Hedge fund investor and billionaire Ray Dalio of Bridgewater Associates once retorted “If you don’t own gold, you know neither history nor economics.” Gold interest began spiking again during the COVID-19 pandemic as investors flocked to real assets to hold their money in while equities were flopping. As the S&P 500, NASDAQ, and Dow Jones have started on a downward trend once again, gold has again been experiencing gains in value. Hopefully, most readers can answer yes when asked “Got Gold?” Servant Financial clients can assuredly answer affirmatively as outlined at the close of this article.

Despite Dalio’s admonition, gold holders, or gold bugs as they are affectionally called, are in the minority of U.S. investors. The Gold IRA Guide conducted a survey in 2020 to reveal the opinions of Americans surrounding gold and silver ownership. 1,500 Americans were surveyed between the ages of 18 and 65+. The survey revealed that 89% answered “no” when asked “Got Gold?” Only 10.8% of respondents owned either just gold (4.3%) or both gold and silver (6.5%). Some respondents just owned silver (5.1%), suggesting a combined 84% of Americans owned neither gold nor silver at that time.

An updated survey by Gold IRA Guide in May 2022 of 2,500 American households found that almost 4 out of 5 reported having done nothing with their investment portfolio or retirement accounts to hedge against generationally high inflation. Consumer Price Inflation (CPI) was reported above 8% for all items in both March and April of 2022. Frankly, I think this is a sad commentary on institutional money management because it is very likely that many of these survey respondents were working with trusted investment advisors. Unfortunately, a large majority of money management firms have apparently not “studied history or economics.” Lemming-like, many institutional money managers are beholden to the traditional 60/40 stock and bond regime that has worked so well for the last 3 decades since the start of the 1990s.

Ray Dalio has also stated that “There are two main drivers of asset class returns – inflation and growth.” We know from history that growth has been the dominant driver since the 1990s aided by a secular decline in inflation and interest rates. Unfortunately, over the next 30-plus years, our elected geniuses in Washington and their co-conspirators at the Federal Reserve mistook that secular trend for permanence and repeatedly doubled down on the mantra “deficits don’t matter.” While most American households cannot feasibly operate under a budget deficit, the U.S. government seems to think they can. Washington elites ignored “history and economics” by spending and printing without limitation. It’s as if they were seeing the world through Morgan Wallen Whiskey Glasses:

Line ’em up, line ’em up, line ’em up, line ’em up

Knock ’em back, knock ’em back, knock ’em back, knock ’em back

Fill ’em up, fill ’em up, fill ’em up, fill ’em up

‘Cause (INFLATION) ain’t ever coming back.

However, it is now increasingly apparent that we are entering a secular period in history where inflation trumps growth as the primary driver of asset class returns. Safe passage through this new secular inflationary period requires polishing up on the history of gold cycles. The chart below from Octavio Costa at Crescat Capital provides a nice overview of gold’s price history since the 1970s. It’s important to note on this timeline that in August 1971 President Nixon closed the “gold window” which prevented foreign governments from redeeming their dollars for gold. Up until this point, gold had served as an important governor on U.S. spending and printing.

History shows that when gold was the primary monetary unit before the adoption of gold-backed fiat currencies, gold also served as a governor of war. Would-be aggressors were limited in financing war against their neighbors by the amount of gold stored in their treasuries and the amount of gold booty or other resources they could recover from their conquests. The same goes for pirates and naval conquests.

For those readers interested in digging a little deeper into gold, we’ve found that the most comprehensive analysis of gold markets available is entitled “In Gold We Trust”, prepared annually by Incrementum. Incrementum published their 417-page, 17th edition earlier in 2023 entitled Showdown | In Gold We Trust report 2023 (hyperlinked to YouTube summary presentation of the report).

Incrementum presciently entitled their May 2023 edition “Showdown.” The report summarizes the four important Showdowns that they expected to play out over the next year or more:

- West Versus East Geopolitics

- Competing Currencies (BRIC+ Currency Bloc)

- Failing Monetary Policies

- Price of Gold (gold price advances have been tame relative to Incrementum’s cycle view)

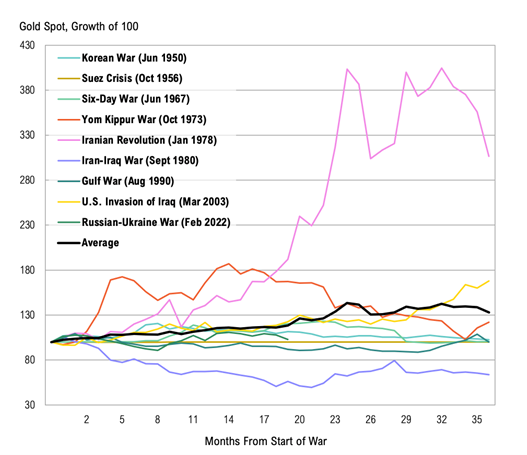

Obviously, Incrementum was aware of the Russia-Ukraine “showdown” at the time of publication but likely could not have anticipated another violent “showdown” in the Middle East. Sadly, the inhumanity of humanity intervened again in recorded history with another Middle Eastern war on the 50th anniversary of the Yom Kippur War of 1973 (also known as the Fourth Arab–Israeli War). That war began on 6 October 1973, when an Arab coalition led by Egypt and Syria jointly launched a surprise attack against Israel on the Jewish holy day of Yom Kippur. Following the outbreak of hostilities, both the United States and the Soviet Union initiated massive resupply efforts for their allies (Israel and the Arab states respectively) during the war which led to a confrontation between the two nuclear-armed superpowers.

Source: Bloomberg, SpringTide

Incrementum included a thoughtful, far-reaching interview with former Credit Suisse economist Zoltan Pozsar. Pozsar is a Hungarian-American economist known for his analysis of the global shadow banking system. He published a widely read December 2022 analysis while at Credit Suisse entitled “War and Commodity Encumbrance”.

Pozsar has since started his own macroeconomic advisory firm specializing in funding and interest rate markets called Ex Uno Plures. The firm’s name (“out of one, many” in Latin) is the antonym of E Pluribus Unum (“out of many, one”), the motto on the Great Seal of the United States and dollar bill. The firm’s raison d’être and the main thesis of the War and Commodity Encumbrance whitepaper is that “for generations, investors have been operating in a unipolar macroeconomic environment, where the U.S. dollar reigned supreme globally and where E Pluribus Unum was the perfect motto to describe what became known as the global dollar cycle. However, the conflict between the U.S. and China is set to reshape the global monetary order centered around the U.S. dollar. De-dollarization, the re-monetization of gold, the invoicing of a growing number of commodities and goods in renminbi, and the proliferation of CBDCs (Central Bank Digital Currencies) will challenge the US dollar’s hegemony (“out of one, many”).”

Incrementum’s headline quote from the Pozsar interview reads, “Two percent inflation and going back to the old world, I don’t think it stands a snowball’s chance in hell. Low inflation is over and we’re not going back.”

Here are some of Pozsar’s specific recommendations from the interview for adapting to the New World Order as he sees it (emphasis added):

- We are moving into a multipolar reserve-currency world where the dollar will be challenged by the renminbi and the euro for reserve currency status.

- These currencies, especially the renminbi, would not necessarily be used as a reserve currency, but rather to settle trade. Gold could play an increased role here. (Pozsar notes that since 2016-17, the renminbi has been convertible to gold on the Shanghai and Hong Kong Gold Exchanges.)

- The Chinese are using swap lines to settle international trade accounts. This is a fundamentally different approach from the dollar reserve framework and would mean that trade can occur in renminbi without nations needing to hold vast reserves of the currency.

- The various crises that today’s financial market participants have witnessed were solved by throwing money at whatever problem arose. The current inflation problem is different.

- This situation is also vastly different from the late 1970s when Paul Volcker curbed inflation by prolonged high-interest rates. Chronic underinvestment in the resource sector and labor issues will cause inflation to remain sticky.

- The traditional 60/40 portfolio allocation will struggle in this environment. Pozsar recommends a 20/40/20/20 (cash, stocks, bonds, and commodities) allocation.

Commenting further on the commodities allocation Pozsar echoed the words of Dalio on “gold, inflation and growth”:

“Within that commodities basket, I think gold is going to have a very special meaning, simply because gold is coming back on the margin as a reserve asset and as a settlement medium for interstate capital flows. I think cash and commodities is a very good mix. I think you can also put, very prominently, some commodity-based equities into that portfolio and also some defensive stocks. Both of these will be value stocks, which are going to benefit from this environment. This is because growth stocks have owned the last decade and value stocks are going to own this decade. I think that’s a pretty healthy mix, but I would be very careful about broad equity exposure, and I would be very careful of growth stocks.”

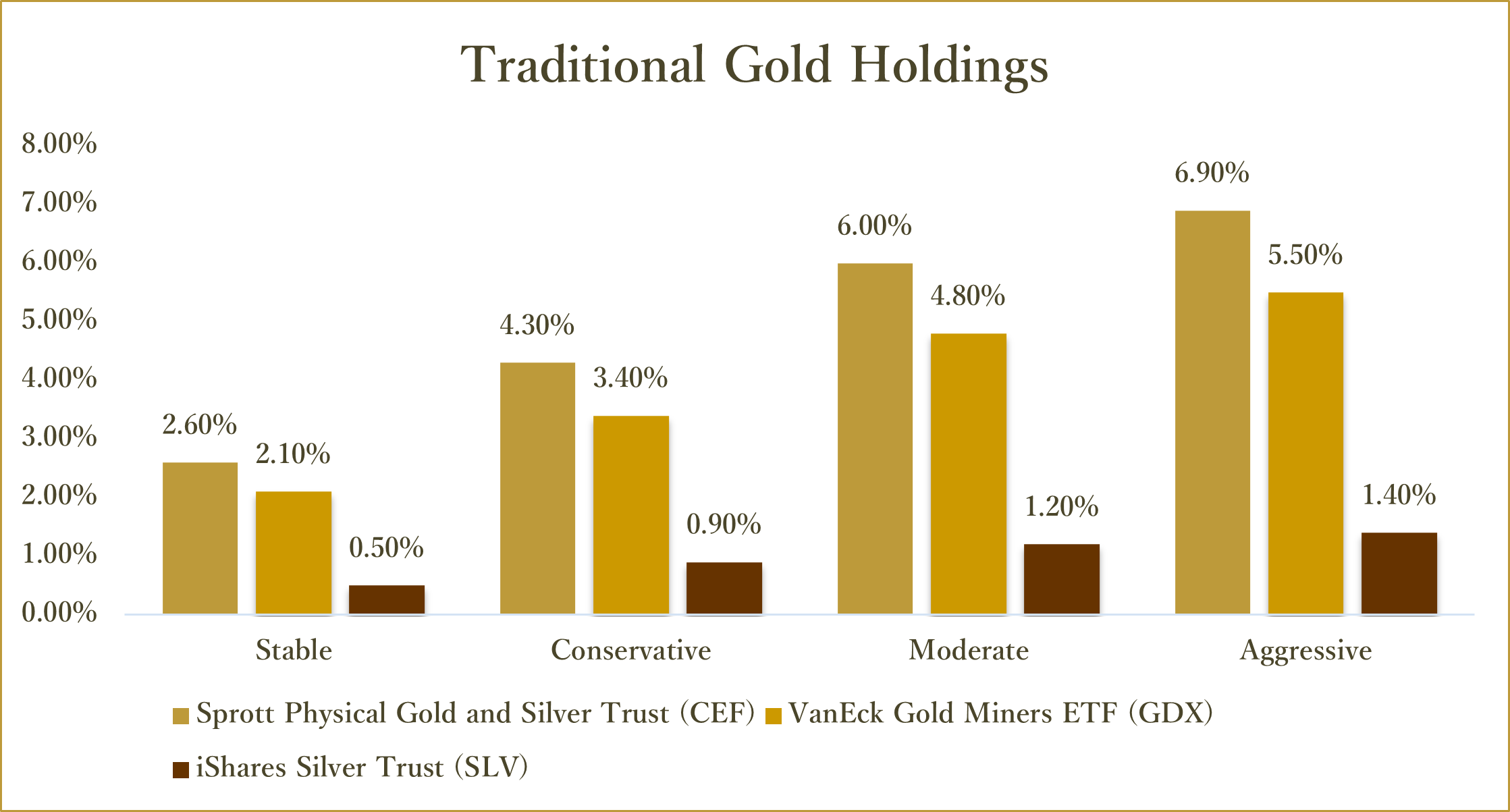

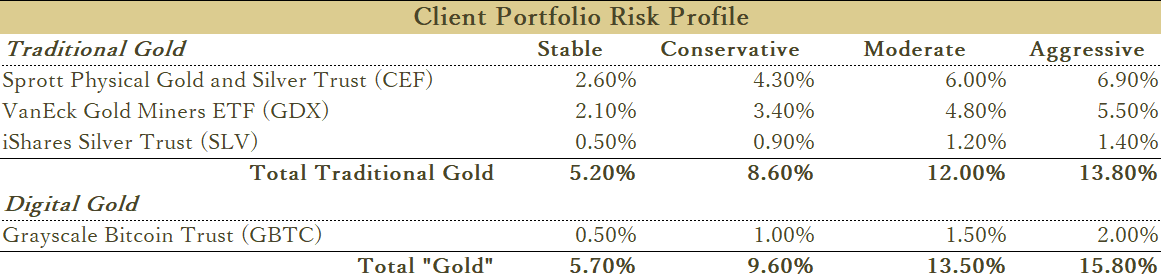

Servant Financial client portfolios have long held, meaningful allocations to gold. Below is a summary of gold allocations by client portfolio risk profile:

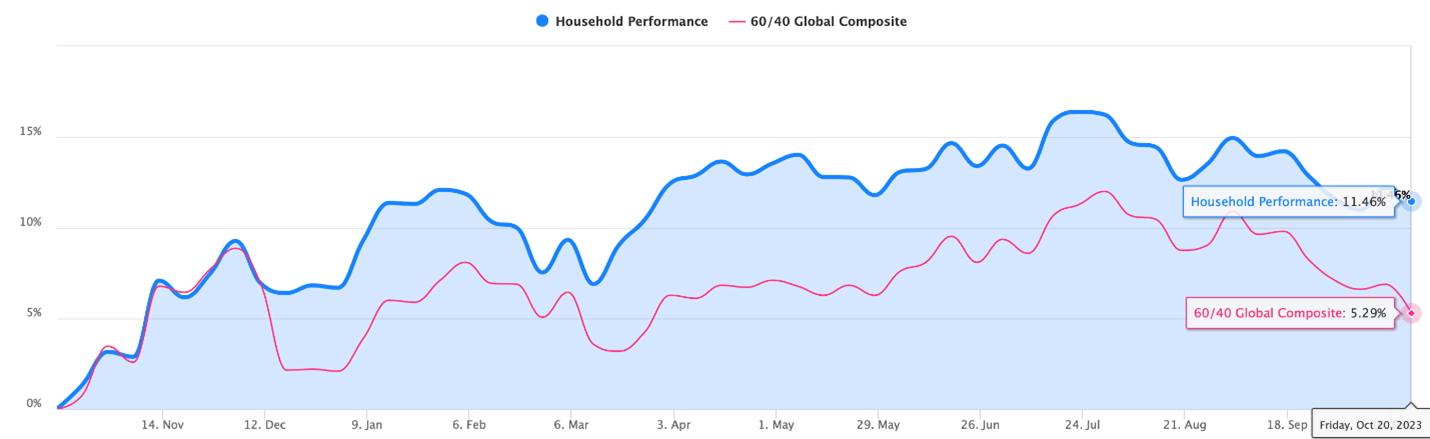

The chart below provides the performance of a Moderate Risk client portfolio after management fees against a traditional 60/40 global composite portfolio (without management fees) over the past twelve months ended October 20, 2023, and highlights the benefit of holding traditional gold and precious metals and digital gold over this time. (Past performance is not indicative of future performance.)

Moreover, bitcoin broke emphatically through the $34K level on October 24, 2023, and is up some $8,400, or 32%, in the past 30 days after the United States Court of Appeal issued a court mandate this week requiring Grayscale Investment’s application for a spot Bitcoin exchange-traded fund (ETF) to be reviewed by the Securities and Exchange Commission (SEC). The mandated SEC review could potentially pave the way for the conversion of the Greyscale Bitcoin Trust (BTC) from a trust (trading a week ago at a 12% discount to the net asset value (NAV) of underlying bitcoin held) to a spot ETF trading much closer to NAV. Servant predicted this “Bitcoinalization” as we coined it back in July of this year.

The title of this month’s newsletter is a hat-tip to the highly successful “Got Milk?” ad campaign of the 1990s and early 2000s. Trends in consumption and investment evolve, affected by the cyclical and episodic nature of humanity and a myriad of factors from health and ethical concerns to technological innovations and geopolitical events. Just as the dairy industry has faced challenges and adapted, the gold investment landscape is also undergoing a transformation and monetary renaissance. The intrinsic value of milk as a household staple of a well-balanced diet is akin to the enduring value that gold brings to a well-diversified investment portfolio. Just as there have been resurgences in milk consumption through innovation and adaptation, the allure of gold, gold miners, and other scarce stores of monetary value remains. A “Got Gold?” mindset offers investors a timeless refuge, especially in an era characterized by economic uncertainties, inflation, and geopolitical unrest.

Blessing for Peace

May those who make riches from violence and war,

Hear in their dreams the cries of the lost.

Excerpt from the poem by John O’Donohue