As 2025 draws to a close, financial markets and the broader economy find themselves at the intersection of several powerful forces: a battle between inflation and interest rates, rapid technological innovation, shifting consumer behavior, and an electrical grid feeling the pressure of rapid automation and digital expansion. What began as a year defined by rate debates has evolved into a broader story about how the United States is absorbing structural change. The themes of the past twelve months tell us as much about the decade ahead as they do about the year behind us.

Interest Rates and a Cooling but Resilient Housing Market

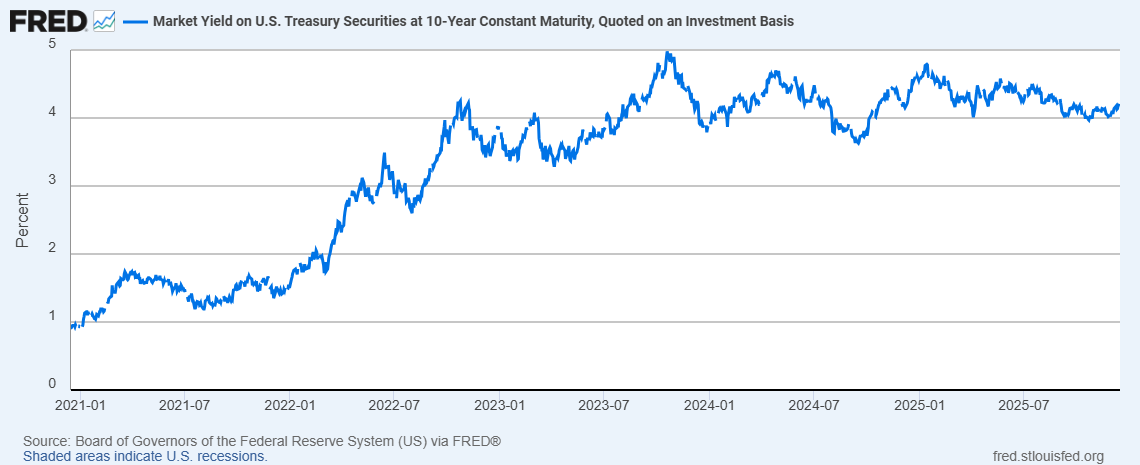

The Federal Reserve’s higher-for-longer posture continued to exert pressure across the economy, from housing affordability to equity valuations. Inflation proved stubbornly sticky, while job growth oscillated between strong and soft patches, complicating the Fed’s interpretation of true economic momentum. The government shut down key data releases, leaving Fed policymakers with an incomplete picture as they weighed interest rate decisions heading into the second half of the year.

Source: St. Louis FRED

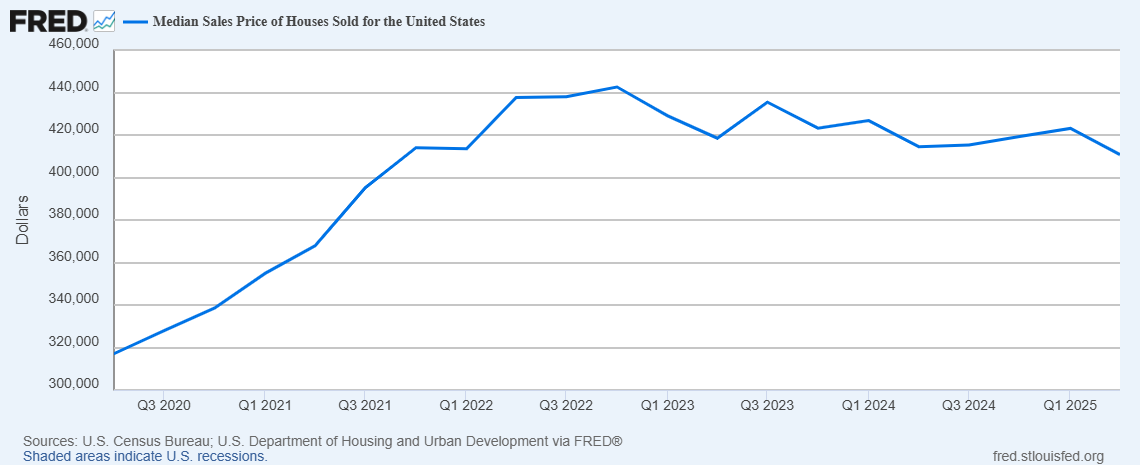

In the housing market, the post-pandemic boom has gradually begun to soften. Home prices have remained elevated, particularly in regulatorily supply-constrained cities like New York, Miami, and Dallas, but the rate of appreciation slowed. The S&P CoreLogic Case-Shiller National Home Price Index rose just 1.3% in the twelve months through September 2025, the lowest rate of home appreciation since mid-2023. While affordability challenges have sidelined many potential buyers, further rate cuts in 2026 could rekindle momentum in the year ahead.

Source: St. Louis FRED

The AI Economy: Real Productivity Meets Bubble Anxiety

If 2023 and 2024 were years of artificial intelligence (“AI”) experimentation, 2025 marked the year AI went mainstream. More than one-third of American workers now report using AI tools on the job, and major corporations have integrated automation directly into their operating models. Artificial intelligence was even used in the editing of this article. Companies such as Amazon, UPS, Target, and Klarna announced significant white-collar job reductions as AI systems replaced administrative and managerial functions, a trend some have dubbed the “death of the middle manager.”

Public figures, including Bill Gates and Elon Musk, predicted that professional fields such as teaching, medicine, and corporate strategy may undergo profound transformation within a decade. Yet even as AI adoption accelerates, questions loom about whether AI-focused companies can justify their valuations. Many remain unprofitable, and concerns about frothy investor optimism persist.

OpenAI CEO Sam Altman captured the contradiction succinctly in an August interview: “Are we in a phase where investors as a whole are overexcited about AI? Yes. Is AI the most important thing to happen in a very long time? Also, yes.” Markets, for now, are trying to price both realities at once in this winner-takes-most AI race.

The Strained Electrical Grid and a New Geography of Computing

The explosion of AI models and the ongoing growth of electric vehicles have pulled America’s power grid into the center of macroeconomic discussions. Massive data centers, many clustered in states like New Jersey, have begun to significantly influence both local land markets and force electricity prices higher. Retail power rates in New Jersey climbed 19% this year, compared with a 6% national increase.

The question of where to locate future data centers has become contentious. Tech companies are increasingly competing for rural land, including farmland, as they seek open space and access to low-cost, efficient power generation. Meanwhile, policymakers are wrestling with how to balance innovation with local community needs and the affordability of consumer electricity.

Energy Secretary Chris Wright, however, pushed back against the idea that AI will inevitably raise energy prices. “The way to get electricity prices down,” he argued, “is to produce more electricity.” Companies such as Amazon and NVIDIA appear to agree, committing billions to new infrastructure designed to meet the escalating demand. Several hyperscale data center operators are taking steps to reinvent electrical grid dynamics with announced projects that include their own “behind-the-grid” power sources.

A Splintered Consumer Base

The strength of the U.S. consumer, a traditional pillar of economic stability, looked increasingly uneven in 2025. High-income households continued to spend robustly, with the top 10% of Americans now responsible for nearly half of all consumer expenditures. Meanwhile, mid-market consumers struggled with rising costs of living, mixed employment markets, and managing their debt burdens in a less favorable interest rate environment.

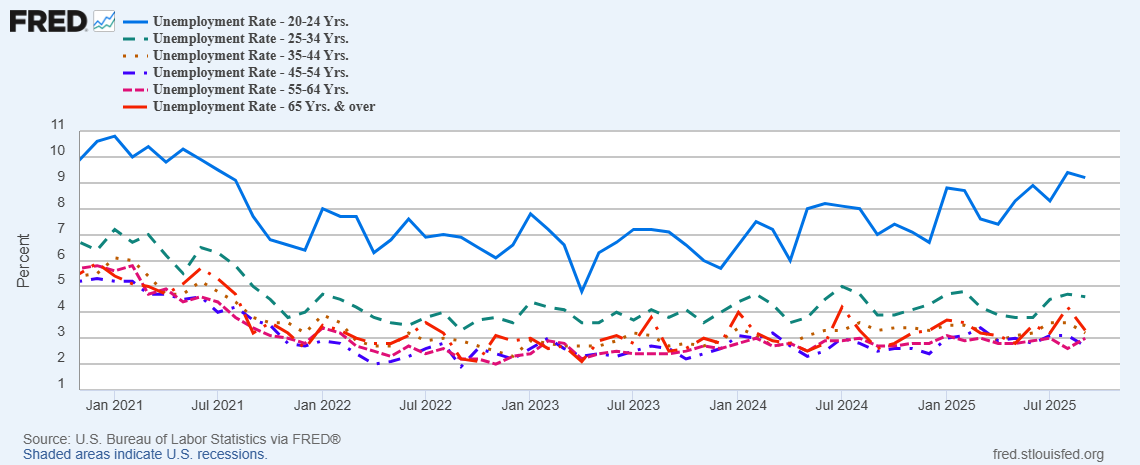

Delinquencies on credit cards and auto loans have been rising for much of the year. Overall, unemployment has hovered near 4.5%, but younger workers have been facing far steeper challenges: Gen Z’s unemployment rate climbed to 10.4% in September, underscoring the shifting dynamics of the labor market.

Source: St. Louis FRED

Healthcare Reimagined as GLP-1 Adoption Surges

Perhaps no sector experienced as dramatic a transformation as healthcare. GLP-1 drugs, once primarily used to treat diabetes, rapidly entered the mainstream as a legitimate weight-loss treatment. A Gallup survey found that 12.4% of U.S. adults used semaglutide-based medications in 2025, up from 5.8% as recently as February. Insurance plans, employers, food manufacturers, and medical device companies all felt the second-order effects of America’s latest health kick.

Obesity rates, long stubbornly high in the U.S., have begun to decline. Meanwhile, pharmaceutical companies such as Novo Nordisk and Eli Lilly are racing to develop pill-based GLP-1 formulations. If pill-based GLP-1 drugs become widely available, they could lower treatment and distribution costs by eliminating injections and specialty delivery, while expanding access through primary care. Broader, earlier use could shift healthcare spending away from costly downstream conditions, such as diabetes, cardiovascular disease, and orthopedic interventions, toward preventive pharmaceutical management. Over time, this would change insurer, employer, and public health spending patterns by increasing pharmacy costs upfront but reducing long-term medical claims.

Housing Scarcity and the Debate Over a 50-Year Mortgage

Even with cooling prices, housing remained scarce across major metropolitan areas. New policy proposals attempted to bridge the affordability gap, including a controversial 50-year mortgage suggestion aimed at lowering monthly payments. While a longer mortgage term does reduce payment size, the total interest burden balloons dramatically. On a $325,000 home, a 50-year loan would generate more than $833,000 in interest, double that of a 30-year mortgage, and over five times that of a 15-year.

| 15 Year | 30 Year | 50 Year | |

| Home Price | $325,000.00 | $ 325,000.00 | $325,000.00 |

| Rate | 5.60% | 6.25% | 6.90% |

| Total Payment | $2,672.80 | $2,001.08 | $1,930.65 |

| Total Interest Paid | $156,103.79 | $395,389.12 | $833,388.95 |

Such a structure might expand the pool of eligible buyers, but likely at the cost of pushing prices even higher, an ironic outcome for a policy intended to ease affordability. Many experts believe that housing supply in certain regions of the country has been constrained by regulation and that a housing market realignment is possible simply by reducing the red tape and letting homebuilders build.

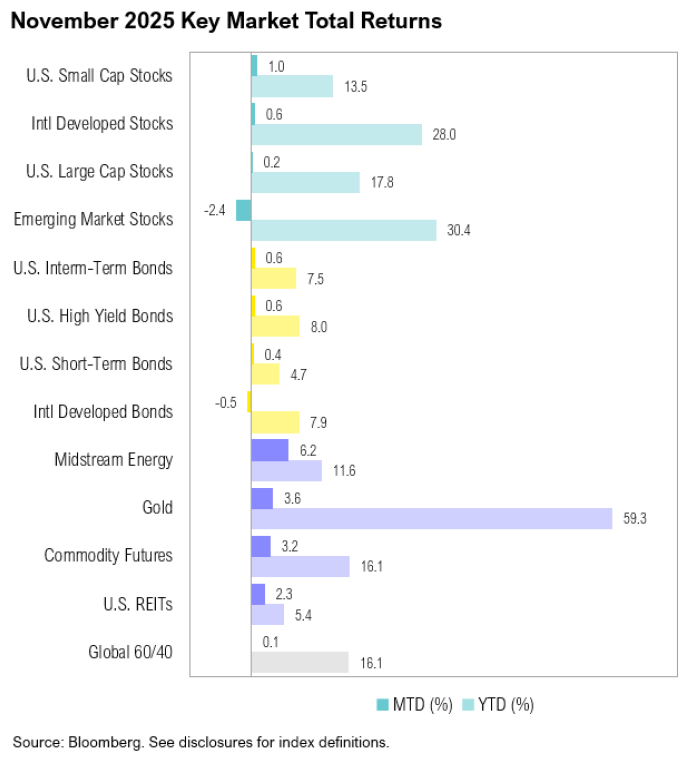

Market Performance: Strong Gains Amid Uncertainty

Despite recurring volatility, 2025 has proven to be a strong year for equities, led by technology, biotech, real assets, and precious metals as markets reprice the future based on the current path of economic, monetary, and international trade policies. U.S. Large Cap Stocks returned over 17%, the Nasdaq Composite more than 21%, and semiconductor stocks surged nearly 50%, fueled by soaring AI computing demand.

However, real assets and commodities stole the spotlight, with gold and precious metals posting extraordinary gains. Gold has jumped nearly 60% as the flock to real assets persisted.

Financials also outperformed with broad equity benchmarks across the Dow, S&P, and Russell families, delivering double-digit returns.

Looking Ahead

The defining story of 2025 is one of economic realignment. Higher-for-longer rates pressured valuations by raising discount rates, triggering a broad repricing of risk across assets. AI shifted from a speculative idea to a foundational technology. A strained power grid emerged as a national constraint on economic prospects. Healthcare has entered a new era of productivity, while housing scarcity and affordability and socioeconomic inequality remain persistent challenges.

As we look toward 2026, the U.S. economy remains dynamic and resilient, but several increasingly complex economic realignments are at our nation’s doorstep. Volatility will likely persist, but so will abundant opportunities, particularly in real assets and critical minerals, select equities, and sectors positioned to benefit from a decade of reinvestment in U.S. energy infrastructure, manufacturing, production, and refining capacity, and advanced technologies.