Modern-day Americans enjoy a standard of living that our forebears could only have dreamed of. Cell phones and computers, ready-made clothes and food, airplanes, microwaves, and air conditioning contribute to our convenient, comfortable existence. We can access food, transportation, friends, and entertainment with a few choice taps of a handheld screen. Still, our easy modern lifestyle has drawbacks. Although we no longer rely on bodily energy to heat our houses, travel, and obtain food, these activities nevertheless require energy—mechanical energy. Today, humans benefit from the convenience of an industrialized world… but at what cost?

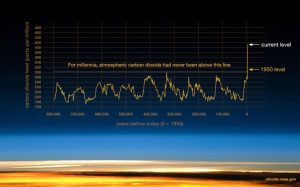

5.1 billion metric tons. That’s the amount of energy-related carbon dioxide the US emitted in 2019 alone. Carbon dioxide, or CO2, is a greenhouse gas. Like methane and nitrous oxides, CO2 traps heat in earth’s atmosphere—the so-called “greenhouse effect” keeps our planet warm and hospitable for life. However, many scientists suspect that the rise of human industry, especially in the past two centuries, has unnaturally elevated atmospheric CO2 levels, which, in turn, result in climate change.

CO2 levels over time

Rising ocean levels, droughts, and severe storms are just some of the phenomena attributed to climate change, a controversial issue, to say the least. While some experts believe that climate change poses a dire threat to our planet, others are more reserved. These climate change “skeptics” do not necessarily deny climate change; rather, they believe its severity and its connection with CO2 levels are exaggerated.

However one views the climate controversy, all can agree that climate change is an influential political issue. Intent on mitigating the “climate crisis,” activists are targeting all areas of human activity in the name of the environment. Business and industry, closely tied with fossil fuels and greenhouse gas emissions, are an especial focus. Environmentalists have proposed numerous plans to regulate, limit, and improve industry with the ultimate goal of net-zero emissions. One particular strategy, although still nascent, is gaining prominence: carbon credits.

What are Carbon Credits?

Harnessing the power of markets, carbon credits incentivize businesses to reduce greenhouse gas emissions. A carbon credit, also known as a carbon offset, is a license to emit one metric ton of CO2 or the equivalent amount of another greenhouse gas. Based on its size and nature, a business receives a certain number of carbon credits. If a business desires to emit more CO2 than its credits permit, that company must purchase subsequent carbon credits. Conversely, should a business emit less CO2 than its allocated carbon credits allow, the company may sell its unused credits. Furthermore, businesses which actively engage in carbon sequestration (for instance, by planting forests, reducing tillage, or implementing crop rotation) are awarded carbon credits. In this way, businesses are penalized for increasing emissions and profit from reducing emissions.

Currently, participation in the carbon market is voluntary. Committed to achieving net-zero emissions, numerous corporations—including IBM and JPMorgan Chase—are purchasing carbon credits through Indigo Ag’s carbon marketplace. Indigo not only advises farmers as they implement carbon sequestration but also verifies the efficacy of these methods by analyzing agricultural data and soil samples. Successful sequestration produces verified agricultural carbon credits. When eco-conscious companies purchase credits through Indigo’s marketplace, farmers profit. Other groups at the forefront of the carbon offset initiative include Nori, a carbon marketplace similar to Indigo, and Verra, which develops standards for awarding carbon credits.

Iowa farmer sequesters CO2 for cash through Nori

Many climate activists envision a compulsory carbon market, known as a compliance market. In this scenario, the government mandates and regulates the carbon market in a cap-and-trade system. Government officials allocate carbon credits, oversee their trade and creation, and certify that businesses comply with emissions requirements. Select jurisdictions, including California and Europe, have already implemented partial compliance markets for certain companies or industries.

Controversies and Concerns

Like the problem it proposes to solve, the carbon market is controversial. Most obvious are the logistical issues: in a compliance market, how will carbon credits be allocated? Will individuals or only companies be compelled to participate in the market? How will carbon pollution be measured? Must every pollution-producing activity, no matter how minuscule, be reported to government regulators? How will startups be treated? Will carbon credits cripple innovation? Cheating is also a concern. Selling phony carbon credits, underreporting carbon emissions, and double-counting carbon sequestration practices are just some of the many opportunities for dishonesty.

Additionally, some environmentalists argue that carbon credits will actually harm the environment by taking the onus off of major polluters. Rather than compelling large corporations to reduce their personal carbon emissions, the carbon market allows them to take credit for the carbon reduction of others. Why should companies change their reliably profitable practices when carbon credits allow them to keep polluting for a small fee?

Furthermore, is agricultural carbon sequestration actually effective? Studies measuring CO2 levels only in the soil’s upper inches produce optimistic findings; when scientists dig deeper, however, the results are less encouraging. Several comprehensive studies show that no-till methods merely change the distribution of CO2 in the soil—more CO2 is stored in the upper layers than the lower layers—rather than sequester more total carbon. Other scientists are skeptical of the benefits of cover crops, which may actually induce microbes to release carbon from the soil into the atmosphere.

Although their prudence and efficacy remain uncertain, carbon credits are indicative of the larger ESG investing trend. Eco-conscious companies, policymakers, and investors are turning to markets to encourage responsible business practices and forge a sustainable future. To learn more about investing with purpose in ESG, contact Servant Financial today.