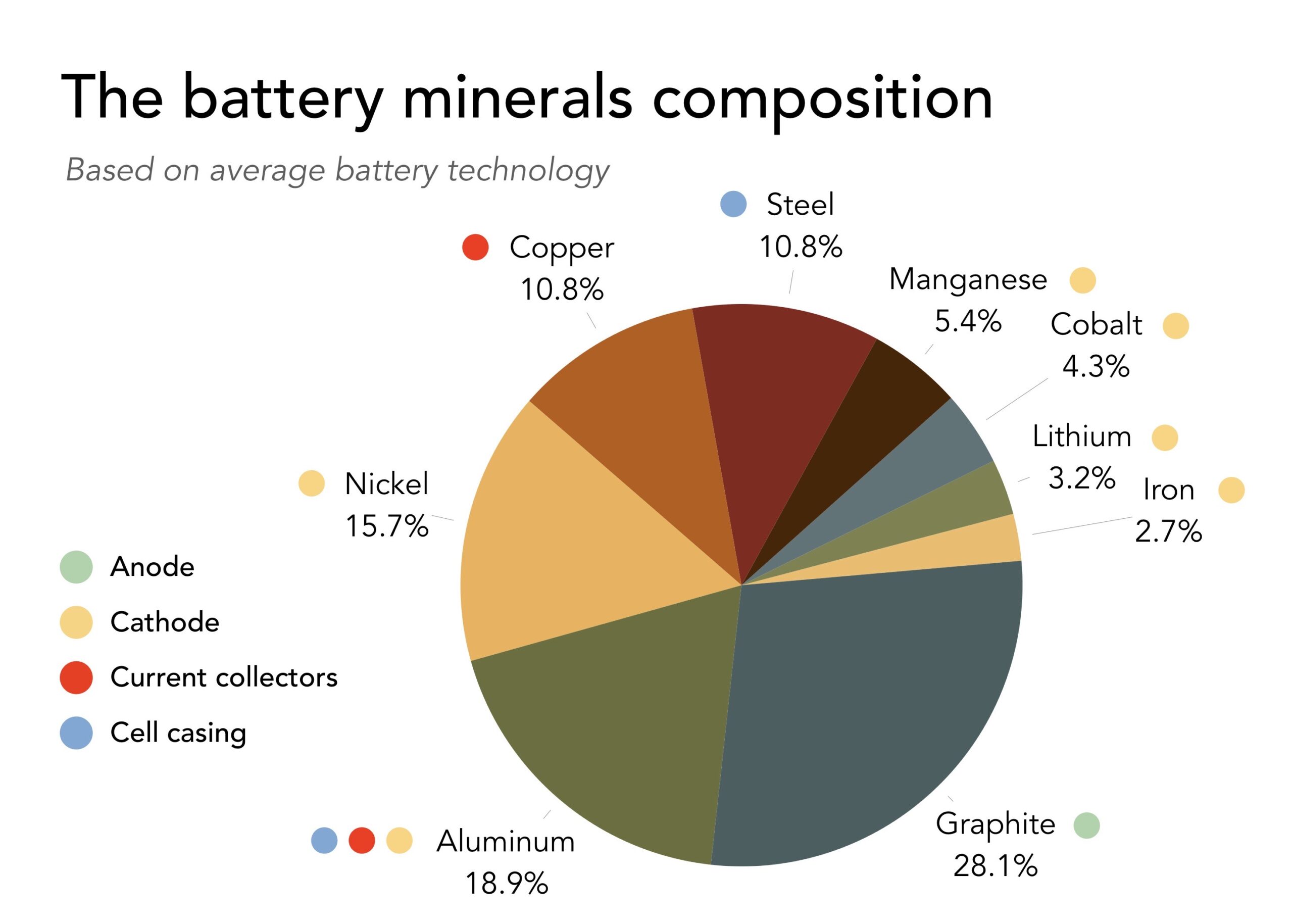

Above Image: Lithium-ion Battery Minerals: Cobalt, Nickel, Manganese, Graphite, and Lithium

In our last edition, Strategic Materials in Focus: Rare Earths and Lithium, we explored the first category of materials important to America’s industrial resurgence. Once again, a reminder below that we categorized raw materials into three investment-relevant groups:

- Strategic Materials – Rare Earth Elements (REEs), Semiconductors, and Lithium

Vital for national defense and advanced technologies, yet heavily reliant on foreign supply chains. - Critical Materials – Cobalt, Graphite, and Aluminum

Essential for energy storage and transportation, with vulnerable domestic sourcing. - Essential Materials – Steel, Copper, and Cement

The foundational components of industrial infrastructure.

Spotlight on Critical Materials: Cobalt, Graphite and Aluminum

Research suggests global cobalt demand is led by batteries and superalloys (~43% and 25% in 2024, respectively), used in automotive, turbine engines and electronics, with a projected growth rate of ~4% CAGR by 2030. For example, cobalt is a component in Lithium-ion batteries, which contain ~10-20% of cobalt and are widely used in Electric Vehicles. An important note is that cobalt is a byproduct of copper mining. In high cobalt deposits, copper yields cobalt at a paltry ratio of .02-.05 metric tons to 1 metric ton of copper mined. The global supply of copper is dominated by the Democratic Republic of Congo (DRC), producing ~70%. Importantly, 65% of cobalt refining is done in China. Given the copper byproduct dependency, very few pure-play cobalt producers exist. Therefore, we concluded the best approach to obtain cobalt exposure is through direct investments in copper miners.

Global graphite demand is also led by batteries ~40%. Lithium-ion batteries for Electric Vehicles require 40-60kg of graphite, for which market growth supports projected graphite use for batteries of 78% by 2035. CAGR for graphite use in the United States is ~7% through 2033. China owns 60% of global graphite mine production and 97% of graphite refining.

Global aluminum demand is led by transportation and packaging (~40% and 20% in 2024, respectively) used in automotive, aerospace, and beverage cans. The US Aluminum market is projected to reach CAGR of ~4.6% through 2030. The US imports most of its Aluminum from Canadian smelters. Canada imports its raw aluminum from Guinea, Australia and Brazil for refining/smelting.

As with strategic raw materials before, China dominance poses significant strategic risk, particularly as it relates to graphite suggesting that the U.S. may benefit from the vertical integration of domestic supply chains for critical minerals.

Four companies in the graphite and aluminum space stand out based upon our research:

Syrah Resources (Ticker: SYAAF)

- Location: HQ in Melbourne, Australia; operations in Mozambique (Balama) and U.S. (Vidalia, LA)

- Focus: Natural graphite mining and active anode material (AAM) production for batteries

- Use Case: EV and grid storage lithium-ion batteries (supplying OEMs like Tesla, Ford, Samsung)

- Strategic Edge: Only fully vertically integrated graphite-to-anode producer outside of China

- Website

Alcoa Corporation (Ticker: AA)

- Location: S. HQ in Pittsburgh with integrated global operations (Canada, Australia, Spain)

- Focus: Bauxite extraction, aluminum smelting, and fabrication

- Use Case: Automotive, aerospace, packaging markets with half its smelting powered by low-carbon hydro-electricity

- Strategic Edge: Vertically integrated, low-carbon production, tariff responsiveness, and joint ventures in Europe (e.g., Spain)

- Website

Kaiser Aluminum (Ticker: KALU)

- Location: HQ in Franklin, Tennessee; North American fabrication plants (13 sites across the U.S.)

- Focus: Rolled, plate, sheet, can-sheet, extruded, and forged aluminum products

- Use Case: S. aerospace, automotive and packaging industries

- Strategic Edge: Pure-play downstream fabricator benefiting from reshoring and tariff protections, with stable operating margins

- Website

Rio Tinto (Ticker: RIO)

- Location: Dual HQ in London and Melbourne; operates globally (~35 countries)

- Focus: Mining & processing—including iron ore, copper, bauxite, alumina, aluminum, lithium, and borates

- Use Case: Broad metals demand—steelmaking, energy transition (copper, lithium), refined aluminum

- Strategic Edge: Massive scale, diversified portfolio, expanding into lithium via Arcadium acquisition

- Website

Looking Ahead

Our research suggests the U.S. government, under President Trump as the 47th President, has intensified efforts to secure critical mineral supply chains. Likely actions include executive orders, use of the Defense Production Act, and deep-sea mining initiatives to reduce reliance on foreign sources, especially China. Here are details on few measures under consideration:

- Executive Order – Immediate Measures to Increase American Mineral Production

- Executive Order – UNLEASHING AMERICA’S OFFSHORE CRITICAL MINERALS AND RESOURCES

- Executive Order – Section 232 Investigation on Critical Minerals and Derivative Products

Our intensive work to develop an internal Strategic Materials Fund (basket of securities) to align with these perceived long-term structural trends of the U.S. strategic sourcing of raw materials is ongoing. Our next newsletter will cover remaining essential materials – steel, copper and cement. Followed by a disclosure of the composition our Strategic Materials Fund. Expect to possibly see portfolio transaction activity as we begin to execute on this theme ahead of further newsletter walkthroughs.