Current Status of US Dollar

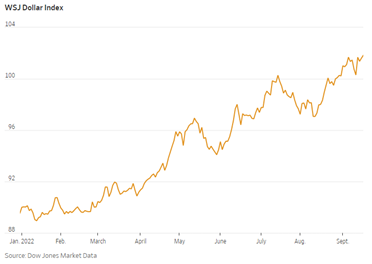

What do George Washington, Abraham Lincoln, and Benjamin Franklin have in common? These three American icons found on the $1, $5, and $100 bills have been getting much stronger the past several months. The U.S. dollar is undergoing one of the longest periods of almost steady appreciation in several decades impacting domestic and foreign economies alike. The ICE U.S. Dollar Index, the most widely adopted currency index, measures the international value of the US dollar against other major fiat currencies with a weighting of Euro (58%), Japanese Yen (14%), British Pound (12%), Canadian Dollar (9%), Swedish Krona (4%), and Swiss Franc (4%). The buck’s value is currently up 22% since the start of 2022 with little end in sight.

Source: Wall Street Journal

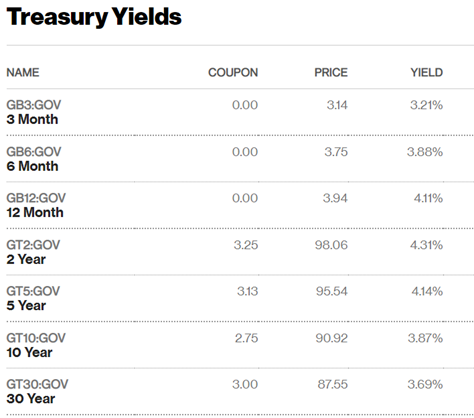

The rise in the dollar’s value is unsurprising as record inflation in the United States has prompted the Federal Reserve to aggressively raise interest rates over the past several months. Just last week, the U.S. central bank decided on another .75 percentage point increase, the third consecutive rate hike. This pushed the implied Fed funds curve higher, with terminal Fed funds now expected to peak at 4.6% and remain above 4.0% through the end of next year. The yield curve inverted further with the 2-year versus 10-year treasury spread at 50 basis points (0.5%). These changes in the risk-free U.S. treasury rates are driving the cost of capital higher for all risk assets and significantly impacting equity and currency markets. While the stock market has experienced significant losses, the dollar has been benefiting from increased capital flows due to rising treasury yields. The U.S. 10-year treasury note is at a multi-year high, yielding over 3.5%. Rising U.S. interest rates have foreign investors flocking to higher-yielding U.S. treasuries and pulling capital out of lower yielding, perhaps riskier currencies, bond and equity investments in other countries. This trend is particularly visible in energy dependent jurisdictions like the European Union, China and Japan.

Impact of the US Dollar on the Global Economy

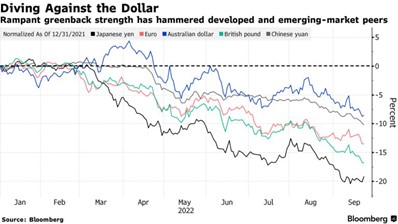

Efforts to combat inflation through interest rate hikes have been counteracted by the strengthening dollar, fueling cheaper imports for the American people. However, the rest of the world has felt the brunt of this change. The economies being hit hardest by the punch of the U.S. dollar, are some of the U.S. largest trading partners: China, Japan, and Europe.

On September 26th, the British pound hit its lowest value ever against the U.S. dollar, sending U.K. bond yields soaring. Emerging economies have also declined in value relative to the dollar with currencies in Egypt, Hungary, and South Africa falling by 18%, 20%, and 9% respectively.

Not only are rising U.S. interest rates impacting these economies, but geopolitical concerns between Ukraine and Russia have Europe in an economic war of its own with Russia. Combined with surging inflation and the aftershocks of the COVID-19 pandemic, the war between Russia and Ukraine has Europe in an energy crisis, only furthering their currencies’ devaluation. Energy prices have skyrocketed while supply dwindles as Europe, particularly Germany, was very heavily dependent on natural gas imports from Russia for its global manufacturing base and winter heating. As European countries are forced to look to the U.S. and other markets for alternative oil and gas imports, the devalued Euro currency is only deepening the economic damage as most imports are traded in U.S. dollars.

Domestic companies with international operations are also being squeezed by the strong dollar. McDonald’s reported global revenue fell 3% this past summer while Microsoft stated that the changes in foreign currency values cut their revenues by close to 1% in the last quarter. According to a report by CBS news , companies comprising the S&P 500 receive 40% of their revenues from foreign countries. This has only added fuel to the downward spiral of the stock market as earnings expectations are lowered due to foreign currency translation losses and inevitable demand destruction. Domestic and foreign companies alike are pointing at the U.S. monetary policy as the root cause of the dramatic economic slowdown globally.

Investment Opportunities

In every market scenario there are winners and losers, and the current strength of the U.S. dollar is no different. While the U.S. stock market has entered a bear market with 20% declines across most major stock indices, treasuries and corporate bond yields have been on the rise in recent months as outstanding bond prices have declined in response to Fed interest rate hikes. Moody’s reports Aaa corporate bonds are currently yielding 4.65% which is up from 2.60% just a year ago while Baa bonds are currently yielding 5.78% on average, up from 3.26% a year ago.

Source: Bloomberg

The looming energy crisis in Europe has some adventuresome investors looking to clean energy options to capitalize on potential long-term secular growth. Even though the energy crisis is worse in Europe, the U.S. has still experienced stubbornly high oil, gas, and electricity prices over the past few years, contributing to the high inflation rate. Last month, we told you about the iShares Global Clean Energy ETF (ticker: ICLN) and the First Trust NASDAQ Clean Edge Green Energy Index Fund (ticker: QCLN) with assets under management of $5.5 billion and $2.4 billion, respectively. Each ETF has demonstrated strong 10 year returns and the government has deepened its commitment to clean energy through the Inflation Reduction Act, meaning this strong performance is likely to persist in the future.

One way to make a contrarian play on the strength of the U.S. dollar waning, or mean reverting over time, would be to invest in a basket of emerging market currencies which for the most part are energy and resource rich. We explored these alternatives on Research Affiliates Asset Allocation Interactive website seeking a fixed income alternative that is expected to pay a real yield (nominal yield less expected U.S. inflation of 4.0%) and an attractive Sharpe ratio (return per unit of risk). Perhaps the best alternative was Emerging Market Cash asset class. As of August 31, 2022, Research Affiliates expects EM Cash to generate a real return of 2.4% (real return in excess of U.S. dollar cash of 4.6%, ie. real loss of (2.2%) holding U.S. dollar) with volatility of 7.2%. This compares to a real return of (0.4%) with volatility of 3.8% for U.S. Treasury intermediate bonds. Of note, Research Affiliates’ risk and return metrics for the EM Cash asset class were derived using a variety of information, including using the J.P. Morgan ELMI+ index as a representative example. Servant Financial portfolio models generally include an allocation to the J.P. Morgan EM Local Currency Bond ETF (EMLC). EMLC yields over 7% and is comprised of mostly investment grade (72%) sovereign debt obligations in local currencies. The top 4 currencies represent 38% of its holdings – Indonesian Rupiah (10%), Chinese Renminbi (10%), Brazilian Real (9%), and Mexican Peso (9%).

As you might expect, the price of EMLC has been declining in line with the U.S. dollar strength this year. We rebalanced the model portfolio last week and at much earlier juncture in 2022 where EMLC was among the list of buys both times. Rebalancing is a prudent investment practice whereby investors buy more of their losing positions and sell winners to get back to overall targeted asset class allocations. Research Affiliates recommends modest allocations to EM Cash of 2% to 4% in conservative to aggressive risk models.

Conclusion

2022 is turning out to be one for the financial record books as inflation, geopolitical pressures, and the bear market has George Washington, Abraham Lincoln, and Benjamin Franklin being stretched in every direction in our wallets. Global recession concerns are rising as the Federal Reserve’s high conviction battle with inflation is affecting consumers and markets all over the world. As participants in a global economy, we need to remember the words of the man found on the $5 bill. “The money power preys on the nation in times of peace and conspires against it in times of adversity. It is more despotic than monarchy, more insolent than autocracy, more selfish than bureaucracy. It denounces, as public enemies, all who question its methods or throw light upon its crimes.” -Abraham Lincoln.

The ubiquitous strength of the almighty dollar and resultant market mayhem suggest the Jerome Powell led Federal Reserve is currently playing the role of Lincoln’s “money power.” The Fed is wielding economist Adam Smith’s “invisible hand” with brass knuckles as it tries to break the back of inflation. The potential collateral damage of the Fed’s heavy-handed approach include the domestic and global economies, the credibility of the Fed, and the almighty dollar’s dominance as the sole global reserve currency.