Goals of the Inflation Reduction Act

The Inflation Reduction Act of 2022 was officially signed into law by President Biden this month. While the name gives the impression that the bill is narrowly focused on inflation, in reality the bill is a complicated 730 page document of objectives and regulations covering a variety of issues. Most notably, the bill includes historic investments in energy and climate reform spanning a ten year period. While the bill itself is long and complicated, the overall goals and methods are easily identifiable.

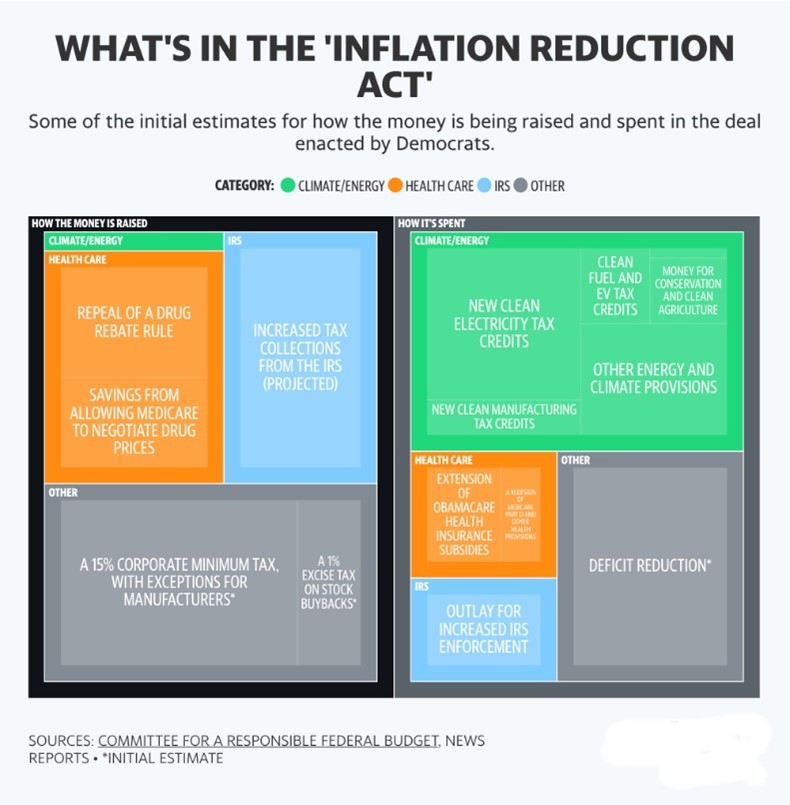

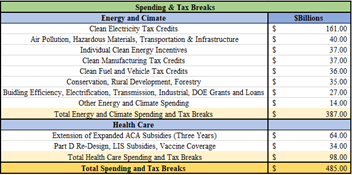

Broadly, the key focuses of the Inflation Reduction Act are increasing taxation and enforcement of taxation for wealthy corporations and individuals, climate and energy reform, and improving health-care programs to increase coverage and lower prices of certain drugs. The last focus is where the bill receives its namesake, to fight historical inflationary levels. However, inflation reduction measures only receive a small fraction of the allocated spending. Of the areas of spending, climate and clean energy receive the largest investment with a historic $379 billion investment. All of these key areas of focus could warrant further examination given the complexity and depth of each of the issues. However, for the sake of viewing this subject through an investment lens, we will briefly highlight the biggest areas of legislative change. We will then examine climate and clean energy reform specifically as this area receives the most funding and creates the most investment opportunities.

What does the IRA do?

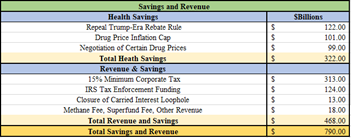

The major source of funding for spending and investment in the Inflation Reduction Act comes from the tax reform aspects in the bill. The most significant of these being a minimum 15% corporate tax for enterprises with adjusted income exceeding $1 billion. According to summary documents on the tax effects of the Inflation Reduction Act, “up to 125 corporations that average nearly $9 billion in profit paid effective tax rates of 1%”. This provision alone will generate an estimated $313 billion over the life of the bill. In addition to this, the bill implements a 1% stock buyback fee or tax. In addition, the bill includes improved funding for the IRS to improve collection and increase the number of audits for individuals with annual income exceeding $400,000. These and other smaller changes are expected to generate a total of $468 billion in revenue for the bill.

The next area of focus for the Inflation Reduction Act is health care reform. The health care provisions include large investments but also generate substantial funds. Some of the key changes made include a) empowering Medicare to negotiate prices of certain medications, b) capping Medicare patients out of pocket payments to $2,000 a year, c) extending Affordable Care Act subsidies for three years, and d) establishing better controls over pharmaceutical companies’ medication price increases. These and other lesser changes made in the health care sections will save an estimated $322 billion of revenues and only require $98 billion of spending.

While the name of the Inflation Reduction Act would likely lead you to believe reducing inflation would be the main focus of the bill, many economists are skeptical that inflation will be reduced at all. According to a study from the Penn Wharton Budget Model, “the impact on inflation is statistically indistinguishable from zero” over the life of the bill. The bill is essentially designed to raise necessary funding through tax reform and healthcare savings and invest those funds into the Administration’s spending priorities in healthcare and climate reform. Any remaining funds are put towards reducing the U.S. budget deficit. While the Biden administration has claimed the Inflation Reduction Act will counter inflation through deficit reduction and fiscal policy with the 15% minimum tax rate, economists believe these methods are unlikely to have much, if any, effect. The estimated $300+ billion that will be put towards deficit reduction wouldn’t even cover the $400 billion deficit we have accumulated this year alone, not to mention the additional government deficits that will accumulate by the end of the bill’s life. Additionally, some economists disagree with the idea that deficit reduction has any effect on reducing inflation at all. Under our current system, the only real way to control inflation is through the Federal Reserve raising interest rates to control the quantity of money in the money supply. Unfortunately this is not something that can be accomplished overnight. For average Americans, most, if any, inflation reduction will be seen through slightly reduced energy prices from policy reforms and investments made in energy and climate change.

![]()

Climate and Clean Energy Reform

The largest focus of the Inflation Reduction Act is the reform and investment in our climate and energy sectors. As mentioned above, the bill allocates $387 billion of the total $485 billion of total funding for a variety of energy and climate-related improvements. This section of the Inflation Reduction Act has four core goals: 1) Lowering consumer energy costs by providing $9 billion in home energy rebate programs, ten years of consumer tax credits to make homes more energy efficient, additional tax credits for the purchase of electric vehicles, and other smaller things to lower consumer energy costs. 2) Improving American energy security and increasing domestic manufacturing by administering $30 billion in production tax credits for manufacturers creating clean energy tech. Grants and loans will also be administered to convert existing auto-manufacturers to electric vehicle production or building of new facilities as well as any other smaller incentives to increase U.S. production of clean energy technologies. 3) Decarbonize our economy by providing incentives in the form of grants, loans, and tax credits to improve our clean energy production and consumption, as well as other programs to reduce industrial emissions. 4) Investing in conservation, infrastructure, and rural development through investments in climate-smart agriculture, infrastructure projects to support rising demand for electricity and reduction in carbon emissions by roughly 40% by 2030, and other miscellaneous programs to improve conservation efforts. This historic investment in climate and clean energy improvements will likely create great investment opportunities in the next decade.

Opportunity to Invest?

Like many technological advancements in the past two decades, many renewable energy sources have gone from fringe and somewhat inefficient technologies to being extremely desirable and widely adopted. Since 2000, U.S. renewable energy sources have increased by 90%. This market has appeared to be a sound investment for many years now. With all of the incentives for advancement and increased adoption of these technologies from the Inflation Reduction Act, there has never been a more attractive time to invest in renewable and clean energy markets. For our purposes, we have our eyes on two exchange-traded funds(ETFs) in the clean energy and renewables space.

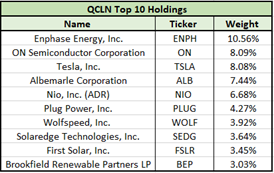

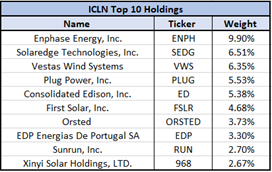

The first opportunity is iShares Global Clean Energy ETF (ticker: ICLN), one of the leading clean energy ETFs holding a portfolio of the industry’s top performing companies. Currently, ICLN holds over $5.5 billion in assets under management and is one of the most popular clean energy ETFs with an average trading volume of around 3.8 million. The second ETF we are watching is the First Trust NASDAQ Clean Edge Green Energy Index Fund (ticker: QCLN). QCLN, another of the more popular clean energy ETFs, holds over $2.35 billion in assets under management with a similar portfolio of top-performing stocks in the clean energy market but with a lower average trading volume of 309,670. Both of these opportunities have historically performed well over the long term. QCLN has been riskier, returning 22.7% per year over the last 10 years through July 31, 2022 and (8.3%) year-to-date compared to 15.9% annualized ten year return and 6.0% year-to-date for ICLN. QCLN’s 8% allocation to Tesla, Inc. (TSLA) might have something to do with its higher volatility. Given the significant investments that will be made in the clean energy and renewables market through the Inflation Reduction Act, this strong performance will likely continue.

In conclusion, the Inflation Reduction Act makes historic improvements to many different areas unrelated to current inflationary trends. Most significantly, the bill will incentivize the transition to a “greener” future as well as improve healthcare for millions of Americans by raising taxes and closing “loopholes” for certain profitable, yet low-tax corporations. The jury is still out on whether this act will successfully achieve its cover story of combatting inflation. However, fiscal policy reforms and deficit reduction efforts will at least ease the load on the Federal Reserve monetary policy somewhat.