ESG and SRI Investing

ESG and SRI Investing

Investors use Environmental, Social, and Governance (ESG) criteria to guide more sustainable and socially responsible investment. ESG falls under the umbrella of socially responsible investing, or SRI. SRI is any investment strategy that considers both financial returns and social and environmental impacts when evaluating the suitability of investments.

Incorporation of ESG criteria helps asset owners align investment decisions to their values and beliefs. It facilitates investing with purpose. ESG links health and wealth outcomes, highlighting the interdependence of healthy populations, environments, and economies.

Environmental criteria address issues like climate change, pollution reduction, and sustainable utilization of natural resources. They increase pressure for regulations that establish environmental liability and steer markets towards sustainable products and services. The criteria also help evaluate practices like greenhouse gas emissions, water usage, and waste disposal. Furthermore, they encourage companies to exhibit transparency surrounding these practices.

Social criteria look at how a company interacts with employees, suppliers, customers, and communities. It addresses workplace health and safety, discriminatory practices, diversity, human rights issues, and again, transparency about these practices.

Governance criteria assess company leadership, board structure and diversity, executive pay, audits, internal controls, and shareholder rights. It evaluates accounting and disclosure practices and controls to prevent corruption and bribery issues.

The more sustainable a company, the higher its ESG score. Investment strategies that integrate ESG criteria into portfolios decrease the weight of companies with lower ESG scores and increase the weight of companies with higher ESG scores. Third parties evaluate company disclosures to subjectively generate these scores.

Several ESG ratings firms now exist to assess and score the ESG disclosures, such as Sustainalytics (with an ownership stake by Morningstar), Institutional Shareholder Services, and MSCI. Think of these as the Moody’s and Standard and Poor’s for sustainability.

Types of Sustainable Investing

ESG integration is one of the most common types of sustainable investment strategies. Restriction screening is also very popular, eliminating industries like tobacco, weaponry, or environmentally damaging operations. Morgan Stanley defined five types of sustainable investing or SRI:

- ESG Integration – Proactively considering ESG criteria alongside financial analysis.

Restriction Screening – Exclusionary, negative or values-based screening of investments. - Impact Investing – Seeking to make investments that intentionally generate measurable positive social and/or environmental outcomes.

- Thematic Investing – Pursuing strategies that address sustainability trends such as clean energy, water, agriculture or community development.

- Shareholder Engagement – Direct company engagement or activist approaches.

The Rise of Socially Responsible Investing

Amy Domini is known as the godmother of socially responsible investing. She started the SRI movement in the 1990s and made the Time 100 list of the world’s most influential people in 2005. She said, “We must continue to stand together to demand that the search for monetary profits not come at the detriment of universal human dignity nor the undermining of ecological sustainability.”

The emergence of the term “ESG” traces back to a 2004 report by the Global Compact titled “Who Cares Wins.” It was published in response to growing investor demand for more sustainable investment avenues and laid the foundations for a common understanding of ESG investment criteria.

The report stated a belief that markets did not fully recognize the significance of emerging trends pressuring companies to improve corporate governance, transparency and accountability, nor the high stakes of reputational risks related to ESG issues.

It emphasized the long-term importance of sustainable development, saying, “A better inclusion of environmental, social and corporate governance (ESG) factors in investment decisions will ultimately contribute to more stable and predictable markets, which is in the interest of all market actors.”

The incorporation of ESG principles and the practice of SRI have exploded in popularity. In 2017, 48% of retail and institutional investors worldwide applied ESG principles to at least a quarter of their portfolios. By 2019, that percentage surged to 75%. The European Union (“EU”) holds the most sustainable invested assets at $14.1 trillion US dollar (USD) equivalents. The United States follows with $12 trillion USD of sustainably invested assets.

SRI now accounts for one out of every four dollars under professional management in the United States. In Europe, it accounts for one out of every two dollars. Sustainable investing is often a voluntary and strategic venture motivated by constituent demand, perceived potential for attractive financial performance, and evolving regulations driving greater disclosure on ESG factors.

Client demand from retail and institutional investors is the top reason for the incorporation of ESG factors in financial reporting disclosures. In the United States, corporations that provide ESG disclosures do so voluntarily. Unlike the EU, there is no definitive accounting or financial reporting framework in the U.S. under which ESG factors are measured and reported to stakeholders.

ESG is most popular among millennials, women, and high-net-worth individuals. 95% of millennials surveyed by Morgan Stanley in 2019 expressed interest in sustainable investing and 90% want to tailor their investments to their impact goals derived from personal values and beliefs.

Millennials are poised to inherit over $68 trillion from their predecessors by 2030. Accordingly, the millennial ‘approach to investing’ will be an important determinant in the demand for ESG investments going forward.

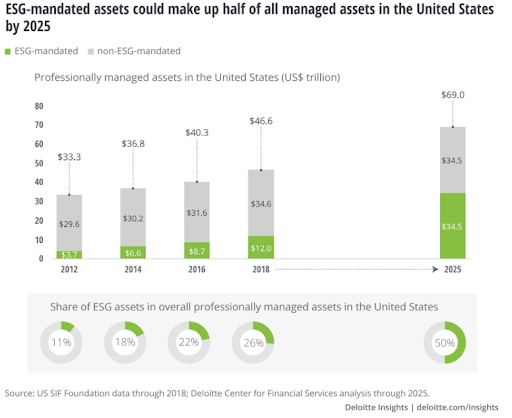

The Deloitte Center for Financial Services (DCFS) projects client demand will accelerate ESG-mandated asset growth by three times that of non-ESG-mandated assets to comprise half of all professionally managed investments in the United States by 2025. Investment managers will likely respond to client demand for ESG by launching new ESG funds.

The iShares ESG MSCI U.S.A. ETF (ESGU) launched in 2016 is the largest Socially Responsible ETF, with $7.8 billion in assets under management. ESGU tracks the MSCI USA Extended ESG Focus Index.

The index functions to maximize exposure to positive environmental, social and governance (ESG) factors. MSCI’s ESG rating framework determines these factors. Additionally, the index exhibits risk and return characteristics similar to those of the MSCI USA Index.

The MSCI USA Extended ESG Focus Index is sector-diversified and targets companies with high ESG ratings in each sector. It excludes tobacco and firearms manufacturers. iShares MSCI KLD 400 Social ETF (DSI) based on Domini’s groundbreaking work in socially responsible investing was the largest ETF prior to the launch of ESGU by BlackRock.

By February 2020, the number of ESG ETFs had skyrocketed to 293, with 805 listings globally. According to ETFGI, total assets invested globally in ESG ETFs reached a new record of $82 billion at the end of May 2020. There are currently 108 socially responsible ETFs traded in the U.S. markets, gathering total assets under management at a value of $37.2 billion and an average expense ratio of 0.39%.

Several brand-name U.S. mega-cap companies are seizing opportunities to incorporate ESG into their governance frameworks. As a result, they will demonstrate their commitment to sustainability to shareholders, stakeholders and customers.

This year, Microsoft pledged to be carbon negative by 2030. By 2050, they aim to remove all the carbon emitted either directly or from electrical consumption since their founding in 1975. This carbon negative goal will be achieved through a $1 billion climate innovation fund to accelerate the global development of carbon reduction, capture, and removal technologies.

By contrast, Starbucks has less ambitious (yet more attainable) sustainability goals. By 2030, the company will reduce carbon emissions by 50 percent. They will also reduce waste sent to landfills from stores and manufacturing by 50 percent. Finally, they will conserve or replenish 50 percent of the water currently used for direct operations and coffee production.

ESG Impact on Expected Returns

Many investors express concern that ESG investing will limit their investment options and potentially lead to lower returns. Studies and analyses express varying conclusions regarding whether ESG investing helps or hurts overall portfolio performance. There is a lively theoretical and practical debate.

In this video, Ben Felix from PWL Capital provides important insights to consider before committing to a sustainable portfolio, based on the assertion that sustainable portfolios provide lower expected returns.

Felix discusses the impact of socially responsible investing on expected returns according to a December 2019 study written. After analyzing a global sample of 5,972 firms between 2004-2018, the authors concluded that companies with higher ESG scores tended to deliver lower average returns than companies with lower ESG scores.

Investor tastes and preferences contribute to pricing effects on expected returns of sustainable and unsustainable companies. Investors with a strong preference for sustainable investments are less likely to invest in unsustainable companies that don’t reflect their core values and beliefs. They are more likely to invest in sustainable companies with lower returns for the tradeoff of aligning investment to their values.

Another implication of this tradeoff is that sustainably-minded investors will require higher expected returns to consider investing in an unsustainable company; the opportunity for financial gain would have to overshadow their desire to uphold a socially responsible portfolio.

At the other end of the spectrum, The Harvard Business School conducted a study in May 2019 that found companies adopting sustainability practices outperform their competitors. According to their analysis, a $1 investment over 20 years yielded $28 in return for companies focused on ESG factors versus a $14 yield for companies without focus on ESG factors. So rather than sustainable portfolios providing lower returns, Harvard concluded that ESG factors enhanced returns.

Research Affiliates, a global investment research firm, recently weighed in on whether ESG integration contributed to portfolio performance in their report, “Is ESG a Factor?” Factors are stock characteristics associated with a long-term risk-adjusted return premium.

In other words, an investor can systematically employ a factor to enhance portfolio returns. Factors must satisfy three critical requirements: they should be grounded in credible academic literature, consistent across definitions, and robust across geographies.

Research Affiliates concluded ESG was not a factor because there is little agreement in academic literature regarding its robustness in earning a return premium for investors, it lacks a common standard definition, and its performance results are not robust across geographies. They believe ESG is an important investing consideration despite dismissing it as a factor and lacking complete confidence in its ability to currently deliver as a theme.

One of our core investment beliefs is that investor preferences are broader than risk and return. Nevertheless, ESG can be a very powerful theme in the portfolio management process in the years ahead. However, as noted by Research Affiliates in their ESG factor analysis, one of the fundamental issues with ESG integration is that there is no common framework for evaluating companies’ ESG impacts.

Call to Action

In his upcoming book, “Impact: Reshaping Capitalism To Drive Real Change”, Sir Ronald Cohen boldly addresses the obstacle of a lack of a common ESG impact measurement and assessment framework. He proposes the international adoption of “generally accepted impact principles” to transparently and consistently reflect the measurement of ESG impacts in financial statements to display “impact weighted profits.”

Cohen argues that today’s technology and big data allow us to reliably measure and assess impacts. He recommends that if governments force companies to publish impact weighted accounts, companies and stakeholders will develop a sharper focus on improving their impact and find creative solutions to social and environmental problems. Cohen calls this novel approach impact capitalism.

Impact capitalism is the invisible heart of markets that drives the invisible hand of Adam Smith’s Wealth of Nations. Impact is the third essential dimension to consider alongside risk and return when considering possible investments. Connecting social initiatives to investment criteria in this manner will enable entrepreneurs to finance purpose-driven investment and charitable organizations.

Investments are deemed attractive when their risk-reward potential is favorable. However, some investments have hidden costs that negatively impact employees, surrounding communities, or the environment.

Many companies do not factor in the cost of mitigating social and environmental problems caused by their operations in their traditional investment analysis, such as a factory that emits air pollution and afflicts people in the area with respiratory problems. These unpaid costs are also known as externalities – costs that are often incurred by vulnerable populations that don’t have the means to fix the problem themselves.

Impact investing presents an opportunity to take the pain out of profit. Its framework fosters financial success that is both self-interested and societally beneficial. When positive impact and profit coexist, everyone wins.

We think impact capitalism has the potential to drive creative solutions for the many socioeconomic imbalances and environmental issues we face today. Watch for our upcoming digital series that will explore these critical matters in greater depth.