By The Numbers

One year ago, the lives of millions of Ukrainians were uprooted, and many more lives around the world were indirectly impacted by the Russian invasion of Ukraine. The human toll alone has been considerable. As it stands today, 8,000 civilians, between 175,000 and 200,000 Russian soldiers, and between 40,000 and 60,000 Ukrainian military members have lost their lives in this crisis. More than 8 million Ukrainians have fled their country. This is equivalent to the population of the Chicago Metropolitan Area being forced to flee their homes. The largest group of refugees are women and children. A further 6,000 Ukrainian children have been taken to refugee camps and facilities in Russia, subject to Russian re-education.

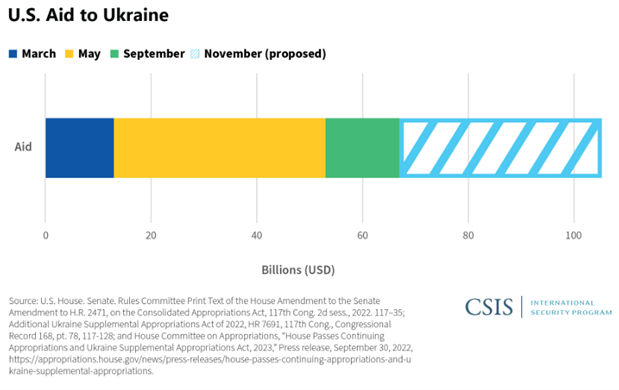

The United States government has provided $68 billion in total economic support with $29.8 billion of that being direct military aid and the rest being humanitarian assistance and economic support. The White House is requesting an additional $37.7 billion in aid in the coming year. The U.S. has given more military aid than any other country; however, the European Union (EU) leads in financial support at $30.3 billion provided to Ukraine within the last year. On the Russian side, communist-led Venezuela, Sudan, Cuba, and Nicaragua have all pledged their allegiance to Russia. While the U.S. has not confirmed China giving direct military aid to Russia, Chinese authorities do not deny their willingness to support their communist ally.

Source: CSIS

In addition to the horrific human toll, the war has also caused a wide swath of economic damage, sending shock waves to financial markets, agricultural markets, energy markets, and world economies. The outcome of the war is still largely unknown as concerns continue to be raised about Russia’s potential use of tactical nuclear capabilities and the uncertain form of Chinese support for Russia. Russia recently suspended its participation in the last remaining nuclear arms deal with the U.S., the 2021 extension of the START treaty (Strategic Arms Reduction Talks). Russia can now begin expanding its nuclear weapons inventories. One year ago, some speculated that Russia would swiftly overtake Ukrainian armed forces, but Volodymyr Zelenskyy and his army have proven their mettle in fighting off close to 320,000 Russian soldiers. While the results of this brutal fight are still hanging in the balance, we will now look back at how this conflict has disrupted global markets.

Agricultural Impact

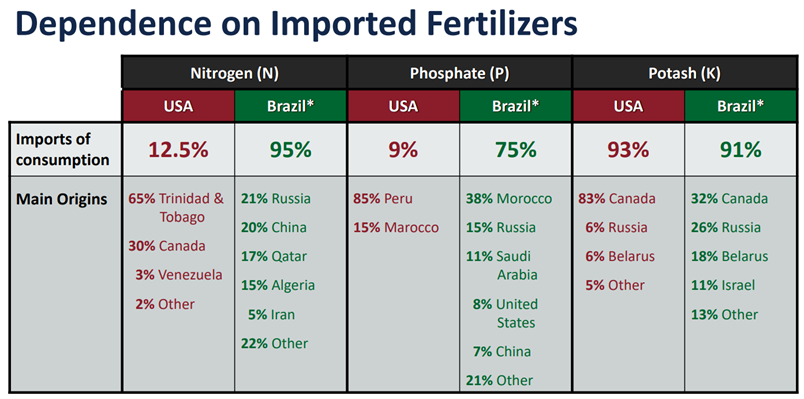

Agriculture generally flies under the radar for many investors and consumers as a sufficient food supply is generally taken as a given, particularly in the developed West. However, the invasion shed light on the tenuous nature of global food and commodity supply as the stomping of Russian boots on Ukrainian soil was felt from the sunflower fields in Ukraine to the amber waves of grain in the United States. Agricultural commodities such as wheat, sunflowers, corn, and soybeans all depend on the trifecta of fertilizers for plant growth: Nitrogen, Phosphate, and Potash. While the United States is not significantly dependent on Russia for imports of these vital crop nutrients, Brazil and other agricultural-producing countries import a significant portion of their fertilizer needs from Russia and its allies in China and Belarus. The fertilizer pressure globally has sent fertilizer prices skyrocketing with energy, seed, and financing costs for farmers also following suit. Input prices increased 20-30% for U.S. farmers in just one year as Brazil and others scowered the global market for alternative sources of supply. Global fertilizer prices remain firm and/or continuing on an upward trend.

Source: Farmdoc Daily

On the flip side of rising fertilizer prices, agricultural commodity prices have generally offset these rising input costs with corn, soybeans, and wheat prices all hitting 8-year highs in the past year. A relatively favorable growing season for much of the corn belt meant strong net farm incomes across the United States. Prices for agricultural commodities however have begun to fall off recently as the world has begun to adjust grain and input risk premiums to discount expected war outcomes with the war at a seemingly painful stalemate.

Globally, Ukraine supplies the world with 30% of the world’s sunflower and its byproducts (oil and meal). It is also a significant producer of corn, wheat, barley, and rapeseed. The conflict has brought about many uncertainties about whether the fields in Ukraine will be turned into battlefields or if they can produce a crop, will there be open ports for them to take their harvest to for export to global markets. Speculation about the war’s impacts on agriculture production are ongoing; however, if the COVID pandemic and Russia-Ukrainian war have taught us anything, it’s that regardless of what is happening in the world and whether there is war or peace, people still need to eat.

Energy and Financial Markets

Investors have been riding a wave of economic turmoil throughout the last year as the Russian ruble tumbled early on against the US Dollar and then climbed the mountain upward as capital controls and petrodollars came in. The ruble began to sell off once again when US and EU energy sanctions threatened a stranglehold on Russia’s critically important energy and gas business. Crude oil has been volatile as a result of the war with the oil price peaking at $128 last March after the Russian invasion began. Importantly, Russia is Europe’s largest oil exporter and although sanctions have been placed on Russia from the West, Russia has been able to re-direct most of its oil sales to China, India, and Southeast Asia. Natural Gas has been subject to similar turmoil as Europe was one of the main customers of Russian natural gas through the Nord stream gas pipeline system. Europe imports 83% of its natural gas and the war has brought about additional sanctions on Russian gas imports impacting the price European consumers pay for heat and energy. Europe has been forced to find new import partners such as the U.S., Qatar, Nigeria, Norway, and Algeria to keep people’s homes heated and the lights on.

Source: exchangerates.org.uk

A stock market repricing for a looming recession or economic slowdown and the Federal Reserve’s ongoing fight against inflation have eaten up investors’ returns over the last year. However, there are sectors of financial markets that have profited from the Russian-Ukrainian conflict. Aerospace and defense stocks are up 11% in past year according to a subindex of the S&P 500. Commodities and raw materials have also remained strong as both sellers of agricultural products and energy commodities benefitted from higher prices and the uncertainties about a region that produces 14% of the world’s energy (Russia) and is a leader in sunflower oil, corn, and wheat production (Ukraine). Price pressures and volatility will remain in global commodity markets until the conflict is resolved. Amundi, Europe’s largest asset manager, says the probability of a long, drawn out war is up to 30%.

Source: WSJ

Global investors have been adjusting their strategic asset allocations for these geopolitical uncertainties and attempting to benefit from strong commodities and defense stocks. The uncertainty surrounding how the U.S. will respond if Russia deploys tactic nukes has some speculating around domestic defense stocks. Some also believe military spending may be in a secular uptrend as U.S. munitions and defense equipment inventories have been depleted and the White House begins saber rattling against the Chinese. The military industrial complex will likely adopt Rahm Emanuel’s approach by “never letting a serious crisis go to waste” to push their military spending agendas. For those looking to go long a secular defense spending spree the iShares U.S. Aerospace and Defense ETF (ITA) has a low expense ratio of 0.39% with concentrated exposure in defense companies such as Raytheon (21.4%), Lockheed Martin Corp (16.14%), and Boeing Co (7.42%) among others. ITA is not cheap; however, as it trades at 24 times projected 2023 net earnings with a dividend yield of 1.4%. For more a narrow, internationally focused play, BAE systems (BAESY), has experienced strong growth over the past year as Europe’s leading defense contractor. BAESY trades at a more modest 18 times trailing earnings and yields 3.0%. Generally, the stock has benefitted from higher military spending which doesn’t seem like it will be tapering off anytime soon.

How the Russia-Ukrainian war will end is still highly uncertain; however, it is clear that sadly global markets will be actively repricing its extended effects long after the last solider leaves the battlefield.