The latest Federal Open Market Committee (FOMC) meeting on September 17, 2025, signaled that change is on the horizon for this primary monetary policymaking body of the U.S. Federal Reserve System. Fed Chairman Powell justified the 0.25% interest rate cut largely by citing softer consumer spending, slowing economic growth, and a cooling labor market. Powell framed the Fed’s move as a ‘risk-management cut’ tied to the massive 911,000 downward data revision in US payrolls. This unprecedented statistical anomaly has some economists and market participants questioning whether there are other FOMC-reliant data elements sourced from long-established government reporting systems that require some level of modernization or at least a fresh look.

To this point, the September FOMC dot plot reflects an especially wide diversity of opinions on the state of the economy among its members. One FOMC member expects a rate hike before year-end. Five other members expect no more rate cuts this year. While the newest Governor and Trump appointee, Stephen I. Miran, forecasts 125 basis points (bps) of cuts before the end of 2025. This dispersion of opinion highlights that there is little consensus on the path forward, whether due to noisy data and/or questions about data timeliness and reliability. This “garbage in, garbage out” aspect to recent labor market data may have pushed Powell to begin “getting on with it.” The “it” being starting two apparent easing cycles – the obvious interest rate cutting cycle and perhaps an easing of Trump’s public criticism of his leadership.

Federal Reserve Governor Stephen I. Miran recently elaborated on his views at the Economic Club of New York, arguing that current monetary policy is too restrictive and risks harming employment. Miran believes the federal funds rate should be around 2.0% to 2.5%, much lower than the current policy rate, due to changes in nonmonetary factors like immigration, fiscal policy, trade, and deregulation. Miran takes a refreshingly forward-looking approach by projecting the future impact of known economic and legislative actions, rather than the traditional FOMC rear window approach. Here’s a plain English summary of his key points.

Miran thinks the Federal Reserve’s current policy is too tight, meaning interest rates are too high, which could lead to job losses. Miran uses the Taylor Rule. This widely respected guideline in economic circles is not a mandatory requirement of the FOMC. The Taylor Rule is an equation introduced in a 1993 paper by John Taylor that prescribes a value for the federal funds rate (the short-term interest rate targeted by the FOMC) based on the values of inflation and economic slack, such as the output gap or unemployment gap. In short, the Taylor Rule is a guideline for setting interest rates based on inflation, the neutral interest rate (r*), and the output gap (how much the economy is producing compared to its potential). Based on his observations and judgment, Miran argues that rates should be lower, around 2.0% to 2.5%, to balance the Fed’s goals of controlling inflation and supporting employment.

Please see the full speech for a more detailed discussion on Miran’s application of the Taylor Rule, which is broadly accepted in economic circles.

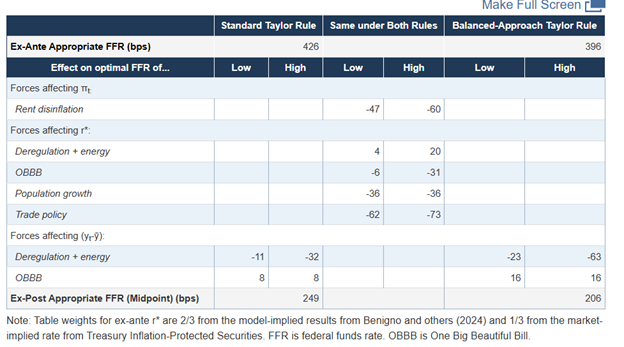

Included in his speech, Miran published the following summary table of his assumptions and calculations under the traditional Taylor Rule and the derivative Balanced-Approach Taylor Rule:

The bond market, as reflected in Fed funds futures pricing via the CME Fed Watch Tool, is leaning more towards Miran’s thinking rather than the FOMC median forecast. The bond market is currently forecasting a total of 3 rate cuts (each by 25 basis points) from the Federal Reserve by the end of 2025. This implies an expected federal funds rate range of 3.50% to 3.75% at the December 2025 FOMC meeting, down from the current 4.00% to 4.25% range following the September cut (the range was 4.25% to 4.50% prior).

The probabilities break down as follows: October 28–29 meeting: ~89% chance of a 25-bps cut. December 16–17 meeting: High probability of a cumulative 50 bps in cuts from the current level (i.e., two more 25-bps cuts total for the year). This pricing assumes no larger-than-expected cuts (e.g., 50 bps) and reflects ~77% likelihood for the 3.50% to 3.75% terminal rate at the end of 2025.

Meanwhile, U.S. Treasury Secretary Scott Bessent weighed in on interest rates on September 24, stating that the economy has clearly entered a monetary easing cycle. Bessent argued rates have remained too high for too long and advocated for 100 to 150 bps of easing to reduce borrowing costs and stimulate growth, predicting a significant drop in mortgage rates from current 6.8% levels. Bessent was advancing his agenda in another way by announcing plans to begin interviewing candidates for Powell’s successor next week, focusing on individuals with “open minds.”

As if on cue, real assets have been appropriately responding even before this signal, the U.S. government is moving into full currency debasement mode. Gold has seen significant year-to-date (YTD) appreciation in 2025, with a jump of over 40%, reaching approximately $3,700 – $3,790 per ounce and new all-time highs. Gold appreciation has been driven by factors like ongoing inflation, economic uncertainty, geopolitical tensions, and strong foreign central bank buying.

Similarly, silver prices peaked recently at $45.39 per ounce on September 25, 2025, marking the highest level since May 2011, before settling at $44.92 with a 2.5% daily gain and 52% year-to-date increase.

Lastly, VanEck Gold Miners ETF (GDX) has risen by approximately 22% over the last month. GDX has significantly outperformed broader equity markets, with a YTD return of around 115% through September 25, 2025. GDX has benefited from rising gold prices and improved operational efficiencies among gold mining companies.

Servant Financial client portfolios have long held, meaningful allocations to gold and other precious metals as outlined in our October 2023 article “Got Gold?”

In other late-breaking news, $10 trillion asset manager Vanguard has reversed their ban on spot bitcoin ETFs in client accounts. Vanguard’s new CEO, Salim Ramji, previously helped launch BlackRock’s spot Bitcoin ETF.

In sum, the September FOMC meeting and the surrounding policy debates underscore a pivotal moment for U.S. monetary policy. With Powell cautiously cutting rates, Miran pushing for a more aggressive easing path, Bessent openly calling for Powell’s successor, and markets aligning more with the bond bulls than the Fed’s median outlook, the stage is set for heightened volatility. Precious metals’ surge and shifting stances from financial giants like Vanguard highlight how investors are repositioning in anticipation of looser monetary conditions and broader structural shifts. Whether this cycle ultimately stabilizes growth or stirs new risks will depend on how well policymakers can balance data uncertainty, political pressures, and evolving global dynamics in the months ahead.