Every four years, Americans are given the rare gift of time. February 29th only appears on the calendars every 1,460 days marking the well-known holiday of Leap Day. This extra day brings about traditions across the world such as women proposing to men and is commonly called “Bachelor’s Day” or “Ladies Privilege.” In other countries, Leap Year is known as an unlucky year for agriculture and particularly sheep. There is an old rhyme that says, “Leap Year was never a good sheep year.” So don’t be a sheep this Leap Year, do your own thinking, particularly on important matters.

What does Leap Year mean for Americans? For credit card holders, it means an additional day to tackle the mounting $1.129 trillion debt Americans currently owe. Americans now have more credit card debt than ever before, and the COVID-19 pandemic only accelerated its “leap” higher. Credit card holders with unpaid balances hold an average of $6,864 with the highest average debt levels being owed by East Coast residents. The debt balances on these credit cards aren’t getting cheaper to carry either given rising interest rates. The average Annual Percentage Rate (APR) on credit cards is 21.47% making it even more difficult for consumers who have found themselves in the debt hole to “leap” their way out of it.

Source: Lending Tree

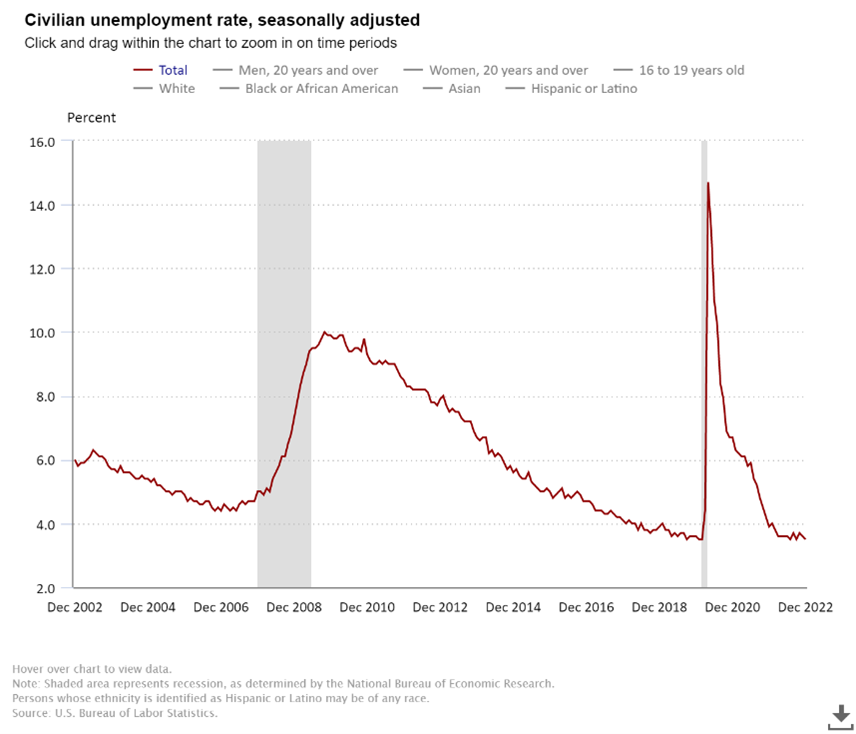

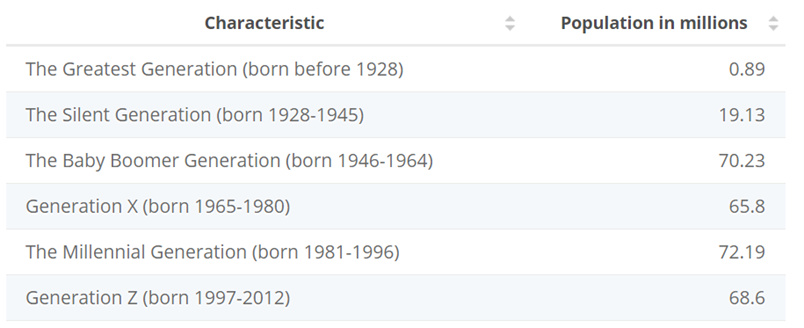

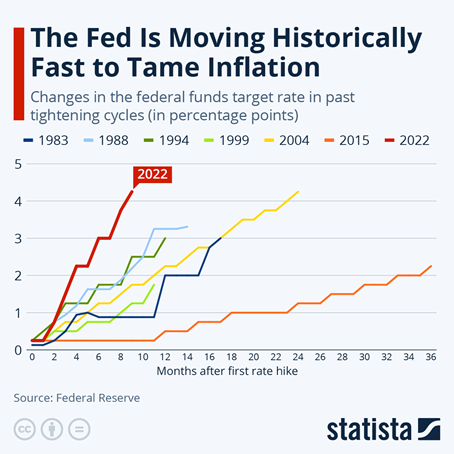

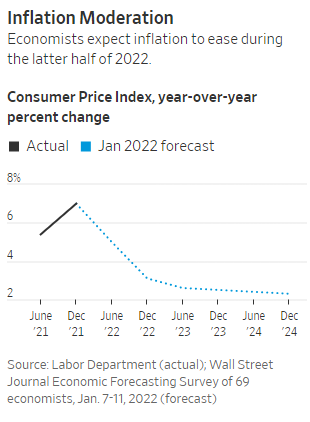

How did the average Americans find themselves in this dilemma? Higher prices at the gas pump and grocery store together with the increasing costs of housing have significantly contributed to the current crisis. Borrowers between the ages of 30 to 39 are particularly feeling the pain of rising interest rates as this age bracket often is also dealing with student loan debt repayments. Even though the U.S. economy continues its expansion, debtholders may be reaching a breaking point and be forced to scale back consumption. Consumer expenditures represent approximately 70% of U.S. economic activity. The post-pandemic inflation levels were believed to be largely attributable to temporary supply chain shocks that would resolve themselves over time and prompted a slow response by the Federal Reserve. Credit card holders felt acute pain when a tardy Federal Reserve instituted an aggressive rate-hiking campaign to tame inflation. Some claim that debtholders are at fault for overspending and while that may be true, they are just taking a profligate spending lesson out of the Federal Government’s budget playbook. The current National Debt is hovering around $34 Trillion which comes out to an average of $102,279 per each American. Interestingly enough, the slope of the National Debt graph shows a very similar shape to the above graph featuring individuals’ credit card debt.

Source: U.S. Department of the Treasury

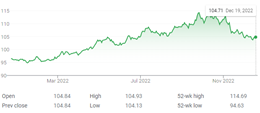

Even though credit card debt levels continue to rise, delinquency rates remain relatively low with only 3.1% of Americans with a balance that is more than 30 days delinquent. What do high debt levels and low delinquency levels mean? Huge profits for credit card companies. Currently, there are four major credit card networks in the United States: Visa, Mastercard, American Express, and Discover. Visa, Mastercard, and American Express have experienced rising earnings over the past several years as people swipe cards quicker and pay later. Not only are these companies leaping into financial success from higher individual card debt but also higher transaction fees. In 2022, credit card companies charged consumers an all-time high in interest and transaction fees of $130 billion.

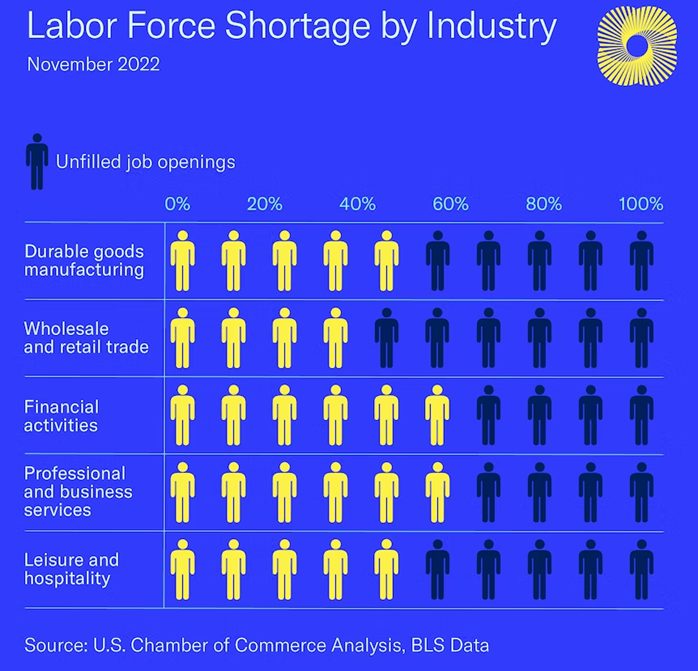

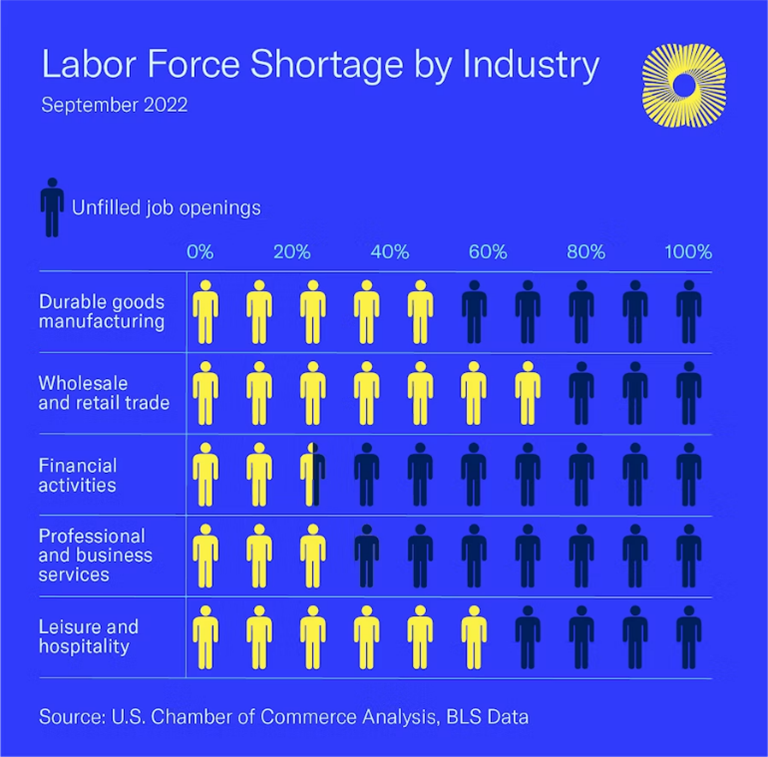

These oligopolies are only projected to get stronger and more concentrated as Capital One announced this month their plans to buy Discover Financial Services for a whopping $35 billion. Discover shareholders would receive 1.0192 Capital One shares for each Discover share under the terms of the proposed deal. Capital One desires Discovers’ independent card network to go with its Capital One Visa operating on the shared Visa credit card network. As more consumers swipe plastic cards rather than pay with cash, financial services are taking notice of the “leap” in prospects for the credit card sector. Some worry the rising credit card debt is signaling a weakening economy, JPMorgan CFO, Jeremy Barnum, reported during their earnings call that consumers are adjusting to the end of government stimulus checks and government-mandated pause on student loan repayments. Other bank executives point to a strong labor market signaling that consumers can afford the high credit card balances.

Servant Client Portfolio Positioning

Here is our Leap Year summary of Servant client portfolio composition compared to traditional benchmarks. A traditional 60/40 portfolio would hold 60% equities and 40% fixed-income securities and cash for a client with moderate risk tolerance.

1. Underweight equities

2. Overweight non-U.S. equities vs. U.S. equities

3. Overweight precious metals, gold miners, and digital assets/bitcoin

4. Underweight fixed income duration

U.S. equity valuations are near extremes. For example, Hussman Fund’s February 26, 2024 newsletter “Speculative Euphoria and the Fear of Missing Out” states that “the valuation measure we find best-correlated with 10-12 year S&P 500 returns in market cycles across history is the ratio of nonfinancial capitalization to corporate gross value-added, including estimated foreign revenues (MarketCap/GVA). Presently, this measure is higher than at any point before June 2021, with the exception of three weeks surrounding the 1929 peak.”

Likewise, market breadth is very, very narrow with the performance of the so-called “Magnificent 7” (U.S. tech behemoths Apple (AAPL), Amazon (AMZN), Alphabet (GGOGL), Facebook/Meta (META), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA)) diverging with NVDA soaring and TSLA tanking.

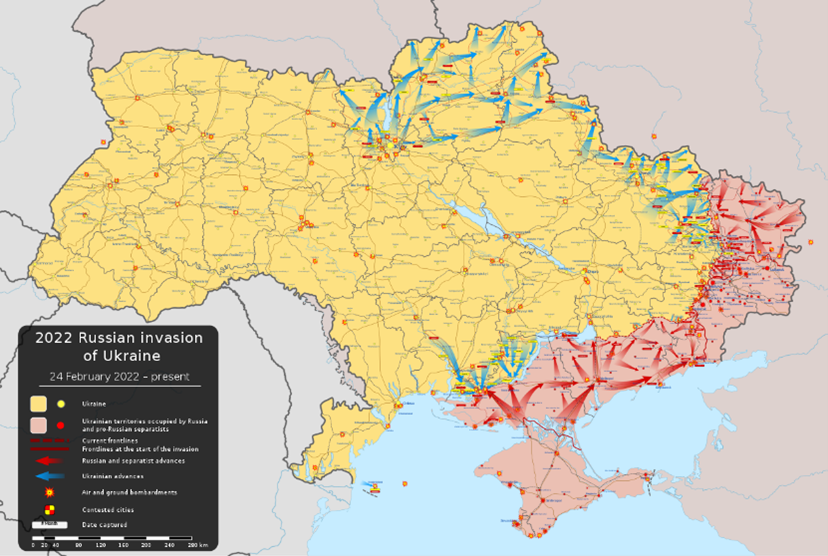

In our opinion, the aggregate stock market is priced for perfection and assumes inflation will sheepishly return to Fed’s targeted rate of 2% and a soft economic landing where a broad recession is avoided. We see the potential for volatility in future economic data. If such volatility were to occur, it could quickly “leap” into the stock market For example, market projections for core PCE (Personal Consumption Expenditures), the Federal Reserve’s preferred inflation measure, remain closer to 4% than the Fed’s targeted 2%. Further, recent economic data (employment and layoff announcements and retail sales) are consistent with a slowing economy.

We think the recent move in Bitcoin may be an economic tell. Bitcoin has leaped from below $52k at the beginning of this week to breach $61k on the day of this writing on February 28th. You may recall that Servant Financial initiated small allocations to client portfolios in 2020 of generally 1% to 2% based on the deep research that we conducted which showed that adding a small bitcoin allocation would historically benefit globally diversified portfolios by lowering risk while providing the potential for higher returns. Market history has been rhyming lately.

John Heneghan recently received his Certificate in Blockchain and Digital Assets – Financial Advisor Track from the Digital Assets Council of Financial Professionals so Servant Financial is prepared to serve your financial planning and investment needs regarding digital assets and bitcoin.

For more bitcoin-curious readers, we have been beta-testing a couple of more concentrated and volatile portfolios on the bitcoin, anti-fiat themes. The first portfolio is focused on active best ideas in both the real asset and bitcoin/digital asset space. This portfolio holds about 15 positions and has almost a 3-year track record. The second and newer portfolio (10-month history) is much more speculative and holds only 6 positions – Fidelity Bitcoin Trust ETF (FBTC) and five other bitcoin-related businesses. Please reach out if you are interested in learning more.

Leap Day is known to be a lucky day – good luck for some and bad luck for others. As Ray Charles sang, “If it wasn’t for bad luck, I wouldn’t have not luck at all.” One thing is sure, consumers cannot rely solely on good luck to leap them out of their debt holes because bad economic luck may be lurking around the corner. If you have found yourself struggling with high levels of credit card debt, we encourage you to check out the National Foundation for Credit Counseling for strategies and tips for your unique situation. Leap Day should not be just another date on the calendar; instead, view it as an opportunity to leap closer to financial freedom from credit card debt.