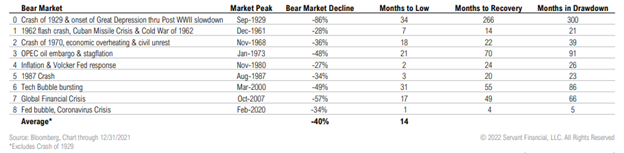

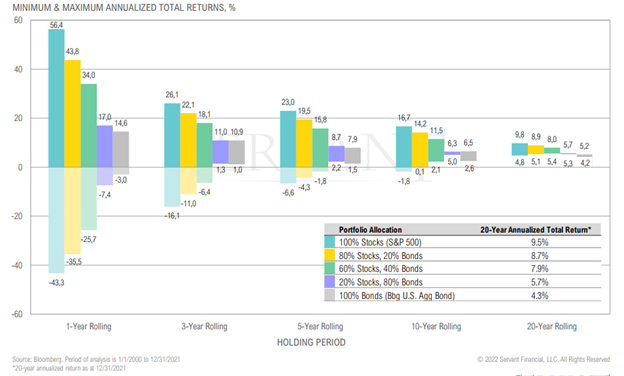

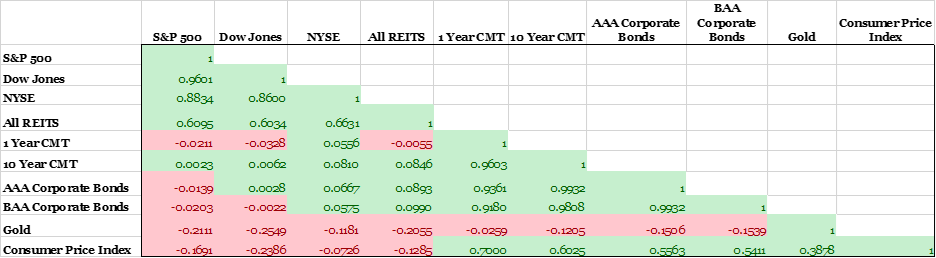

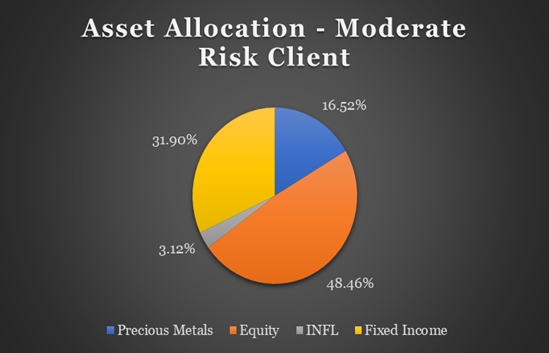

We Wish You a Diversified Portfolio

At Servant Financial, our goal is to help you navigate these turbulent times and help you make the best decisions for your investment portfolio. We understand increased market volatility may be causing investor unease, but it is times like these that the basic investment principle of portfolio diversification proves its mettle. With inflation still a concern and US treasuries on the rise, we are paying close attention to iShares 0–5-year TIPS Bond ETF, STIP. With low management fees (.03%) and a 30-day SEC yield of 5.84%, its 2.5-year duration could be an ideal addition to a blended debt and equity portfolio. The principal value of TIPS (upon which the stated interest is paid) is adjusted semiannually as inflation rises, as measured by CPI. STIP holds a variety of U.S. treasuries with maturities of less than 5 years protecting you against rising interest rates and inflation. STIP is a core holding of Servant’s risk-based client portfolios.

Happy Holiday’s from your friends at Servant Financial and we wish you a globally diversified portfolio.

Instead of holiday cards or gifts, Servant Financial will be making an annual contribution on behalf of clients and friends to Mercy Home for Boys & Girls.

May this holiday season be a time of rich blessings for you and your family.

Source: Pinterest