Somebody Call 911, the U.S. Economy is Sick.

Ambulance sirens blare, doctors prepare, and the patient is on their way to the E.R. with little time to spare. The patient is the U.S. economy which is on its way into the E.R. – Economic Recession that is! Anxiously waiting for the wellness diagnosis are U.S. consumers, Wall Street investors, and analysts around the globe. A recession is defined as a “significant, extensive, and lingering period of economic downturn.” Some may argue that since COVID-19 we have been experiencing these symptoms as inflation persists and equity markets tumble. But who diagnoses a recession or determines economic well-being? The r-word has been tossed around over the past few years by Wall Street experts, media pundits, and struggling consumers but the entity that gets the final say is the National Bureau for Economic Research (NBER). Unlike the relatively timely results from your personal physician, NBER’s diagnosis can be painstakingly slow. It took 366 days for NBER to announce its recession conclusion after the 2008 financial crisis. That’s like sitting in your doctor’s office knowing you are seriously ill with common flu symptoms, yet the doctor will not accept the obvious diagnosis and prescribe anything until they rule out every other ailment first.

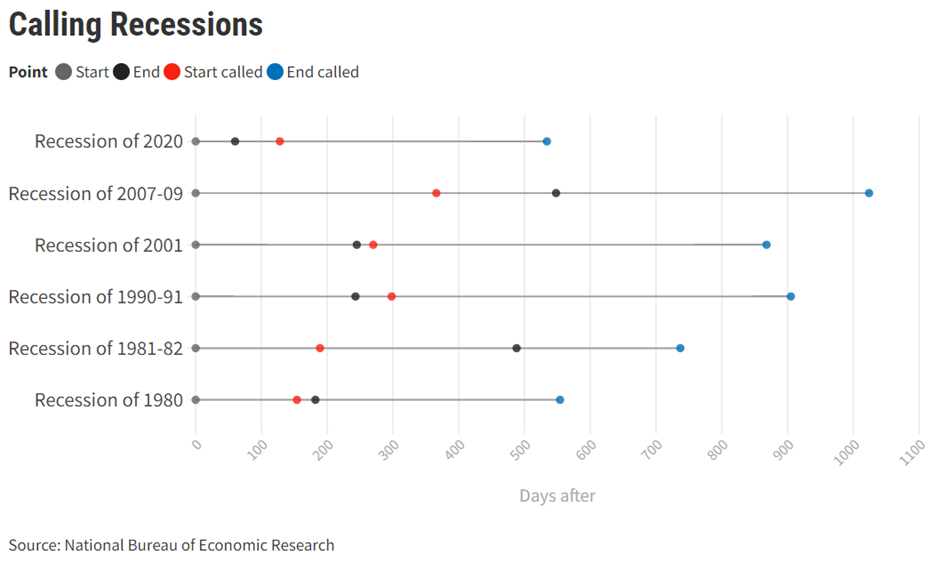

So, what’s the hold-up? Why does it take so long for NBER to call a recession? Much like doctors, several tests and conclusions must be drawn by NBER before a formal recession decision is made. NBER states “It waits until sufficient data are available to avoid the need for major revisions to the business cycle chronology.” Their goal is to not sound an alarm that could cause consumers and investors to make premature decisions before all the data is analyzed. In other words, NBER does not want to be the proximate cause of a recession. The effects of a recession diagnosis can radiate through the economy and impact government policy decisions. Accordingly, NBER takes its time to confirm a recession has occurred well after that conclusion has been universally accepted. Not only do they take their time calling a recession, but they also wait to confirm the economy has healed and an economic recovery has taken hold. It can also take more than a year for NBER to make the call of a recovery. See below.

Source: Newsweek

The symptoms of a recession can vary and are unique in each case. Many define a recession as two consecutive quarters of falling real Gross Domestic Product (“GDP”); however, NBER evaluates a variety of metrics before making the call. NBER analyzes data about labor markets, consumer spending, business spending, industrial production, and overall income. They take a more holistic approach to analyzing the economic situation rather than using a practical rule of thumb or threshold to trigger a recession diagnosis. So, let us look at the current vital signs of the U.S. economy.

Vital Sign #1: Gross Domestic Product

The U.S. economy’s GDP is a key benchmark of economic performance. GDP measures the value of the final goods and services produced in the U.S. As an economic vital sign, typically a recession diagnosis is given when the economy’s GDP experiences two consecutive quarters of negative GDP growth. The economy experienced this already during the first half of 2022. There was considerable debate in many circles about a recessionary call at that time given the one-time distortive impacts of COVID-19 preventive measures. Consensus GDP projections for 2023 were for growth of around 2.5% in the first quarter. The Commerce Department announced on April 27th that GDP growth slowed to a 1.1% annual rate as consumers retrenched due to high inflation and rising interest rates. Reported first quarter 2023 GDP marked a slowdown from inflation- and seasonally adjusted 2.6% growth in the fourth quarter of 2022 and 2.2% average annual growth in the 10 years before the pandemic. This rapid slowing in the U.S. economic pulse sets the stage for a potential recession in the second half of 2023 if this vital sign continues to deteriorate.

Vital Signs #2, #3, and #4: Inflation, Federal Reserve’s Monetary Policy, and Bank Instability

While persistent inflation is not necessarily a sign of recession it can be the first domino to fall in a series of economic drivers. Inflation has been causing the United States economic discomfort for the past year and its peak of over 9% was like a sharp pain in the gut of the U.S. economy. Chronic inflation caused the surgeons at the Federal Reserve and U.S Treasury to grab their scalpel and open up the patient to take a closer look. In last month’s article entitled Jeromeggedon and Calamity Janet, we highlighted the banking and economic trauma caused by the sheer force of the Fed’s aggressive rate hiking campaign and the potential damage to the banking system, a lifeblood to the U.S. economy. This aggressive monetary policy has caused the yield curve to invert which is a telltale sign that the patient isn’t well, and it is a reliable signal of an oncoming recession. Typically, banks profit on the spread between longer-term assets and the interest paid on short-term liabilities such as bank deposits. However, if the yield curve is inverted, bank profitability is problematic. As a result, banks may have to lessen their lending activities which can reduce economic growth. Moreover, today banks can deposit their excess reserves at the Federal Reserve and safely earn 5% on the Federal Funds Rate. This further depresses bank lending.

The inverted yield has already caused a few banks to collapse that anticipated inflation to be “transitory” after comments made by Fed Chairman, Jerome Powell in 2021. However, inflation persisted causing the Federal Reserve to aggressively hike interest rates. This caused long-duration securities to fall in value, taking Silicon Valley Bank down with it. Concerns surrounding bank stability have arisen and depositors have already started to reduce their bank deposits below the FDIC’s $250,000 insurance limit. The fallout from the banking crisis has economists and the Federal Reserve cautioning that a recession is probable later this year. Not everyone agrees about the potential unhealthy condition of the banking system as the Vice Chair for Supervision, Michael Barr, said the banking sector “is sound and resilient.” While there are multiple opinions about the diagnosis and prognosis of the US economy, the banking sector should at least be considered an acute care patient and continue to be closely monitored.

Vital Signs #5 and #6: Consumer Spending and Unemployment Levels

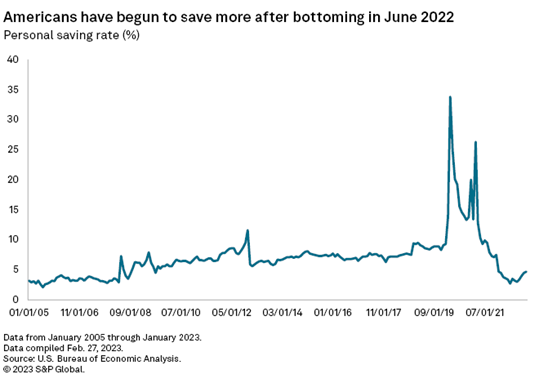

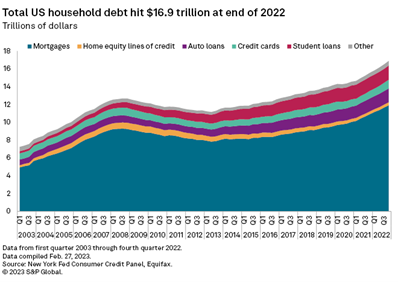

“It’s a recession when your neighbor loses his job; it’s a depression when you lose your own.” – Harry Truman. But what would President Truman have to say about an economy that is experiencing some of the lowest unemployment levels ever, but the central bank is signaling a recession beginning later this year? Consumer spending has not appeared to be slowing much even as recession fears among economists persist. Retail spending jumped 3% from December 2022 to January 2023. Yet the consumer appears to be leveraging future income to meet consumption as consumer debt levels have reached historic peaks. And while its growth has tapered a bit in recent months, household debt is projected to reach the highest value in history with the personal savings rate also declining after hitting its pandemic high at almost 35%. Credit card debt is at an all-time high with U.S. household credit card debt reaching $986 billion in 2022, a 15% increase from 2021. While some see this metric as a strength of consumer sentiment, others believe that Americans are having to put more and more on credit cards to keep up with rising prices and wages that have stagnated.

Source: SP Global

Some people may look at consumer spending and wonder when consumers will start to crumble and begin reducing their consumption and spending. However, the continued strong economic outlook for the job market has some wondering if a change in consumer behavior will even happen. Historically, recessions are characterized by weak job markets and subsequently reduced consumer spending. However, this is not the type of labor environment we are experiencing right now. With an unemployment level hovering just above 3% and consumer sentiment scores still strong, American workers remain confident in their job security and ability to maintain income and spending levels. Consumers who are confident about their job prospects and income level will likely continue to spend and finance purchases on credit cards.

The strong job market has been an important vital sign for consumers however it has been to the detriment of many employers. “Help Wanted” signs continue to be posted in a variety of businesses from retail to finance and technology. Companies are having a hard time filling open positions and coupled with continued supply chain lags, their production has slowed. This fact has many economists intently focused on government and private market reporting on employment statistics, watching closely for early symptoms of illness in the job market.

The Prognosis and Prescription

So, what’s the overall prognosis for the U.S. economy? Will the old adage “an apple a day keeps the recession away” hold true in the upcoming year? Both the Federal Reserve and economists have signaled the economy is likely to enter a recession within the next 12 months. Many economists, like physicians often do, put a little sugarcoating on their messaging using terms like “mild” or “treatable” The most up-to-date leading economic indicators from The Conference Board point to a 99% likelihood of a recession over the next year with the root causes stemming from the Federal Reserve’s interest rate hikes and tightening of financial conditions within the banking sector. The Federal Reserve has predicted a mild recession to begin later this year with a recovery happening over the next two years.

Investors have been watching recession vitals closely and some argue that recessionary fears are already priced into the market. We believe this market is at historically high relative valuation levels and is priced for an economic soft-landing or shallow recession rather than the median historical recession. The S&P 500 for example has continued an upward trend since January even as recessionary fears grew. This U.S. large cap valuation index has moved higher mostly on the back of a handful of large technology names. Further, while earnings expectations for 2023 have come in, they are only showing a mild earning contraction over 2022 which would be a highly favorable outcome for the typical recessionary period.

Given this prognosis, we lowered risk elements across Servant client portfolios by lightening up allocations to a) equities and b) inflation hedges earlier in April. Proceeds were deployed into short-term treasuries and high-quality corporate bonds. Note we were conservatively positioned across investor risk profiles prior to these tactical moves. These trades further increased our equity underweight.

We trimmed allocations to Distillate U.S. Fundamental Stability & Value ETF (DSTL) by a third and deployed proceeds into iShares iBonds December 2024 Term Treasury ETF (IBTE). We also swapped allocations to iShares 0-5 Year TIPS Bond ETF (STIP) for Invesco BulletShares 2026 Corporate Bond ETF (BSCQ). The STIP inflation hedge has played its important portfolio buffering role well as inflation moved from “transitory” to “chronic” in Dr. Powell’s medical charts.

The motivation for the equity trimming is purely a function of stock market valuations rising into a deteriorating economic backdrop, creating an even more unfavorable risk/return set up. We continue to believe that crucial pillars to the economy and markets are trending in the wrong direction and opportunities for a smooth transition out of elevated inflation are running out of time. Issues in the banking system may also cause further economic disruptions at the same time the elongated negative real wage growth cycle for consumers will ultimately force real spending to slow.

In short, the stock market is priced for mild or “transitory” case of economic recession in line with Fed speak while we are discounting the downside case that the economy is speeding towards the E.R. with potentially more acute or “chronic” conditions.