What is Bitcoin?

Over the past few years it is more than likely you have either directly encountered Bitcoin or heard of it, and this is for good reason. As cryptocurrencies are still so new and foreign to most people, reluctance and skepticism are a natural hurdle. Just as many people thought the internet was a waste of time during its inception, Bitcoin is bound to face similar issues. However, popular financial figures such as Elon Musk and Anthony Scaramucci have sung cryptocurrencies’ praises for its innovative blockchain technology. Bitcoin has the potential to significantly disrupt current financial systems such as our current fiat money system while revolutionizing data collection and financial transaction systems.

In 2008, a person using the name Satoshi Nakamoto published a white paper on a public online mailing list. The paper, titled Bitcoin: A Peer-to-Peer Electronic Cash System stated the objectives of the currency as well as the actual code for how to make it possible. As the name suggests, the main objective of Bitcoin is to create a decentralized digital currency that is fully peer-to-peer, not requiring any regulators, banks to be a mediator, or middlemen for transactions. Additionally, Bitcoin avoids rapid fiat currency inflationary episodes like we are seeing currently because the number of bitcoin to be mined has been fixed at 21 million. All of these are made possible through the computer code for blockchain which Satoshi provides in the same paper.

Blockchain Technology

Blockchain is the technology that makes Bitcoin and all cryptocurrencies possible. While it is an extremely complicated system altogether, it can be summarized in a fairly digestible way. Blockchain is essentially a linear public ledger of all transactions, using encryption and decryption as a means of verifying transactions. As Bitcoin transactions are made, they are publicly broadcasted to all computers in the blockchain network and grouped into blocks. These blocks must then be decrypted by the network of computers in the system. Once one of these computers solves the block, the ledger is permanently updated with that block being the newest block on the end of the chain. This process continues indefinitely, constantly adding verified blocks full of transactions. This process eliminates the risk of double spending while remaining decentralized. Double-spending occurs when a single digital token can be spent more than once through duplication or falsification of the blockchain record. The information for all of these blocks as well as the individual transactions within them are all public and can be viewed at any time. While the crypto wallet public key is displayed for transactions, no information is linked to the key that could compromise anonymity.

Mining and Supply

There is only a single way new Bitcoins are created. That is through the process of mining. Calling it mining is slightly misleading as in reality mining is an essential process that maintains the blockchain network. Miners are the computers connected to the blockchain network which complete the decryption process to verify and post blocks. Whichever computer eventually solves the encryption by providing the correct 64-digit hexadecimal value is rewarded a set number of new Bitcoins. This is the only way new Bitcoins are added to the system.

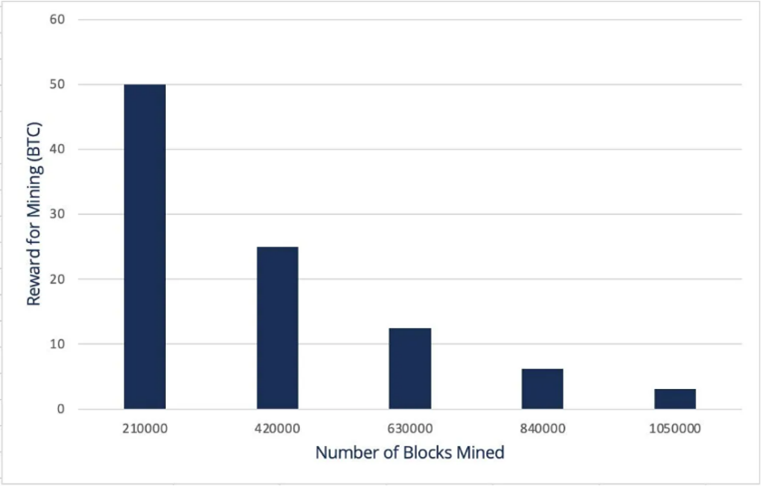

About every four years or 210,000 blocks verified, the Bitcoin reward for solving a block is halved. This rate was established at inception to limit the supply growth and cap the total number of Bitcoins that will ever exist at 21 million. In addition to this, the blockchain system adjusts the difficulty of its encryptions to the amount of mining power in the network to maintain this rate. This is how Bitcoin handles inflation. These countermeasures to inflating the supply are hard-coded into the blockchain. Unlike the U.S. fiat dollar system where money can be arbitrarily created whenever needed by the government, Bitcoin has a fixed total supply and rate of adding to the supply that is not controlled by an irresponsible third party. Today, the reward for solving a single block is 6.25 BTC which currently, would be valued at around $144,000.

About every four years or 210,000 blocks verified, the Bitcoin reward for solving a block is halved. This rate was established at inception to limit the supply growth and cap the total number of Bitcoins that will ever exist at 21 million. In addition to this, the blockchain system adjusts the difficulty of its encryptions to the amount of mining power in the network to maintain this rate. This is how Bitcoin handles inflation. These countermeasures to inflating the supply are hard-coded into the blockchain. Unlike the U.S. fiat dollar system where money can be arbitrarily created whenever needed by the government, Bitcoin has a fixed total supply and rate of adding to the supply that is not controlled by an irresponsible third party. Today, the reward for solving a single block is 6.25 BTC which currently, would be valued at around $144,000.

While a $144,000 payout for running a computer sounds attractive, the odds of actually being the one to solve the encryption is estimated to be about 1 in 22 trillion. Mining technology is becoming more productive every year with inventions like ASICs (Application-Specific-Integrated-Circuit) which are computers designed for the sole purpose of mining Bitcoin. However, even with one of these top-of-the-line computers, odds of solving the encryption are terrible as there are many other individuals and companies running mining operations at a scale that no individual can afford. This issue has led to the creation of mining pools. These are pools of individuals all agreeing to share in the profits of their combined computing power. With thousands of times the computing power, the chances of being the one to solve and be rewarded Bitcoin go up significantly. These profits are then divided up amongst individuals in the pool by how much computing power they offered to the pool.

Bitcoin Today

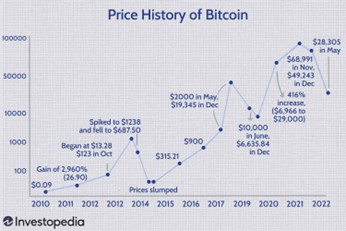

Fourteen years later, it is hard to imagine Satoshi had any idea that his creation would become such a big deal with some countries even using Bitcoin as legal tender. While the coin came from extremely humble beginnings, with a value as low as $0.09 per Bitcoin in 2010, it has hit astonishing highs of nearly $69,000 per Bitcoin just last year. Bitcoin’s price has fallen considerably from this point, today being worth just under $23,000 per coin. This decline is largely from a recent crypto panic caused by the crashing of multiple extremely over-leveraged crypto companies. Despite this recent dip, Bitcoin still shows immense promise for all of the reasons listed above. Even for those skeptical about Bitcoin, the blockchain technology surrounding it has taken off in every sector from food and supply chain to insurance and banking. American Express, Facebook, Walt Disney, and Berkshire Hathaway have all invested in the technology. As the fiat money system becomes more and more problematic and the importance of data collection grows, individuals and countries will be looking to Bitcoin and blockchain technologies for guidance.

Fourteen years later, it is hard to imagine Satoshi had any idea that his creation would become such a big deal with some countries even using Bitcoin as legal tender. While the coin came from extremely humble beginnings, with a value as low as $0.09 per Bitcoin in 2010, it has hit astonishing highs of nearly $69,000 per Bitcoin just last year. Bitcoin’s price has fallen considerably from this point, today being worth just under $23,000 per coin. This decline is largely from a recent crypto panic caused by the crashing of multiple extremely over-leveraged crypto companies. Despite this recent dip, Bitcoin still shows immense promise for all of the reasons listed above. Even for those skeptical about Bitcoin, the blockchain technology surrounding it has taken off in every sector from food and supply chain to insurance and banking. American Express, Facebook, Walt Disney, and Berkshire Hathaway have all invested in the technology. As the fiat money system becomes more and more problematic and the importance of data collection grows, individuals and countries will be looking to Bitcoin and blockchain technologies for guidance.

Investing in Bitcoin

If you are considering putting money in Bitcoin there is a lot to consider. Crypto wallets can be intimidating and are only for direct investment in crypto assets. Instead, we will be focusing on investment opportunities that are tradeable like typical stocks but still provide exposure to the crypto markets. These come in a wide variety and may have different approaches to how they offer crypto exposure. For our purposes, we will cover three of these opportunities.

The first fund has been in the news for the past couple of months. Grayscale Bitcoin Trust (ticker: GBTC) is a closed-end fund holding purely bitcoin assets. Unlike actual bitcoin, GBTC can be held in a tradional investment brokerage account or an IRA (individual retirement account). Grayscale currently has assets under management of around $15 billion, making it the largest Bitcoin fund in the world. The fund provides the opportunity for people to gain exposure to the direct price changes in Bitcoin. Grayscale has plans to convert to an exchanged-traded-fund (ETF) which would allow them to use the creation and redemption technique of an ETF to stabilize the value to the net asset value (NAV). Currently, Grayscale’s inability to use this stabilizing technique has led to GBTC trading at nearly a 30% discount from the NAV of the underlying Bitcoin. In June, the SEC denied Grayscale’s application to convert to an ETF, citing concerns of potential manipulation. Grayscale is now suing the SEC over the decision following previous inconsistent approvals from the SEC for a Bitcoin futures ETF. If Grayscale ends up receiving approval for conversion, the current 30% discount will become a 30% profit for investors as the price will return close to NAV.

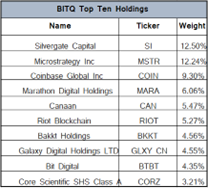

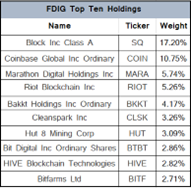

The next few investment opportunities take on more of a “pick and shovel” approach to investing in Bitcoin and crypto. This means investing in the tools that make this sector possible, such as computer chips and ASICs and the mining companies, rather than the crypto assets themselves as they can admittedly be volatile. The first of these is Fidelity Crypto Industry and Digital Payment ETF (Ticker: FDIG). This ETF holds assets across Fidelity’s entire Crypto Industry and Digital Payment Index, closely tracking the performance of the crypto sector rather than the potentially volatile prices of the cryptos themselves. Currently, FDIG holds assets under management of about $13 million with a NAV of $16.71. The second company we have an eye on takes a similar pick and shovel approach to invest in crypto. Bitwise Crypto Industry Innovators ETF (Ticker: BITQ) is another ETF holding shares of companies innovating in and supporting the crypto industry. Specifically, only companies that generate at least half of their revenues from crypto business activities. BITQ currently has assets under management of $72 million and a NAV of $8.10. These could be good options for those who are interested or have faith in crypto but want to take a more diversified approach on the sector.

An investment in GBTC, FDIG or BITQ can be as volatile as owning bitcoin or any other crypto. We recommend only modest allocations to the crypto space of 1% to 5% within an investment portfolio because of the higher risk and speculative aspects of this nascent industry/technology. Servant Financial client portfolio models include GBTC and were recently rebalanced to purchase more given the market correction in the crypto sector along with traditional stock and bond markets. More risk tolerant client models also hold Hut 8 Mining (NASDAQ: HUT) and these models were also rebalanced. We typically do not invest in ETFs that do not have more than $100 million in assets under management so we will continue to monitor FDIG and BITQ.

Looking Forward

Crypto is still only in its beginning phase. With the application and acceptance of Bitcoin and other cryptos increasing each year, demand is expected to increase significantly. Broader acceptance and application of the technology is expected to lead to improved regulation of these currencies which will serve to increase adoption and overall understanding of cryptos as well as the benefits they have to offer. Bitcoin and crypto will continue to establish themselves as major disruptive forces to the current financial system. Bitcoin and crypto can potentially disintermediate traditional financial institutions much like what the internet and e-commerce did to traditional retailers, like book stores. As innovators such as Steve Jobs, Nikola Tesla, and Jeff Bezos will tell you, being on the right side of change can reap financial benefits and societal advancements.