2022 has proven to be a particularly interesting and bumpy ride for investors as we travel the economic path toward the end of our rainbows and the achievement of our long-term savings and investment goals. Recent monetary policy and global events have investors reconsidering what role gold plays in a modern investment portfolio. Diversification into inflation hedging assets, such as gold, will be a key consideration for investment portfolios to manage the inflation bumps and monetary policy U-turns. In many respects, the market has indicated early in 2022 that what may be the key to surviving this rocky economic road is by looking ahead to what’s at the mythical end of the rainbow: a pot of gold.

Gold Rush

What do today’s investors and gold prospectors from the 1800s have in common? They are both rushing to get their hands on gold. Inflation woes and market uncertainty have rightfully sent the gold market into a frenzy as investors seek its real asset protection. As of April 25th, gold’s value is up around 10% from the previous year and is up 22.8% since right before the pandemic began in March 2020. While it has given up some gains in recent weeks, it still has strong year-to-date returns. Frankly, gold has been a sparkling investment since 1999 when its price averaged around $252.50 per ounce. Today, gold is trading at closer to $1,900 per ounce, creating a strong upward trend over the last 23 years. Gold reached an all-time high on March 9th when the price of the “barbarous relic” topped out at $2,053.60. Volatility still plagues the real asset but for gold investors who have buried American Eagle coins, gold bars, or equivalents in their safety deposit boxes or investment portfolios, the reward has paid off.

Speculators have questioned whether this gold rush will continue throughout 2022. To be certain, gold prices will be very dependent on what happens with inflation, interest rates, and the Russian/Ukrainian conflict. The barbarous relic’s bullish trends are currently projected to continue throughout 2022 but even the most optimistic investors will continue to keep an eye on its volatility because as we have experienced “All that glitters is not gold.” – William Shakespeare.

Gold Performance During Economic Crisis & Inflationary Pressure

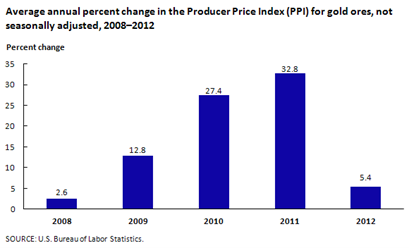

Real assets such as gold or real estate like farmland have often been favored during times of economic crisis and global uncertainty since fiat money printing becomes global governments’ default solution. Investors flocked to real assets during The Great Inflation of the 1970s when unemployment levels were high, and the economy was turbulent. We saw similar circumstances during the 2008 Global Financial Crisis. Initially, gold also faced considerable volatility in 2008 as investors sought liquidity across all investment holdings. After the initial shock of the financial crisis, people bought gold when they sensed that the money printing had started in earnest. Growth slowed down in 2012 as the Federal Reserve lowered interest rates and a weaker dollar resulted. The figure below shows the annual price movements of gold during this time period.

Source: U.S. Bureau of Labor Statistics

The most recent notoriety surrounding gold has understandably been driven by its relationship with inflation. Recently inflationary numbers accelerated with CPI growing more than 8% year over year and the narrative has flipped from “transitory inflation” to “secular inflation” and there is a growing concern for stagflation (slow economic growth with high inflation). The Federal Reserve has reversed course and dropped its inane “transitory” policies and is aggressively raising interest rates to temper demand and combat rising prices. However, with supply chains still recovering from the COVID-19 pandemic, the Russian/Ukraine conflict has thrown another wrench into global economic gears as the market for commodities, such as oil, gas, and grains grows more fractured.

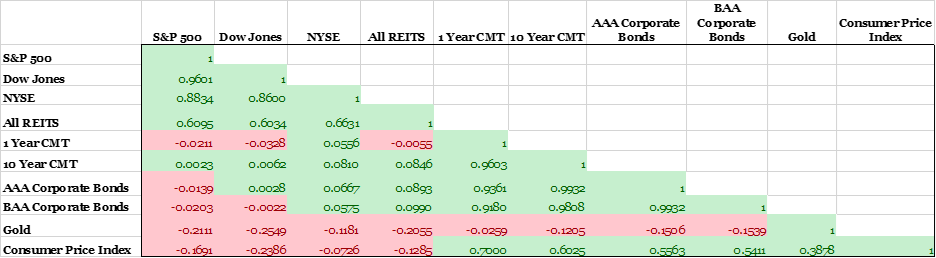

What does all of this have to do with Gold? Well, this considerable market uncertainty has investors accumulating real assets and gold because of its historical positive correlation. In the past, as inflation levels have risen so has the price of gold. We discussed this dynamic in more detail in our February insight. Gold’s positive correlation with inflation has continued to hold in 2022 with gold prices peaking just as investors are seeking protection from high inflation. The following table shows the correlations of various asset classes, including gold, to Consumer Price Index (CPI).

Historical Correlations of Financial Assets with Inflation (1970-2020)

Source: Data supplied by the TIAA Center for Farmland Research

Gold’s Performance in an Investment Portfolio

Gold can play a valuable role in an investment portfolio not only for its inflation hedging capabilities but also for its historical negative correlation with bonds and equities given its safe-haven attributes in times of war and geopolitical turmoil. Some investors argue that gold is unattractive within an investment portfolio because of its volatility and inability to produce an income stream. However, asset allocators and investors might be rethinking portfolio construction as recessionary fears persist and U.S. stock indices continue their volatile fall. The S&P500 is down –11.25% year to date with the NASDAQ and Dow Jones also posting similar losses for the period of -18.05% and -6.14%, respectively. In contrast, gold is up close to 4% year to date and investors are aggressively rethinking their portfolio diversification strategies.

Source: Q1 Market Commentary

There are a variety of alternatives for investors to gain exposure to the gold market. The most obvious is buying gold coins or bullion directly and storing them in a secure vault at a financial institution. Buying gold directly is unlikely to be the best option for many investors due to the high frictional cost of storage and security for the physical asset. Another option would be to invest in the supply chain for gold such as gold miners. Barrick Gold Corporation (GOLD) is the largest gold company in the world. The Toronto-based company mines, processes, and has reserves across five continents. Its stock price is up 7% year over year. A more diversified gold mining play is the VanEck Gold Miners ETF up 20% year over year. For investors seeking less direct gold exposure but still scouting for inflation protection, Horizon Kinetics Inflation Beneficiaries ETF (INFL), offers broad diversification benefits. We wrote about INFL in February when it was added to the Servant Financial portfolio. It currently has $896 million in assets under management with holdings in gold and other mining companies, energy and food infrastructure, and transportation: all sectors that have experienced some of the most positive price movements in the underlying commodities or products and services.

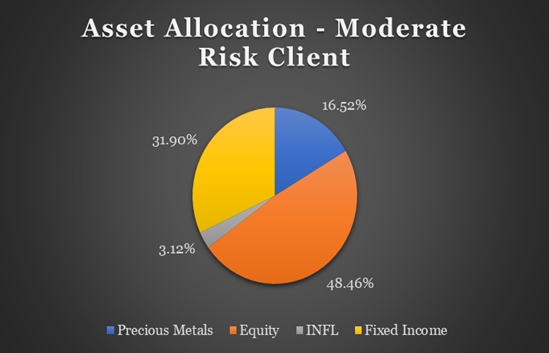

Traditional investment theory cites the most prevalent portfolio benchmark is a 60/40 split in an

investment portfolio with 60% equities or stocks and 40% fixed income instruments or bonds. Under this portfolio model, investors would be down -5.6% quarter to date as both U.S. stocks and bonds were hammered by rising inflation. The performance of the traditional 60/40 portfolio compares unfavorably with Servant Financials’ sample moderate risk client. The Servant model portfolio also holds a diversified mix of global equities and bonds but also includes a healthy allocation to precious metals. This inflation-protected model portfolio was down only -0.57% quarter to date. See the accompanying asset allocation chart.

Within this Servant model portfolio, INFL had total returns of 8.8% for the first quarter of 2022, Berkshire Hathaway Class B shares (+17.6%), Farmland Partners Inc shares (+14.6%), and various precious metal investments (GDX +19.0%, Sprott Gold & Silver Trust +8.9% and iShares Silver ETF +7.2%) accounted for the bulk of the favorable performance variance to the traditional 60/40 benchmark.

We will continue to monitor the performance of gold and other inflation hedges and adjust asset allocation as we chart the optimal path to the achievement of your long-term savings and investment goals. If you would like to discuss your financial situation and how to secure that pot of gold at the end of your investment rainbow, please contact us at john@servantfinancial.com.