“Guess what guys, it’s time to embrace the horror! Look, we’ve got front-row tickets to the end of the earth!” This month’s collapse of Silicon Valley Bank (SVB) had many of their well-heeled venture capitalist depositors and customers metaphorically reliving this scene from the 1998 movie, Armageddon. SVB’s downfall had people questioning if we are headed for another epic crisis in the banking system like that experienced in the 2008 Global Financial Crisis punctuated by the failure of Lehman Brothers. On March 8th, SVB announced a $1.8 billion loss on its investments in long-term treasuries prompted by depositors withdrawing funds. Withdrawals soon snowballed as general partners at venture-capital firms began pulling their money out of Silicon Valley Bank and urged their portfolio companies to do the same. Hours later, Moody’s downgraded SVB Financial triggering its stock price to crash sending shockwaves reverberating throughout the banking system. $52 billion in the market value of JP Morgan Chase, Bank of America, Wells Fargo, and Citigroup was lost as panic spread about the safety of banking deposits, particularly deposits over Federal Deposit Insurance Corporation (FDIC) insurance limits of $250,000. Two days after the initial announcement, the FDIC took control of SVB after depositors attempted to withdraw $42 billion. On March 12th, the New York Department of Financial Services regulators announced the 3rd largest bank failure, Signature Bank. Signature Bank was one of the few banks accepting crypto deposits; some believe this made them an easy regulatory target. SVB’s failure prompted Signature Bank customers to move their depository funds to larger systemically important banks, like JP Morgan Chase and Citigroup, as concern rose surrounding its portfolio which was very similar to SVB’s. Systemically important is the code for “too big to fail banks” that the Federal government will likely step in and save in a full-blown crisis.

Panic and concerns surrounding the U.S. banking system sent shockwaves from large banks down to your local community bank known for giving out lollipops for new deposits or transactions. $165 billion in losses of market value were experienced among the 10 biggest bank stocks and $108 billion in losses were incurred among small bank stocks according to the Federal Reserve. Concerns began to arise that we were in for another collapse of the banking system as the closure of SVB marked the 2nd largest bank collapse ever and the largest since the 2008 Global Financial Crisis. Many experts wondered aloud whether SVB was analogous to a Lehman moment within the technology sector centered around Silicon Valley and San Francisco.

Image Source: Fox Business

The Downfall of Silicon Valley Bank

So where did SVB go wrong? As the name suggests, Silicon Valley Bank was a preferred bank for many tech start-ups and venture capital firms. The bank saw substantial growth during the pandemic as the technology sector was booming and venture capital money was raining down on VC startups, minting hundreds of Unicorns – VC startups valued at $1 billion or more. SVB invested the flood of deposit funds into treasury bonds, mortgage-backed bonds, and other long-dated assets which provided SVB with a larger interest spread over the interest SVB paid to its depositors in the low-interest rate environment during the pandemic. The Federal Reserve monetary and interest rate policy decisions and long-term guidance encouraged this behavior as Fed Chairman Powell labeled incipient inflation “transitory” in 2021. But as inflation continued to rise into 2022, the Federal Reserve was ultimately forced to hike interest rates very aggressively. The yield curve eventually inverted as long-term interest on 10-year treasuries fell below those offered on 2-year treasuries. Consequently, the long-duration securities that SVB purchased to back its deposits fell substantially in value, something on the order of 25%. In accordance with accounting rules and the regulatory framework for banks, SVB had counted on the fact that they would hold their investments until maturity and did not recognize the mark to market impact of higher interest rates in its financial statements. These held-to-maturity securities were carried at cost on their balance sheet until they could no longer be “held.” Sophisticated depositors caught wind of this shadow accounting issue with SVB’s announcement of a $2 billion equity capital raise. Deposits were rapidly withdrawn causing a forced sale of these long-term securities and creating large realized losses.

SVB had also been facing a general slowdown in the venture capital funding cycle and deposit taking. Venture capital investments are far less attractive when the cost of capital rises with interest rates. It’s far easier to finance these ventures that do not cash flow for several years, maybe a decade or more, at zero interest rates, but it’s a completely different ballgame with the Federal Funds Rate at 5.0%. Funding across the venture capital space slowed meaningfully and deposits to the preferred depository institution began to shrink massively. Moreover, these cashflow-burning startup enterprises continued to rapidly withdraw money for payroll and operational expenses. The Federal Reserve’s wild misjudgment on inflation and subsequent unprecedented rapid hiking campaign fomented the destructive conditions for a life-or-death decision between the safety of deposits and SVB’s insolvency, or Jeromeggeden. The Federal Reserve had effectively financially engineered this textbook run on Silicon Valley Bank by its policies. Many sophisticated investors had long ago concluded that the Fed would keep hiking interest rates until they broke something. Technology-sector concentrated SVB proved to be the weak link and the first domino to fall.

The big question is how many other banks will be caught swimming naked on interest rate risk management now that the banking deposit tide is going out. This banking cycle is a foreseeable consequence of Fed monetary policies. Remember under quantitative easing (QE), the Federal Reserve printed dollar reserves and used those reserves to take U.S. treasuries and other government-backed securities out of private hands. These excess reserves generated by QE are now trapped in the U.S. banking system. Depositors are being rational economic actors and withdrawing bank deposits and buying money market funds that hold U.S. treasuries. With money market funds yielding 4.3% today, this deposit withdrawal cycle may be largely irreversible. The Fed should be accelerating its wind-down of its U.S. treasury holdings to soak up the wave of private demand for treasuries.

The Federal Reserve’s Response

The fears around the financial stability of the banking system had investors and consumers alike calling for a slowing of Federal interest rate hikes. Investors and banks alike had already been questioning Chairman Jerome Powell on the timing (too late to start the hiking cycle) and pace (too fast hiking because playing catchup) of their policy decisions. Judgment day came on March 22nd when the Fed announced another 0.25% rate increase making it clear their priority was combating inflation despite growing fears about the stability of the banking system. The rate hike prompted banks to lose further equity value both domestically and in Europe, causing unease that the Fed’s decision could cause additional damage to the already wounded banking system. Mr. Powell said that “depositors should assume that their deposits are safe” as the government plans to impose further regulations on an already heavily regulated industry. This “watch and see what happens” approach was small comfort and hasn’t given bank depositors in non-systematically important banks that warm and fuzzy feeling about the safety of their deposits. Deposit withdrawals at regional and small community banks continued apace.

Will the Large Banks Keep Getting Larger?

The resulting crisis has depositors and banks alike looking to the FDIC and U.S. Treasury Secretary, Janet Yellen for guidance. Yellen commented at a Capitol Hill hearing that the FDIC will cover the uninsured deposits (excess of $250,000) of both SVB and Signature bank, yet there is great uncertainty if this policy decision would apply to other bank depositors in the future. Yellen publicly said shortly after the SVB collapse that the FDIC could cover depositors whose funds exceed the $250,000 limit. However, when questioned if all banks would receive this treatment at the Congressional hearings, Yellen’s response appeared to suggest that small and midsized banks would be left out. The calamity caused by Yellen’s comments was highly disruptive for many smaller banks as it prompted businesses and individuals to contact their local community banks about transferring their depository funds to larger banks that Yellen said would be protected. This was a surprisingly dismal show of confidence from the U.S. Treasury Secretary who once proclaimed in 2017 as Fed Chairman “I don’t see a financial crisis occurring in our lifetimes.”

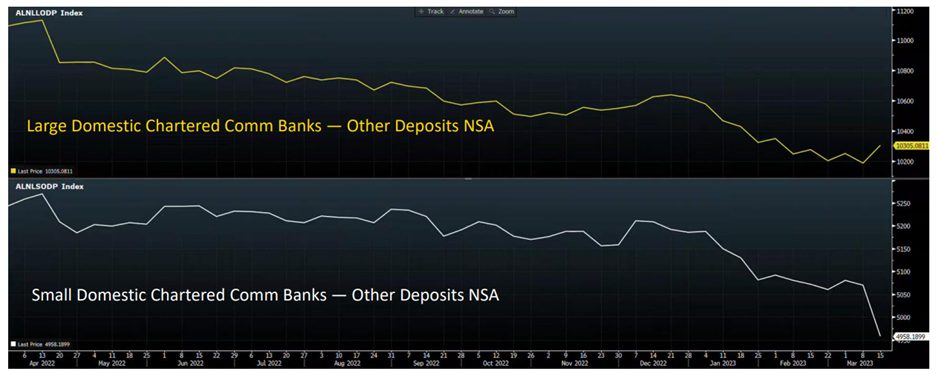

From March 8th to March 15th, $110 billion flowed out of small banks into larger banks. Small banks account for just 34% of deposits in the U.S. banking system; however, they account for a substantial portion of commercial real estate loans sitting at 74% of total loan activity. Like the iconic Bailey Building and Loan from It’s a Wonderful Life, these small community banks lend out deposit funds to Main Street America borrowers for local commercial real estate projects or businesses. If deposits to small banking institutions continue to contract, then this would reduce capital available for commercial real estate lending. Small banks often work with borrowers whose needs are more specialized or whose funding needs are too small in size for the larger banks in America to consider. For example, according to the American Banking Association, a majority of agricultural lending is done by small and mid-sized banks that have deep roots in their rural communities. Farm loans require specialized analysis and training that not many large banks possess. If depositors pull their money from these small institutions, this could affect the availability of capital for agricultural lending, small business lending, and lending to underserved/underbanked communities.

While concerns surrounding the U.S. banking system have merit, the situation Silicon Valley Bank found itself in was somewhat unique. Nationwide, 45% of all deposits in the United States banks are uninsured; however, at SVB almost 94% of their deposits were uninsured. To stem this evolving bank liquidity crisis, the Fed created a new program to administer additional funding called the “Bank Term Funding Program,” (BTFP). Through this program, banks would be loaned funds if they pledge U.S. Treasury securities, mortgage backed securities, and other collateral. The result would be potentially transferring the risk of bank losses from the bank to the federal government. Through BTFP, the Federal Reserve apparently will provide liquidity to the borrowing bank may give loans based on the par value/cost of the securities rather than its depreciated market value. In other words, they moved the shadow accounting for unrealized losses to the Fed’s balance sheet.

Safety of the US Banking System

Despite ongoing concerns surrounding the stability of the U.S. Banking system and another potential banking crisis similar to 2008, most economists believe that the U.S. Banking system is sound. On a broad scale, U.S. Banks are solvent overall and are not at a high risk of systematic failure or collapse. While rapid interest rate hikes have caused more severe fluctuations in capital flows in higher interest rate sensitive sectors of the economy, like technology and banks concentrated on that sector, we would expect that most large banks have well-risk-managed investment and lending portfolios and show more of diverse depositor base among sectors. Silicon Valley Bank appears to be a unique case of a large bank that did not properly manage the interest rate or duration risk of its investment holdings and Federal regulators were found asleep on the job again. Small community or regional banks may struggle to diversify their portfolio from a geographic standpoint however their focus gives them the ability to lend to a wide array of small businesses such as farms, retail, commercial property, and others. The investment portfolio of these smaller banks is closely watched by bank regulators as they serve such a large percentage of the total loan volume.

Policy actions and statements from the Fed’s Jeromeggedon and Treasury’s Calamity Janet have many Wall Street economists forecasting the U.S. will be in a full-blown recession by the second half of 2023, potentially forcing the Fed to pivot and begin lowering interest rates. Servant Financial client portfolios continue to stay overweight cash and fixed-income securities relative to strategic risk targets. The Federal Open Market Committee’s (FOMC) decision to raise the Fed funds rate by 25 basis points last week shows that the Fed is prioritizing its “stable prices” mandate over financial stability. We believe this policy decision will ultimately lead to increased financial instability while heightening inflation risk. As such, we are maintaining underweights to equity and credit risk and healthy portfolio allocations to precious metals and other real assets.

Based on the FOMC’s subsequent actions, we plan on adjusting risk allocations once financial instability and recession risks have been fully repriced. We expect the Fed will be forced to abandon its inflation fight and lower interest rates materially in the coming quarters. For now, we are advising clients to remain the rational actors that all economists expect us to be. For our portion, that means getting paid to wait by holding excess cash in money market funds with better yields from short-term investment-grade bonds. For example, the Fidelity Government Cash Reserve money market fund (FDRXX) yields 4.3% as compared to just 0.7% more in yield (5.0%) for a high-quality bond fund with a 6-year duration. This short-term positioning greatly reduces the risk of taking a wait-and-see approach to the rapidly evolving macro, policy, and market backdrop.

Keep it simple with money market funds for your liquid savings as well or keep it local if you can. Consider maintaining savings accounts or bank certificates of deposit (CDs) of 6 to 12 months at multiple local banks in support of your community. CDs, like checking or savings deposits, are only FDIC-insured up to $250,000 but are now offering rates from 4% to 5%. Ultimately, it is important to do business with people you trust and places you know will be there when you need them. Have conversations with your local banker to find out how protected your money is. Shop around, this is a saver’s dream after nearly a decade of near-zero interest rates.

Disclaimer: This is not investment advice and should not be used in the context of forming an investment portfolio. See your investment advisor or talk with Servant Financial today about how these factors affect your portfolio.