In the investment world, it is often said, “It is better to fail conventionally than to succeed unconventionally.” Investors’ attitudes have been shaped over the last four decades to believe that the best portfolio strategy is to simply invest in a traditional benchmark 60/40 stock-bond portfolio. The Wall Street mantra to buy “stocks for the long run,” balanced with an allocation to government and corporate bonds for their stability and safety of income reigns in investment advisory circles. As we noted in last October’s “Got Gold?”, modern investment portfolios have generally been constructed with gold absent from the asset allocation, despite gold’s long history of portfolio diversification benefits and as a hedge against inflation and geopolitical risks. For example, around 71% of U.S. advisors have less than 1% exposure to gold. And only 2% of U.S. advisors had between 5% and 10% of gold exposure in portfolios, with none having an exposure exceeding 10%, according to Bank of America Global Research.

Luminary investor Peter Lynch, portfolio manager of the highly successful Fidelity Magellan Fund and writer of “One Up On Wall Street: How To Use What You Already Know To Make Money In The Market” takes a decidedly balanced approach to investing. He often condensed his commonsense approach to “Never invest in anything you can’t illustrate with a crayon.” He further advised that if you cannot summarize your investment thesis in a concise two-minute elevator speech (or convey your thesis through a short song or ditty), then you should simply move on.

Crayon Illustration

Our fanciful, fictional “crayon illustration” this month begins by time traveling back to the 1980s to a tune about “Two American kids growin’ up in the heartland.” A rural upbringing with its Tastee-Freez pop culture instilled in our young lovers a great appreciation for scarce assets like gold, farmland, and true love. In fact, the singer-songwriter in our tale was a co-founder of the Farm Aid concert fundraiser in Champaign, Illinois in 1985 along with Willie Nelson. Of course, we’re talking about John Cougar Mellencamp and his little ditty about Jack and Diane. Let’s imagine that our young Jack and Diane developed an unconventional investment plan back in 1982 after their “little ditty” got some AM/FM radio airtime.

These “two American kids growing up the heartland” just “doin’ the best they can” did some napkin illustrations while eating their $1.50 chili dogs. Today, a gourmet chili dog costs $5.19 at Portillo’s, or 3.5 times the price of a chili dog in 1982. Jack and Diane took a portion of the royalties from their certified gold single (1 million in unit sales) and decided to invest it in a scarce asset with stable, enduring value across time and cultures.

“Jackie sits back, collects his thoughts for the moment. Scratches his head and does his best {Peter Lynch}. “Well then, there Diane, we oughta {just buy some gold.} “Diane says, Baby, you ain’t missin’ a thing.”

Jack has been thinking about his awesome good fortune of a number one single and so they buy a single gold bar at the average price of gold in 1982 of $447 an ounce for a total investment of $179,000. Our hopelessly romantic young lovers bury that gold bar behind their favorite “shady tree” on the generational family farm for safekeeping.

Today, that gold bar birthed from true love and a solid gold single about rural life in America is now worth a cool One Million Dollars! Gold’s spot price just surpassed $2,500 per troy ounce on August 16th, an all-time high. With gold bars typically weighing in at about 400 ounces, that makes Jack and Diane’s gold bar worth around $1 million, or 5.6 times its cost.

Source: Trading Economics

Got Gold Reflections

In our October 2023 gold report, we cited commentary from former Credit Suisse economist Zoltan Pozsar that appears to be quite prescient with the benefit of 10 months of hindsight:

Commenting further on the commodities allocation Pozsar echoed the words of Ray Dalio on “gold, inflation and growth”:

“Within that commodities basket, I think gold is going to have a very special meaning, simply because gold is coming back on the margin as a reserve asset and as a settlement medium for interstate capital flows. I think cash and commodities is a very good mix. I think you can also put, very prominently, some commodity-based equities into that portfolio and also some defensive stocks. Both of these will be value stocks, which are going to benefit from this environment. This is because growth stocks have owned the last decade and value stocks are going to own this decade. I think that’s a pretty healthy mix, but I would be very careful about broad equity exposure, and I would be very careful of growth stocks.”

Year-to-date through the week ended August 16th, gold has indeed been shining with total returns of 19.4%, leading all major asset classes except Bitcoin. It’s been a safe haven’s dream, outperforming many traditional stock indices. VanEck Gold Miners ETF (GDX) and iShares Silver Trust (SLV) have also been showing some luster while playing some catch-up to gold over recent years with total returns of 27.7% and 23.8%, respectively, over the same period.

Bitcoin (digital gold) continues to be this decade’s top hit with total returns of 40.7% year-to-date. If gold is the old reliable of the 1980s, Bitcoin’s been the wild, unpredictable teenager of this era.

The midstream energy asset class nosed out U.S. large caps (S&P 500) with a total return of 17.6% compared to 17.5% for the S&P 500 over this period. The Magnificent Seven technology stocks, particularly Nvidia, have been responsible for a substantial majority of the S&P 500 year-to-date gains, with Nvidia alone skyrocketing by 162.2%.

With the Federal Reserve expected to embark on a rate-cutting cycle at its next meeting in September, ongoing wars in Ukraine and the Middle East, and Presidential candidates floating inflationary policy trial balloons like price controls (“inflation’s absolute best friend for life”), hiking and lowering of corporate income tax rates, tariffs on imports, taxing of unrealized capital gains, forgiveness of student loan debt, and free healthcare for all, Pozsar’s statement on inflation from that Got Gold? The article is also looking like a 24-karat prediction:

“Two percent inflation and going back to the old world, I don’t think it stands a snowball’s chance in hell. Low inflation is over and we’re not going back.”

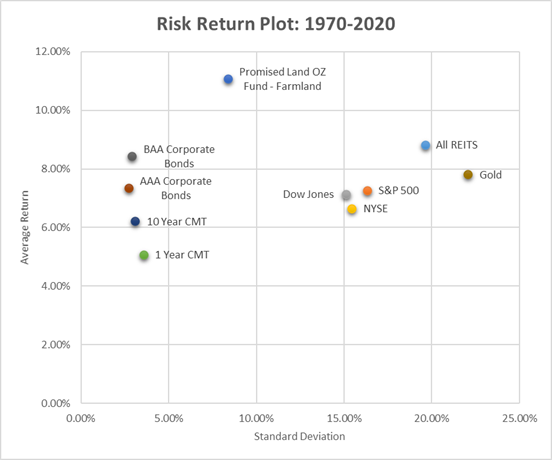

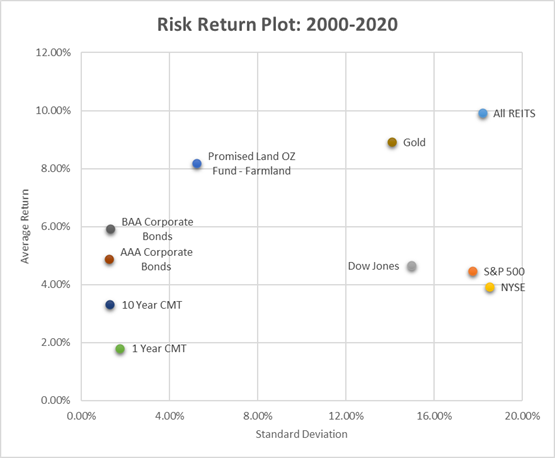

Forward Positioning

With continued U.S. dollar purchasing power erosion due to inflation, gold continues to serve as a store of value, outperforming bonds over the past five decades as illustrated by our protagonists Jack and Diane. Gold has returned 7.9% annualized over the past 50 years, outperforming U.S. intermediate-term bond returns of 7.0%. Gold has also been one of the top-performing assets since the peak of the Tech Bubble in March 2000 with an annualized return of 9.2%, outperforming U.S. large-cap stocks’ total return of 7.8%.

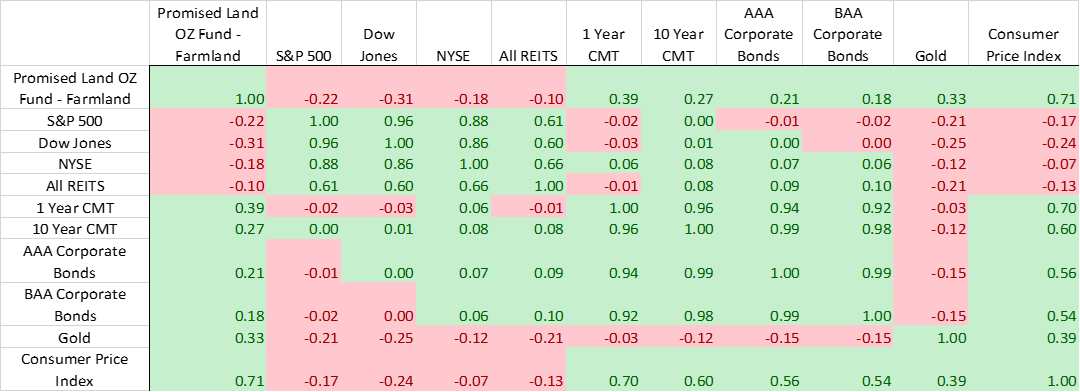

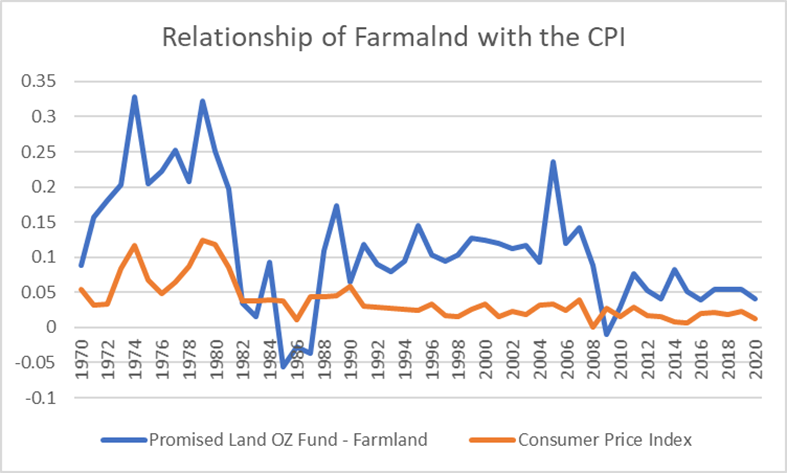

Exhibiting low correlations with major asset classes and a positive correlation with inflation, gold can serve as a strategic portfolio diversifier. Demand from U.S. investors is starting to increase, while strong demand from central banks and geopolitical and financial risks have helped drive gold to all-time highs in 2024. While there are risks, current fiscal policies, geopolitical tensions, central bank dynamics, and expected easing in monetary policy could bode well for gold returns in the coming years.

Potential risks to gold include higher real interest rates and the emergence of Bitcoin as a potential mainstream alternative. Since 2016, Bitcoin has outperformed gold, although gold has outperformed very recently. The growing interest in Bitcoin among investors, particularly younger generations, may be cannibalizing gold demand. Servant Financial advocates a blended approach that includes physical gold, Bitcoin/digital assets, and gold miners as we seek to hedge portfolios for the inevitable erosion of purchasing power resulting from inflationary monetary policy.

Record gold prices and signs of cost stabilization have led to notable margin improvements for gold miners. Gold miner production has reaccelerated, with large miners seeing improvements in cash flow as capex has leveled out since the start of the year. Stock performance of the miners has also been improving, with gold stocks outperforming U.S. large-cap stocks in 2024. Given record gold prices, we see the potential for further production improvements at attractive margins. Servant Financial plans to maintain existing client portfolio exposures to gold miners but intends to trim positions if the current balanced sentiment on gold miners moves toward excessive bullishness.

Let’s close this golden ditty about Jack and Diane with a karaoke sing-along, “Oh, let it rock, let it roll. Hold some gold to save your souls. Holding on to sixteen as long as you can. Changes come around real soon, make us women and men.”