As humans, we are constantly looking towards “the next big thing.” Children look forward to Christmas Day when they find presents under the tree. College students look forward to the end of the semester and being one step closer to closing the door on homework and exams. Adults constantly think about the next big life event such as buying homes, marriage, starting a family, retirement, or just trying to make it to the weekend after a long workweek. The human nature of “the next big thing” has created the yearly phenomenon of the New Year’s resolution.

Have you ever wondered where this tradition started? Why did we become so caught up with big or important goals or accomplishments of “next year I am finally going to get in shape” or “this is the year will be the year I finally start my own business”? The tradition is said to have begun 4,000 years ago with the ancient Babylonians. People would hold massive celebrations to honor the new year which began in March when crops were planted, and new life would begin to grow. Oftentimes this would be the time that the Babylonians would crown a new king which is an interesting analogy as we head into election year 2024 in the United States. Likewise, Ancient Romans believed in a similar practice and that their god Janus (how January got its name) would look backward to the previous year and make predictions about “big things” in the coming year.

Thousands of years later, we follow a similar practice of looking at our biggest accomplishments of the past year and setting new bigger, or higher goals for the coming year. In last month’s article, we evaluated the ups and downs of the U.S. economy by addressing interest rates, recession concerns, consumer spending, geopolitical issues, and bitcoin adoption among others. Looking at 2024, we see some New Year’s resolutions on the brink for the U.S. but not your typical “I want to lose 10 pounds” or “I want to finally get out of debt,” even though the U.S. government should definitely work on that second one. We expect some New Year’s resolutions within the U.S. regarding economic stability during election year madness and the public likely has some resolutions about the growing credit card burden in light of rising inflation and interest rates post-COVID-19 pandemic. We also expect a few big companies to have an IPO on their New Year resolution list and investors will be keeping a watchful high to see if they can hit these goals.

We Need to Keep the Economy Calm During the Election Year Madness

High on the New Year’s wish list for 2024 for many in the United States is to maintain a relatively stable economy during what is sure to be a volatile election year with more ballot histrionics and chicanery. Regardless of political beliefs, it is easy to see that polarization between political parties is paramount, which may only breed volatility in the economy and financial markets. People typically keep a watchful eye on the factors driving the economy during elections as sometimes changes in power or just the thought of a change in power can create uncertainty or confidence that shifts the trajectory of the economy one way other the other.

U.S. Bank recently published an analysis examining how elections have historically affected the U.S. stock market. Their analysis showed that while election years can bring added volatility to the market, there was no evidence suggesting a meaningful long-term impact on the market. U.S. Bank showed in the figure below how political party control has historically impacted the value of the S&P500 specifically during the first 3 months following an election.

However, individual sectors can swing more widely than overall markets depending on the key campaign issues during an election year such as energy, infrastructure, defense, health care, and trade or tax policy. Key issues going into the 2024 race are likely to be inflation, climate change, foreign policy, student loan forgiveness, and reproductive rights. U.S. Bank also concluded that the individual drivers such as economic growth, interest rates, and inflation are still the most critical factors for investors to consider. Each political candidate is likely considering these market-moving factors as they position their “big things” for their 2024 election runs.

This Year I Want to Get Out of Credit Card Debt

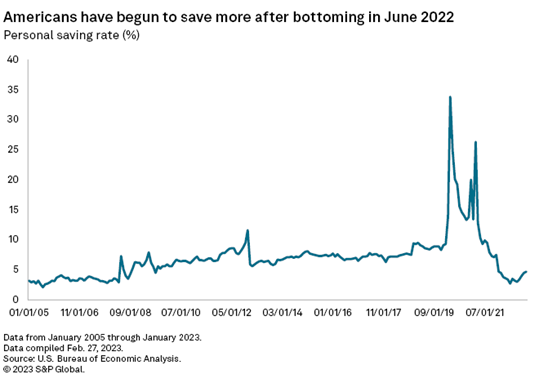

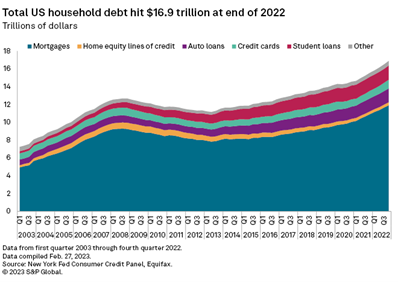

Those plastic shiny cards in Americans’ pockets may be seeing a little less action in the coming year. Credit card debt levels reached an all-time high of over $1 trillion in 2023 as consumers resort to spending on credit to maintain their standard of living in the face of the rising costs of almost everything. Interestingly, Statista reported in a recent survey that people’s #1 priority going into 2024 was saving more which means swiping less. The average unpaid debt among consumers is around $7,000 and the double-digit interest rate accruals on those debt levels do not bode well for consumer saving or spending.

Source: Statista

While the Federal Reserve is celebrating inflation heading towards its 2% target, some people forget that the inflation number is a year-over-year metric. This fact means while year-over-year inflation numbers have come down, they are being compared to high single-digit inflation numbers from the previous year. Let’s look at the specific costs of a few items. A loaf of bread in March 2020 just before the pandemic began was around $1.37 and a gallon of milk was $3.25 according to the U.S. Bureau of Labor Statistics. Currently, the price of bread is $2.00 per loaf and the price of a gallon of milk is $4.00 meaning there have been “big time” increases of 46% and 23%, respectively, in the price of these staples in just 3 years. On the other hand, the median household income in the United States has only grown around 9% since 2020 suggesting that wage increases have not kept up with consumer price inflation. That’s a “big deal” and this mounting credit card debt and higher interest rates will make it very difficult for most consumers to dig out the debt hole that has been created. Applying the first “big rule” of getting out of the hole is to stop digging, many consumers will cut up their credit cards and pursue more frugal lifestyles.

This is the Year We Go Public

In 2023, there were the fewest number of IPOs in recent history with only 153 companies going public compared to 181 in 2022 and 1,035 in 2021. Some of the biggest IPOs for 2023 were AI chipmaker Arm Holdings PLC [NASDAQ: ARM], which IPO’d on September 14 at a $54.5 billion valuation. The next biggest was Kenvue [NYSE: KVUE], Johnson & Johnson’s spinoff of its consumer healthcare division (Band-Aid, Tylenol, etc.) which IPO’d on May 4, at a valuation of $41 billion. In third place was the popular shoe brand, Birkenstock [NYSE: BIRK], IPO’d on October 11, at a valuation of $7.5 billion.

Looking ahead, 2024 is shaping up to be a “big year” for the IPO market. Topping the list of “next big thing” is Stripe, an Irish e-commerce company valued at $50 billion as the most valuable privately held “technology” concern in the world. Batting second is AI company, Databricks, planning to go public with at a $43 billion valuation. Next in line is the popular social media service, Reddit, planning to go public with at a $15 billion monetization of its more than 50 million daily users.

Buzz due to a recent report from Bloomberg has also ensued around a possible public offering for Elon Musk’s Starlink which provides satellite internet to users around the world. The service has brought high-speed internet to people in even the most remote areas of the country to connect electronically with the rest of the world. Musk released a statement in November saying that Starlink had achieved break-even cash flow but denied reports that the company would be spun out separately from Space X and go public in 2024. Space X, including the Starlink satellite business, is truly the “next big thing.” Space X’s 2023 market share of global satellite launches is estimated at 80% and it has an estimated valuation of $150 billion. While Musk seems to have already “hit the moon” with SpaceX, some are wondering what he will do next and if a Starlink IPO will be the next chain in his legacy.

Bitcoin Spot ETF Approval

Speaking of “big launches”, Reuters reported that up to seven applicants for a spot Bitcoin exchange-traded fund (ETF) only have a few days to finalize their filings to meet a looming deadline set by the United States Securities and Exchange Commission (SEC). The SEC has set a deadline for spot Bitcoin ETF applicants to file final S-1 amendments by Dec. 29, 2023. The SEC reportedly told applicants in meetings that it will only approve “cash only” redemptions of ETF shares and will disallow in-kind redemption of ETF shares. Further, the SEC also reportedly wants Bitcoin ETF filers to name the authorized participants (AP) in their filings. APs are effectively market makers and risk takers in the creation and redemption of ETF shares. APs acquire the underlying bitcoin that backs the ETF shares created and, likewise, sell the underlying bitcoin for ETF share redemptions. Any issuer that doesn’t meet the Dec. 29 deadline will not be part of a first wave of potential spot Bitcoin ETF approvals in early January.

The SEC approval of one or more bitcoin spot ETFs is expected to markedly increase institutional and retail investor demand for bitcoin as well as accelerate the bitcoin adoption curve. Bitcoin experts predict this will result in much higher prices for Bitcoin over time.

Bitcoin is currently trading at $42k and has been by far the leading asset class for 2023 with a 154% year-to-date return.

Our New Year’s Resolution

As we sing Auld Lang Syne into the New Year, we at Servant Financial remain committed to maintaining broadly diversified global investment portfolios tailored for each client’s risk tolerance and station in life. Further, we will make it our New Year’s Resolution to stay on top of the “next big thing” that could either adversely or positively impact the achievement of your long-term investment goals and objectives. That “big thing” could be inflation or deflationary concerns that suggest positioning towards greater real asset exposures or lightening up. Alternatively, it could be sensible, yet unconventional portfolio allocations to more volatile asset classes, like bitcoin and gold miners, as anti-fragility plays on the bankrupt fiat money system. Hopefully, the end of 2023 will bring you great joy and satisfaction in some of your biggest life accomplishments for the year and the turn of the year brings you thoughts of resolutions that have you aiming higher or asking yourself what’s “ the next big thing” in your life. May prosperity, good health, and well-being be your constant companion in the New Year.