Investors are shaking out the dustbin of their investment strategies to take a fresh look at commodities that haven’t seen a strong portfolio allocation since the 1970s/80s. With inflation rampant and the U.S. consumer price index hitting a 40-year high in September of 8.2% annual rate, it may be time to reconsider commodities as an investment option. With this inflationary backdrop, it’s the first time in a generation that investors are losing sleep over inflation eating away at their purchasing power and devaluing their hard-earned life savings.

Conventional wisdom holds that commodity investments can provide beneficial portfolio diversification and hedging benefits against inflation. The commodity asset class is generally considered a tactical insurance policy rather than a strategic asset allocation. The returns from commodities are more episodic driven primarily by inflationary surprises leading to commodities’ primary use as a tactical or trading instrument. Historically, commodities have not been a stable source of returns. On a forward-looking basis, investment firm Research Affiliates projects measly expected annual returns of 0.2% over the next ten years with an expected volatility of 15.5% for commodities (Asset Allocation Interactive research platform). That said, commodities’ asymmetric return profile can provide valuable inflation protection similar to recoveries under an insurance policy from catastrophes.

Accordingly, we think of the commodity asset class as a tactical/trading tool to deploy before a wave of unexpected inflation or a long period of sustained inflation. In hindsight, an opportune time to allocate to commodities was earlier in 2021 while the Federal Reserve’s mantra was “inflation is transitory” and well before the Fed’s December 15, 2021 inflation capitulation. For instance, an allocation to the iShares S&P Goldman Sachs Commodity Index (GSCI) Commodity-Indexed Trust (GSG) returned 39.0% for calendar 2021 and has gained a further 26.0% through October 26, 2022. Although we were appropriately concerned about inflation trends and adjusted Servant Financial client portfolios accordingly, we did not add any direct exposure to commodities to client portfolios. We opted instead to tilt model portfolios, subject to client risk tolerances, to real assets and inflation hedges with more stable risk-adjusted return profiles – gold/precious metals (CEF, GDX, SLV), bitcoin (GBTC, HUT), farmland (FPI), and Horizon Kinetics Inflation Beneficiaries ETF (INFL).

With spectacular commodity price responses to the unexpected spike in inflation now largely behind us, we are hard-pressed to add commodity exposure to client portfolios at this juncture unless we were highly confident that a long period of sustained inflation or what is called a Commodity Super Cycle (Super Cycle) has begun. Super Cycles are extended periods of time of around a decade where commodities as a whole trade at prices that are greater than their long-term moving averages. A Super Cycle will usually occur when there is a large industrial and commercial change in demand within a country or globally that requires more resources or supplies of commodities with large demand-supply imbalances.

There have been four super cycles over the last 120 years. The first started in late 1890 and was accelerated with widespread industrialization of the United States and industrial build-up associated with World War I. This cycle peaked in 1917. A new Super Cycle started in the late 1930s with the advent of World War II and peaked in 1951 after Europe and Asia’s heavy rebuilding from the war was complete.

The next Super Cycle started in the 1970s at the beginning of a long phase of global industrialization. World economies industrialized and populations moved to urban centers, requiring more raw materials and energy to sustain this more intensive growth. The Vietnam War and Nixon’s closing of the gold window (halting foreign nations’ convertibility of U.S. dollars to gold and the dollar plunged by 1/3rd in the 1970s) were also significant factors in this cycle.

Note that the Vietnam War was one of the first Cold War-era proxy wars with eerily similar characteristics to the current Ukraine-Russian conflict. The Vietnam war took place in Vietnam, Laos, and Cambodia from November 1955 to the fall of Saigon in April 1975. It was “officially” fought between North Vietnam and South Vietnam. However, North Vietnam was supported by the Soviet Union, China, and other communist allies. While South Vietnam was supported by the United States and its democratic allies. Ominously, the Vietnam war lasted almost 20 years. The 1970 Super Cycle came to an end as the Vietnam War ended and foreign investments fled as extractive industries became nationalized.

The most recent Super Cycle began in 2000 as China and its population of 1.3 billion, or 20% of the world’s population, joined the World Trade Organization. With 1.3 billion Chinese jumping on the globalization and industrialization bandwagon, demand for energy and raw materials needed to build new megacities surged. The Great Recession hit in 2009 and ended this last Super Cycle.

The current spike in inflation and commodity prices could well mark the beginning of a fifth Super Cycle. The Ukraine-Russia conflict, destruction and/or destabilization of global supply chains from the COVID-19 pandemic, breakdown in global trading partnerships, dangerously loose global central bank monetary policies, and a shortage of new investment in energy and raw materials exploration and development point to the makings of a fifth Super Cycle potentiality.

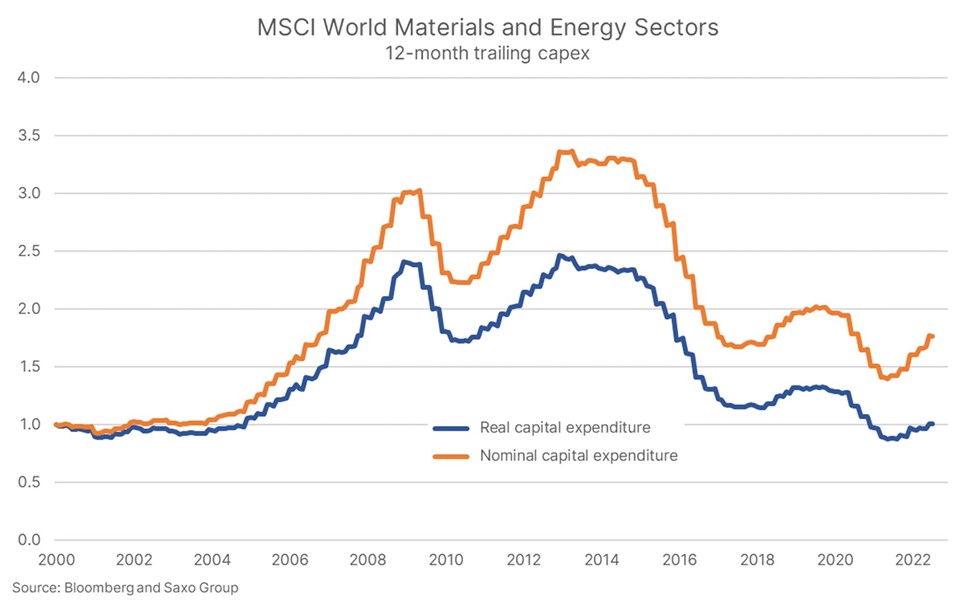

Ole Hansen Head of Commodity Strategy at Saxo Bank believes this lack of investments in materials and energy sectors, as depicted below, together with the forces of decarbonization, electrification and urbanization will keep supply tight and inflation high.

At a minimum, investors should consider the possibility of a new Commodity Super Cycle. The key matter of debate is whether investors believe the Federal Reserve will ultimately be successful in taming the inflation beast. The Fed is playing catchup after letting the beast run wild for some time before taking credible action. For a more in-depth discussion on the Fed’s chances of policy success, readers are encouraged to watch investment research firm Real Vision’s video where perspectives on both sides of the economic debate – deflation/disinflation/recession and inflation/stagflation – are discussed.

We’ll be watching for signs that the Federal Reserve’s interest rate hikes and quantitative tightening cycle are having the desired economic impact – the destruction of demand for goods and labor. One factor we’re highly focused on is the labor market and whether unemployment levels will trend higher and if inflationary wage pressures lessen. Secondly, we’re watching for signs of a possible Federal Reserve policy mistake, like a premature policy pivot before the back of inflation is broken.

Our preferred investment vehicle for a tactical allocation to commodities is the Invesco Optimum Yield Commodity Strategy No K-1 ETF (PDBC). PDBC is an actively managed exchange-traded fund (ETF) that seeks broad-based commodity exposure through financial instruments (commodity futures and swaps and U.S. Treasury Bills) that are economically linked to the world’s most heavily traded commodities. The Fund’s commodity allocation is production weighted and therefore structurally overweights the energy complex relative to other commodity indexes. The following summarizes commodity allocations (current % and strategic rebalance target %):

Sector |

Current % Allocation |

Strategic Rebalance Target % |

Commodity Allocation |

| Energy | 63% | 55% | WTI Crude, Brent Crude, Natural Gas, Gasoline |

| Precious Metals | 8% | 10% | Gold & Silver |

| Industrial Metals | 9% | 13% | Aluminum, Copper, & Zinc |

| Agriculture | 20% | 23% | Corn, Soybeans, Sugar, Wheat |

PDBC outperformed GSG in 2021 returning 41.9%, but the Fund is lagging that GSG year-to-date at 20.7% in gains through October 26, 2022. Importantly, the Fund does not generate a K-1 tax reporting obligation.

Clear signs of an impending Fed policy mistake would lead us to aggressively consider a tactical allocation to commodities through PDBC. One low-probability scenario would be a significant dislocation or lack of market liquidity in the U.S. Treasury market that forces the Fed to purchase treasuries. The Fed would effectively be adopting yield curve controls, much like the recent Bank of England’s actions in the gilts market to stem an uncontrolled blow-out of gilt yields. One expected casualty in this outlier fact set would be foreigners’ loss of faith in the U.S. Dollar with an ensuing currency devaluation like in the 1970s when Nixon ended dollar convertibility to gold.

Clear signs of an impending Fed policy mistake would lead us to aggressively consider a tactical allocation to commodities through PDBC. One low-probability scenario would be a significant dislocation or lack of market liquidity in the U.S. Treasury market that forces the Fed to purchase treasuries. The Fed would effectively be adopting yield curve controls, much like the recent Bank of England’s actions in the gilts market to stem an uncontrolled blow-out of gilt yields. One expected casualty in this outlier fact set would be foreigners’ loss of faith in the U.S. Dollar with an ensuing currency devaluation like in the 1970s when Nixon ended dollar convertibility to gold.