Beginning in April 2025 we began a series of monthly newsletters that permitted readers to follow along with our deep investment thesis work on Together We Build: Reindustrialization of America. The outcome of that research ultimately was a sleeve of physical and productive resource companies we dubbed “Forge Ahead” and added to Servant Client models. We explicitly avoided significant direct Chinese resource and refining exposure that is available with the VanEck Rare Earth ETF (REMX) given our expectation of a more adversarial relationship between the two trading partners. This newsletter will summarize performance of the Forge Ahead sleeve as well as highlight policy and news updates that we believe further reinforce our thesis.

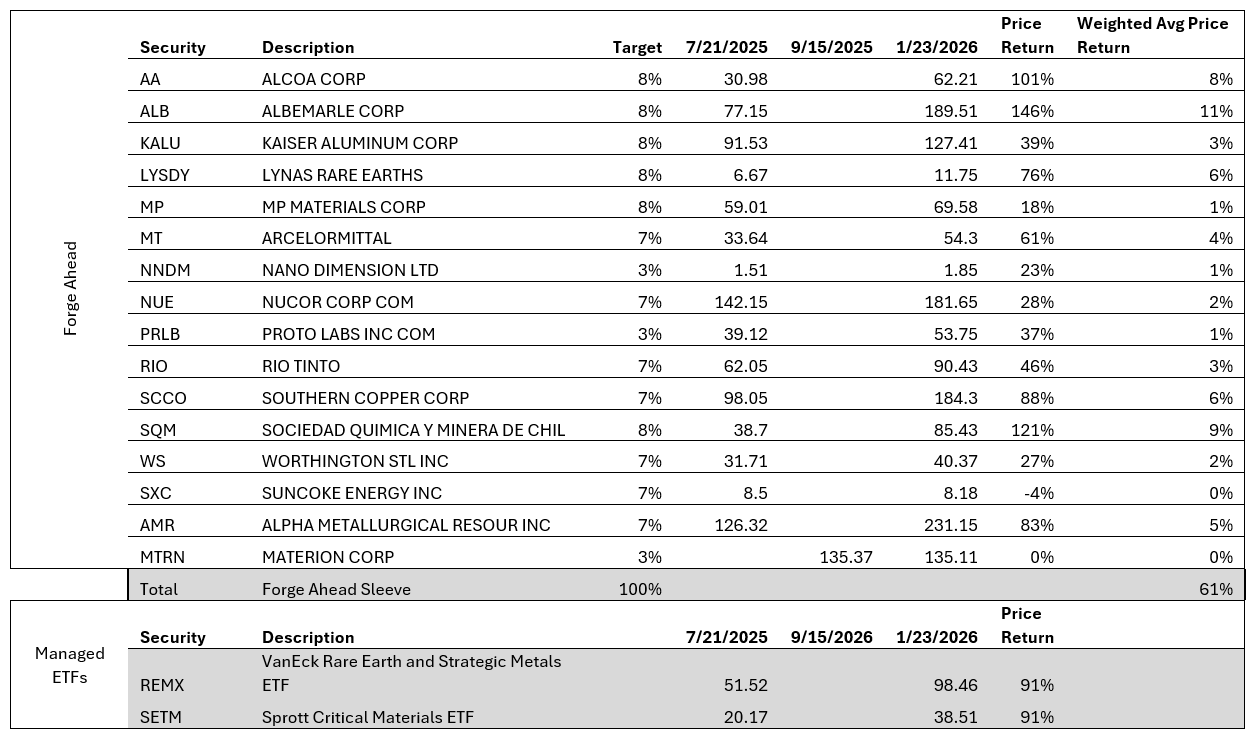

Forge Ahead Performance vs Managed Proxy ETFs: (6 months)

Below is the trailing 6-month performance of our Forge Ahead sleeve compared against managed ETFs as proxy. Forge Ahead is not inclusive of impact of dividends ~2.5%.

This performance summary is solely presented for illustrative purposes. It assumes that all the Forge Ahead sleeve components were purchased on the dates and prices specified at their targeted weightings. Actual client account performance holdings and performance metrics will invariably differ from this illustration due to position sizing, timing and frequency of rebalancing, and other factors.

Overall, lithium companies (Albemarle and SQM) drove Forge Ahead’s performance for the last 6 months. The REMX ETF presented below was weighted much more heavily to lithium producing companies (Albemarle, SQM, Pilbara, Ganfeng, Liontown, Lithium Americas) at 40-45%. Also noteworthy is the diversification in Forge Ahead across differentiated productive assets, such as steel, aluminum, copper, tooling companies (Nano and Proto Labs) and coking coal company (Suncoke), not included in the REMX ETF. Although portfolio composition has had a negative impact on the comparative return over the first 6-month measurement period, we believe Forge Ahead’s broader diversification and its limitations on direct China exposure will produce more attractive risk-adjusted returns over the longer term. REMX’s direct exposure to Chinese companies is estimated at 25% to 30%.

Nevertheless, the Forge Ahead thesis has outperformed the S&P 500 which provided ~10% price return over the same period.

Re-enforcement of Thesis:

Geopolitical Strategists at The Land Investment Expo Conference

On January 13, 2026, Servant Financial attended the Land Investment Expo where two noteworthy geopolitical strategists spoke, Peter Zeihan and Marco Papic. Both speakers had similar overall messages: there are global tensions that are shifting the world into China-centric vs USA/NAFTA-centric worlds or a multipolar world, and areas that they think will thrive under these conditions are physical and productive assets. Peter pointed to materials processing, non-ferrous metals, and electrical steel, while Marco touted land, copper, nickel and natural gas. Marco thought that land as a store of value would catch up to gold. Today, you need only 1.1 ounces of gold at $5,045 per ounce to buy the average US cropland acre according to the USDA. Historically this purchase required 3.7 ounces on average. Likewise, you need only 1.9 ounces of gold to buy the average prime Illinois cropland acre. Historically this same purchase required 6.7 ounces.

Presidential Proclamations

Following is a Presidential proclamation made on January 14, 2026, which highlights the importance of processed critical minerals to the national security of the United States and the overreliance on foreign sources. The administration is aggressively working on a plan for resolution of these dependencies.

SECURE Minerals Act

The Securing Essential and Critical U.S. Resources and Elements (SECURE) Minerals Act is a proposed Congressional solution to the overreliance on foreign processing of critical minerals. The proposed legislation seeks to establish a $2.5 billion strategic reserve like the Strategic Petroleum Reserve (SPR) of critical minerals overseen by a board of governors similar to the Federal Reserve.

US lawmakers introduce bill to create $2.5 billion critical-minerals stockpile | Reuters

The United States isn’t the only country preparing for this multipolar world. Europe has responded with ReSourceEU, which budgets spending of 3 billion euro to combat Chinese dominance in critical mineral processing.

EU to curb exports of recyclable battery, rare earth waste to cut China reliance | Reuters

Our Next Steps:

Our research is ongoing to identify key chokeholds in strategic resources and capabilities. We are presently researching downstream refining and processing of critical minerals to identify strategic dependencies and listed company solutions to potentially add to our Forge Ahead sleeve. Mining companies within Forge Ahead are generally vertically integrated and therefore already picks up elements of refining in the supply chain. But we think there may be other more tactical ways to add exposure to this important step. We are also evaluating mineral resource opportunities in Greenland to determine if they are a suitable fit within our investment thesis.