On September 18th, the Federal Reserve cut interest rates by 50 basis points, marking the beginning of a new rate-cutting cycle. Historically, such a large initial rate cut has typically been reserved for times of economic crisis. Updated economic projections provided by the Fed, referred to as the “dot plots”, indicate that the Fed now anticipates a higher ending 2024 unemployment rate (4.4% vs. 4.1%), higher GDP growth (2.0% vs. 1.4%), lower inflation as measured by the Personal Consumption Expenditure (PCE) index (2.3% vs. 2.4%), and a reduced 2024 year-end Federal Funds rate (4.4% vs. 4.6%) compared to its December 2023 forecasts. These updated forecasts hardly suggest any economic downturn or crisis is around the corner. Both the bond market and the Fed expect an additional 50 basis points in cuts by year-end, implying a 25 basis-point reduction at each of the two remaining Federal Open Market Committee (FOMC) meetings this year.

The Fed’s 50 basis-point cut lacks clear justification based on currently available economic data. Core and headline inflation continue to exceed the Fed’s 2% target, and base effects and housing dynamics suggest that core inflation could remain sticky. Further, on September 26th, the U.S. Bureau of Economic Analysis reported that U.S. GDP grew at an annual rate of 3.0% for the second quarter of 2024. This final 2Q24 GDP figure was revised upward from the initial estimates and reflects healthy economic growth, driven by strong consumer spending, an upturn in private inventory investment, and business investments. Additionally, financial conditions are at their lowest since May 2022, and jobless claims continue to fall. Initial jobless claims in the U.S. fell to 218,000 for the week ended September 21, lower than analyst estimates of 223,000 to 225,000. The latest jobless claims represent a four-month low, indicating a stronger labor market than some analysts and perhaps the Fed anticipated. In addition, the latest Bank of America Fund Manager Survey shows that over 50% of respondents do not foresee a U.S. recession within the next 18 months, i.e.. the consensus expectation remains for a soft landing.

The Fed’s decision to cut interest rates by 50 basis points last week has sent mixed messages to the markets. The ensemble of market reactions suggests the Fed has ignited risk-on behavior.:

- Stock Market: Initially, there was a muted or even negative reaction in the stock market. This might seem counterintuitive because rate cuts are typically viewed as positive for stocks due to lower borrowing costs which can stimulate growth. However, the immediate dip could be attributed to investor concerns that the larger-than-expected cut might indicate the Fed’s worries about underlying economic weaknesses, particularly concerning the labor market. However, following the initial confusion, there has been a meaningfully positive reaction with stocks rallying sharply as market consensus moves toward the assessment that the Fed does not have any inside information on data portending broad economic weakness.

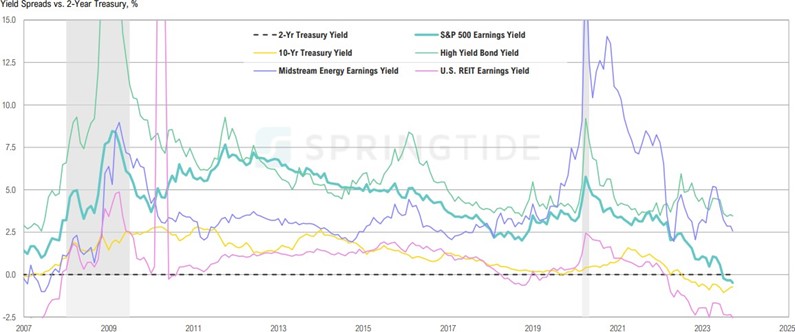

- Bond Market: The bond market showed a significant and immediate reaction with the 10-year Treasury yield spiking to 3.78% on September 26th from 3.64% the day before the Fed’s rate cut. The bond market seems to be repricing for higher expected inflation and/or stronger economic growth in the longer term post the Fed’s cut.

- Gold: Gold spiked to an all-time high on September 26th by topping $2,700 per ounce for the first time in history. This signals both the possibility of a Fed dovish policy mistake and safe haven buying in response to the escalation of the wars in Ukraine and the Middle East.

- Bitcoin: Likewise, bitcoin, or digital gold, has popped above $65,000 and is up almost 4% on the 26th. For market technicians, the $65,000 price per bitcoin represents a key technical level with many analysts suggesting that a breakthrough of this level may signal the beginning of another epic run. Today’s price appreciation may signal the start of a run to Bitcoin’s all-time high, previously set in November 2021 at approximately $69,000. Pop zing!

- Energy Markets:

- Oil: Oil prices have shown limited volatility as of late. Brent crude has been range-bound around $75 per barrel. There’s some underlying sentiment of a bear market in oil, with some hopes pinned on-demand increases or external stimuli like actions from China to boost prices. Escalation of the Middle East war between Israel and Iran’s Hezbollah proxy in Lebanon could drive increased risk premiums into oil prices.

- Natural Gas: Natural gas experienced a significant jump, with futures up over 8% recently, possibly due to the aforementioned geopolitical tensions in the Middle East or expectations of increased demand from electricity producers looking for energy resources to satisfy the growing demand for Artificial Intelligence computing capacity.

- Uranium: Uranium has seen quite dramatic swings in prices in 2024. The spot price of uranium has decreased by (11.6%) since the beginning of 2024, reaching around $80 per pound as of late September, after hitting a 16-year high earlier in the year due to increased demand and tight supply. Despite this year-to-date decrease, uranium has been the best-performing energy commodity year-over-year, despite its decline from a peak of $106 in February 2024. The supply-demand imbalances in uranium are long-term in nature as it takes around a decade to bring new supply online. As we’ve outlined previously, there is strong interest in uranium due to its role in nuclear power production, especially with global pushes towards decarbonization and the “greening” of nuclear energy. Uranium prices and Sprott Uranium Miners ETF (URNM) have been raging as of late. URNM is up about 13% since the last FOMC meeting.

X Grok AI rendering of Three Mile Island nuclear plant

Last week, BlackRock, Global Infrastructure Partners, Microsoft, and MGX announced an AI partnership that could invest up to $100 billion in U.S. energy infrastructure and data centers. Additionally, Constellation Energy signed its largest-ever power purchase agreement with Microsoft, adding 835 megawatts of carbon-free, nuclear energy to the grid. Microsoft’s long-term offtake commitment catalyzed the restart of the decommissioned Three Mile Island nuclear plant in Pennsylvania, with key permits still required. The deal is projected to contribute $16 billion to Pennsylvania’s GDP and generate over $3 billion in taxes.

Prince fans will remember an analogous Fed policy instance that occurred in 1999. At the December 21, 1999, FOMC meeting, the Fed kept interest rates unchanged, citing uncertainties around the century date change across the nation’s information processing systems. Nearly a year later, in January 2001, the Fed began cutting rates, starting with a 50 basis-point reduction due to weakening production, declining consumer confidence, tightening financial conditions, and high energy prices. At that time, jobless claims and headline inflation were higher than today. Core inflation and manufacturing activity were lower. The price-to-earnings (P/E) ratio of the S&P 500 was 30.1x, compared to 27.5x today. However, the technology sector’s price-to-sales ratio is currently over 30% higher than it was during the peak of the 2000 Tech Bubble. The top 10 companies in the S&P 500 now make up 34% of this large-cap index, compared to 25% at the height of the Tech Bubble.

Servant Financial’s market commentary and portfolio recommendations for this 1999-like party atmosphere are as follows. S&P 500 valuations appear rich using metrics like the Shiller P/E ratio. Further, yield-to-earnings comparison (the inverse of the P/E ratio versus bond yields) suggests U.S. stocks are less attractively priced relative to bonds than at any time since the 1990s and are reminiscent of conditions before the dot-com bubble. For now, looser financial conditions introduced by the Fed (characterized by lower interest rates, higher liquidity, and easier credit) may end up keeping the ‘party’ going for some time, but no one knows for sure. We will continue to keep a watchful eye on the adults (10-year Treasury yield and gold) and the underage, yet savvy teenager (bitcoin) for messages and clues that things are getting out of hand and it’s time to leave the party. We’ll also keep an eye on inflation rates, shifts in Fed policy guidance, or significant geopolitical events that could also serve as catalysts for a change in market dynamics.

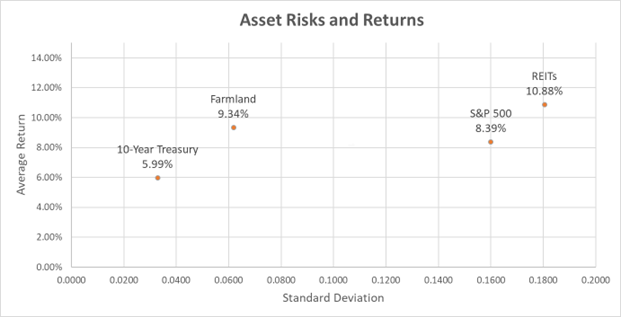

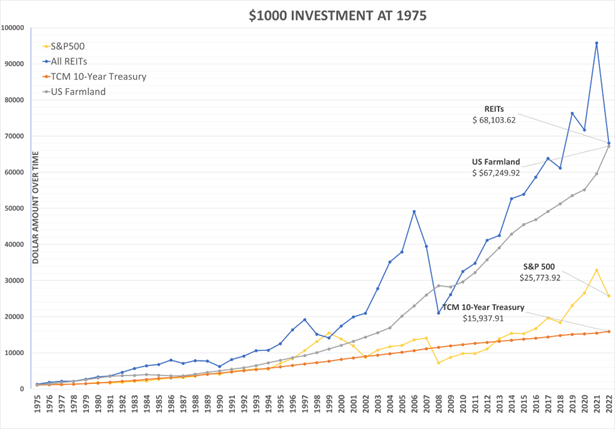

In light of these economic uncertainties, we believe it’s prudent for investors to continue to maintain globally diversified portfolios. Globally diversified portfolios are comprised of traditional investments in stocks and bonds but importantly also include diversifying assets like gold, silver, shares in gold miners, bitcoin, and real assets such as uranium and farmland. These assets offer a hedge against inflation, and currency fluctuations, and provide portfolio stability during periods of market volatility.